Question: assets = $900. payable = $110; = $540: sales = $450; = 34%; dividends = $16.50. Costs, assets, and Given the followig information: in =RR

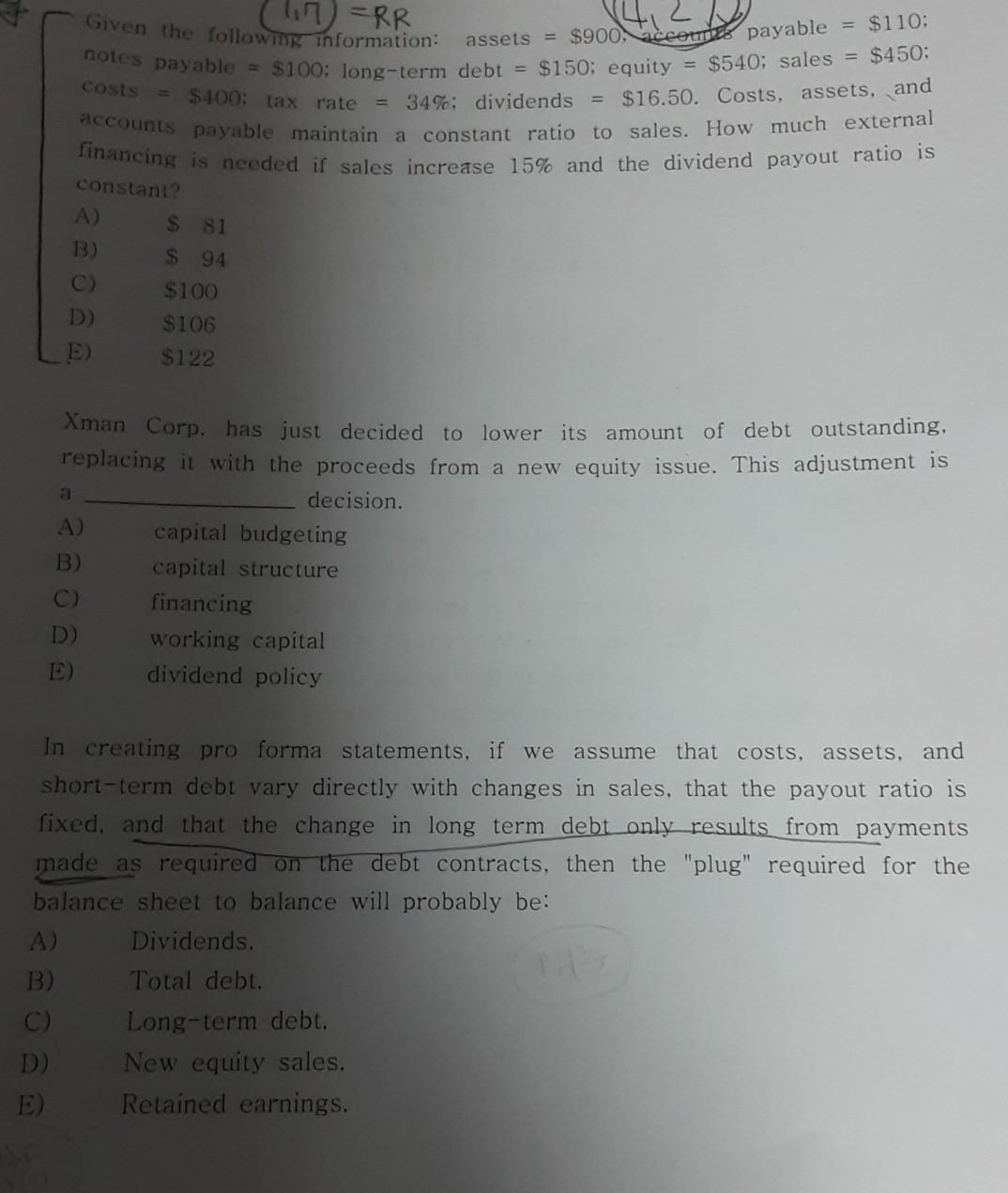

assets = $900. payable = $110; = $540: sales = $450; = 34%; dividends = $16.50. Costs, assets, and Given the followig information: in =RR noles payable = $100: long-term debt = $150; equity costs = $400; tax rate accounts payable maintain a constant ratio to sales. How much external financing is needed if sales increase 15% and the dividend payout ratio is constant? A) $ 81 B) $ 94 $100 D) $106 D $122 a Xman Corp. has just decided to lower its amount of debt outstanding, replacing it with the proceeds from a new equity issue. This adjustment is decision. A) capital budgeting B) capital structure C financing D) working capital E dividend policy In creating pro forma statements, if we assume that costs, assets, and short-term debt vary directly with changes in sales, that the payout ratio is fixed, and that the change in long term debt only_results from payments made as required on the debt contracts, then the "plug" required for the balance sheet to balance will probably be: A) Dividends. B) Total debt. C) Long-term debt. D) New equity sales, E) Retained earnings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts