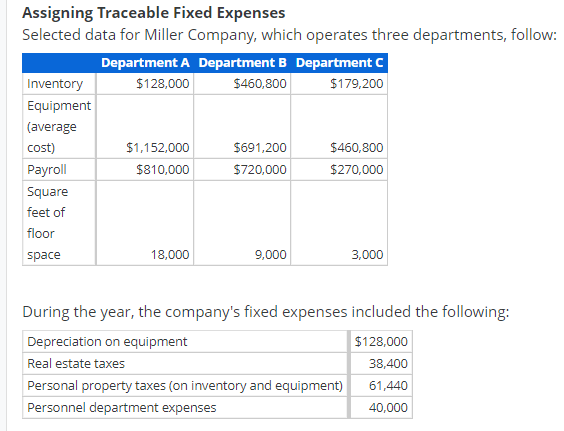

Question: Assigning Traceable Fixed Expenses Selected data for Miller Company, which operates three departments, follow: Department A Department B Department Inventory $128,000 $460,800 $179,200 Equipment (average

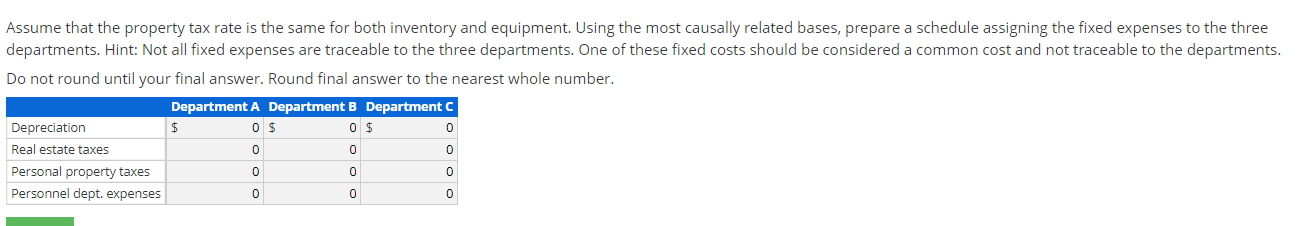

Assigning Traceable Fixed Expenses Selected data for Miller Company, which operates three departments, follow: Department A Department B Department Inventory $128,000 $460,800 $179,200 Equipment (average cost) $1,152,000 $691,200 $460,800 Payroll $810,000 $720,000 $270,000 Square feet of floor space 18,000 9,000 3,000 During the year, the company's fixed expenses included the following: Depreciation on equipment $128,000 Real estate taxes 38,400 Personal property taxes (on inventory and equipment) 61,440 Personnel department expenses 40,000 Assume that the property tax rate is the same for both inventory and equipment. Using the most causally related bases, prepare a schedule assigning the fixed expenses to the three departments. Hint: Not all fixed expenses are traceable to the three departments. One of these fixed costs should be considered a common cost and not traceable to the departments. Do not round until your final answer. Round final answer to the nearest whole number. Department A Department B Department C Depreciation 0 $ 0 $ Real estate taxes Personal property taxes 0 Personnel dept. expenses 0 $ 0 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts