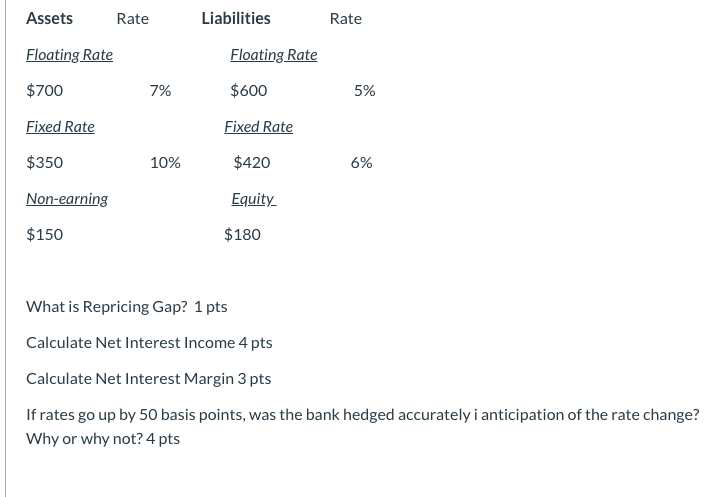

Question: Assets Rate Liabilities Rate Floating Rate Floating Rate $700 7% $600 5% Fixed Rate Fixed Rate $350 10% $420 6% Non-earning Equity $150 $180 What

Assets Rate Liabilities Rate Floating Rate Floating Rate $700 7% $600 5% Fixed Rate Fixed Rate $350 10% $420 6% Non-earning Equity $150 $180 What is Repricing Gap? 1 pts Calculate Net Interest Income 4 pts Calculate Net Interest Margin 3 pts If rates go up by 50 basis points, was the bank hedged accurately i anticipation of the rate change? Why or why not? 4 pts Assets Rate Liabilities Rate Floating Rate Floating Rate $700 7% $600 5% Fixed Rate Fixed Rate $350 10% $420 6% Non-earning Equity $150 $180 What is Repricing Gap? 1 pts Calculate Net Interest Income 4 pts Calculate Net Interest Margin 3 pts If rates go up by 50 basis points, was the bank hedged accurately i anticipation of the rate change? Why or why not? 4 pts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts