Question: Assigned Problem 1 Winston Clinic is evaluating a project that costs $52,125 and has expected net cash flows of $12,000 per year for eight years.

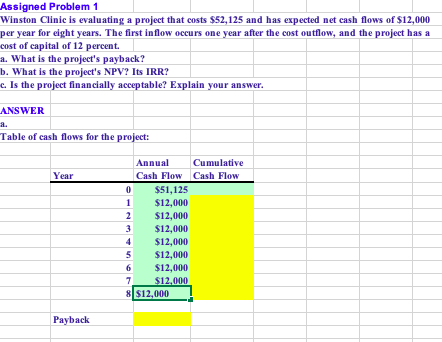

Assigned Problem 1 Winston Clinic is evaluating a project that costs $52,125 and has expected net cash flows of $12,000 per year for eight years. The first inflow occurs one year after the cost outflow, and the project has a cost of capital of 12 percent. a. What is the project's payback? b. What is the project's NPV? Its IRR? c. Is the project financially acceptable? Explain your answer. ANSWER Table of cash flows for the project: Year Annual Cumulative Cash Flow Cash Flow 0 $51,125 1 $12,000 2 $12,000 3 $12,000 4 $12,000 5 $12,000 6 $12,000 7 $12,000 8 $12,000 Payback

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts