Question: Assets R&D Log Assets Log R&D Log 10 Assets Log 10 R&D 905.15 50.72 6.8081 3.9264 2.9567 1.7052 801.43 59.58 6.6864 4.0874 2.9039 1.7751 180.13

Assets R&D Log Assets Log R&D Log 10 Assets Log 10 R&D 905.15 50.72 6.8081 3.9264 2.9567 1.7052 801.43 59.58 6.6864 4.0874 2.9039 1.7751 180.13 15.56 5.1937 2.7447 2.2556 1.1920 0.25 0.11 -1.3793 -2.2119 -0.5990 -0.9606 4.51 1.60 1.5055 0.4717 0.6538 0.2049 367.79 51.20 5.9075 3.9357 2.5656 1.7093 98,626.97 7,666.38 11.4991 8.9446 4.9940 3.8846 45.27 3.80 3.8127 1.3347 1.6558 0.5797 10.68 2.31 2.3688 0.8376 1.0288 0.3638 492.16 43.52 6.1988 3.7733 2.6921 1.6387 48,800.70 4,730.57 10.7955 8.4618 4.6884 3.6749 101.52 8.26 4.6203 2.1116 2.0066 0.9171 5,869.94 235.52 8.6776 5.4618 3.7686 2.3720 44.53 7.16 3.7962 1.9686 1.6487 0.8550 10.00 1.43 2.3029 0.3543 1.0001 0.1539 715.30 55.12 6.5727 4.0095 2.8545 1.7413 0.19 0.06 -1.6577 -2.8126 -0.7199 -1.2215 0.16 0.11 -1.8231 -2.1836 -0.7918 -0.9483 8,755.17 460.17 9.0774 6.1316 3.9423 2.6629 2.89 0.63 1.0608 -0.4586 0.4607 -0.1992 0.62 0.17 -0.4737 -1.7936 -0.2057 -0.7790 4.02 1.16 1.3904 0.1496 0.6038 0.0650 1,084.96 67.67 6.9893 4.2146 3.0354 1.8304 47.76 9.64 3.8661 2.2656 1.6790 0.9839 1.14 0.32 0.1308 -1.1506 0.0568 -0.4997 207.43 26.85 5.3348 3.2903 2.3169 1.4290 5,528.66 321.53 8.6177 5.7731 3.7426 2.5072 0.15 0.04 -1.8936 -3.1577 -0.8224 -1.3714 377.96 32.43 5.9348 3.4791 2.5775 1.5110 3.15 0.61 1.1489 -0.5023 0.4990 -0.2181

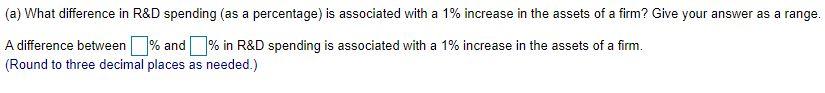

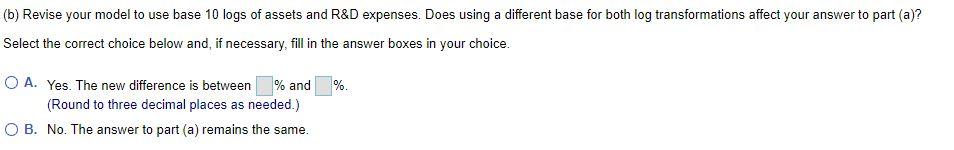

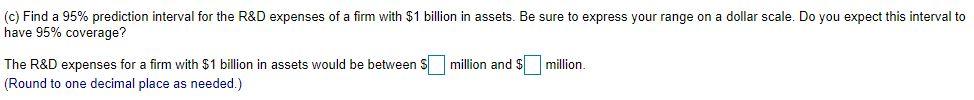

(a) What difference in R&D spending (as a percentage) is associated with a 1% increase in the assets of a firm? Give your answer as a range. A difference between % and % in R&D spending is associated with a 1% increase in the assets of a firm. (Round to three decimal places as needed.) (b) Revise your model to use base 10 logs of assets and R&D expenses. Does using a different base for both log transformations affect your answer to part (a)? Select the correct choice below and, if necessary, fill in the answer boxes in your choice. % O A. Yes. The new difference is between % and (Round to three decimal places as needed.) OB. No. The answer to part (a) remains the same. (c) Find a 95% prediction interval for the R&D expenses of a firm with $1 billion in assets. Be sure to express your range on a dollar scale. Do you expect this interval to have 95% coverage? The R&D expenses for a firm with $1 billion in assets would be between million and $ million. (Round to one decimal place as needed.) (a) What difference in R&D spending (as a percentage) is associated with a 1% increase in the assets of a firm? Give your answer as a range. A difference between % and % in R&D spending is associated with a 1% increase in the assets of a firm. (Round to three decimal places as needed.) (b) Revise your model to use base 10 logs of assets and R&D expenses. Does using a different base for both log transformations affect your answer to part (a)? Select the correct choice below and, if necessary, fill in the answer boxes in your choice. % O A. Yes. The new difference is between % and (Round to three decimal places as needed.) OB. No. The answer to part (a) remains the same. (c) Find a 95% prediction interval for the R&D expenses of a firm with $1 billion in assets. Be sure to express your range on a dollar scale. Do you expect this interval to have 95% coverage? The R&D expenses for a firm with $1 billion in assets would be between million and $ million. (Round to one decimal place as needed.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts