Question: Assignment 1 A factor that most likely measures a client's ability to bear risk is his or her: A time horizon. B inclination to independent

Assignment

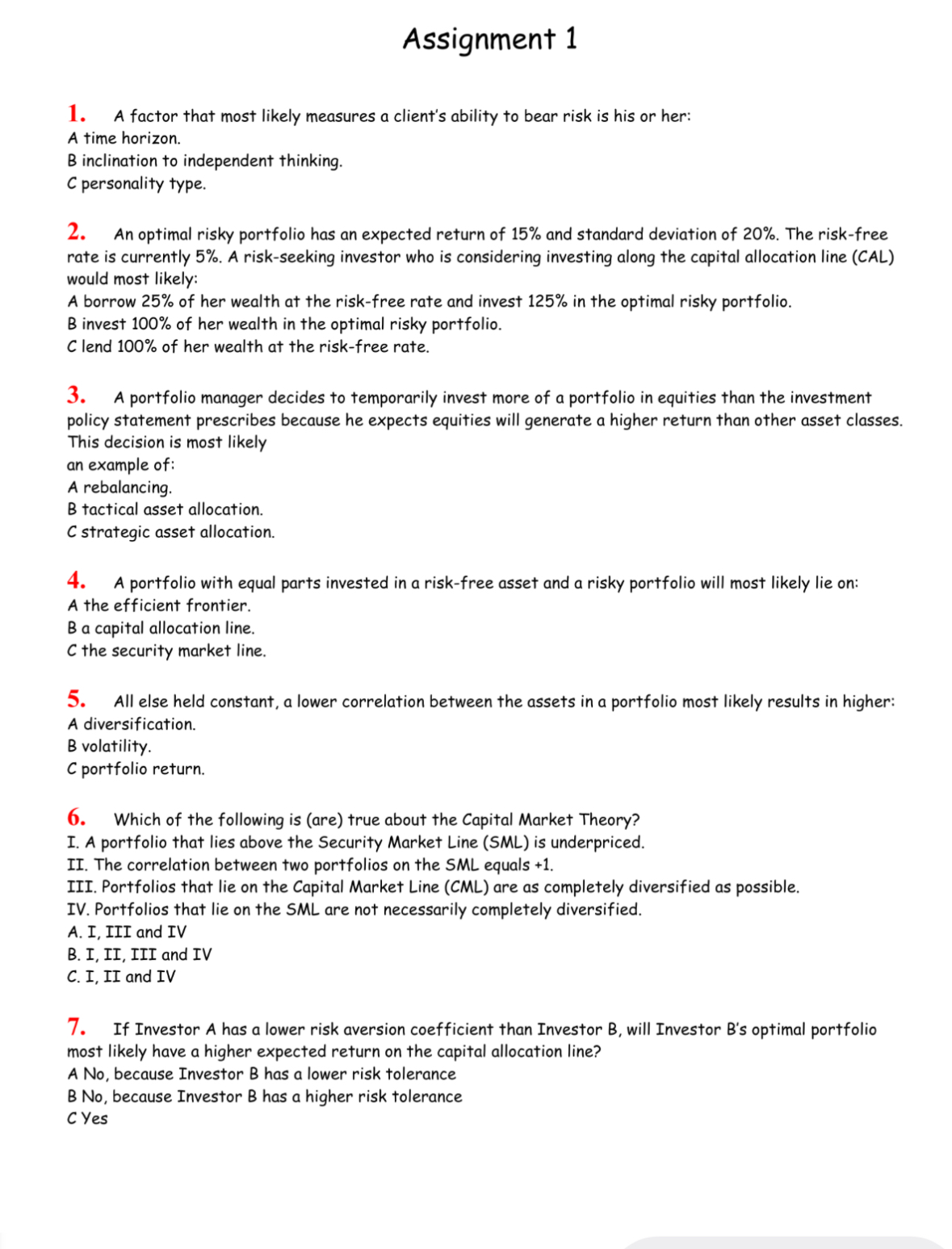

A factor that most likely measures a client's ability to bear risk is his or her:

A time horizon.

B inclination to independent thinking.

C personality type.

An optimal risky portfolio has an expected return of and standard deviation of The riskfree

rate is currently A riskseeking investor who is considering investing along the capital allocation line CAL

would most likely:

A borrow of her wealth at the riskfree rate and invest in the optimal risky portfolio.

B invest of her wealth in the optimal risky portfolio.

Clend of her wealth at the riskfree rate.

A portfolio manager decides to temporarily invest more of a portfolio in equities than the investment

policy statement prescribes because he expects equities will generate a higher return than other asset classes.

This decision is most likely

an example of:

A rebalancing.

B tactical asset allocation.

C strategic asset allocation.

A portfolio with equal parts invested in a riskfree asset and a risky portfolio will most likely lie on:

A the efficient frontier.

B a capital allocation line.

the security market line.

All else held constant, a lower correlation between the assets in a portfolio most likely results in higher:

A diversification.

B volatility.

portfolio return.

Which of the following is are true about the Capital Market Theory?

I. A portfolio that lies above the Security Market Line SML is underpriced.

II The correlation between two portfolios on the SML equals

III. Portfolios that lie on the Capital Market Line CML are as completely diversified as possible.

IV Portfolios that lie on the SML are not necessarily completely diversified.

A I, III and IV

B I, II III and IV

C I. II and IV

If Investor A has a lower risk aversion coefficient than Investor B will Investor Bs optimal portfolio

most likely have a higher expected return on the capital allocation line?

A No because Investor B has a lower risk tolerance

No because Investor B has a higher risk tolerance

Yes

Assignment

A factor that most likely measures a client's ability to bear risk is his or her:

A time horizon.

B inclination to independent thinking.

personality type.

An optimal risky portfolio has an expected return of and standard deviation of The riskfree

rate is currently A riskseeking investor who is considering investing along the capital allocation line CAL

would most likely:

A borrow of her wealth at the riskfree rate and invest in the optimal risky portfolio.

B invest of her wealth in the optimal risky portfolio.

lend of her wealth at the riskfree rate.

A portfolio manager decides to temporarily invest more of a portfolio in equities than the investment

policy statement prescribes because he expects equities will generate a higher return than other asset classes.

This decision is most likely

an example of:

A rebalancing.

B tactical asset allocation.

C strategic asset allocation.

A portfolio with equal parts invested in a riskfree asset and a risky portfolio will most likely lie on:

A the efficient frontier.

B a capital allocation line.

the security market line.

All else held constant, a lower correlation between the assets in a portfolio most likely results in higher:

A diversification.

B volatility.

portfolio return.

Which of the following is are true about the Capital Market Theory?

I. A portfolio that lies above the Security Market Line SML is underpriced.

II The correlation between two portfolios on the SML equals

III. Portfolios that lie on the Capital Market Line CML are as completely diversified as possible.

IV Portfolios that lie on the SML are not necessarily completely diversified.

A I, III and IV

B I, II III and IV

C I, II and IV

If Investor A has a lower risk aversion coefficient than Investor will Investor Bs optimal portfolio

most likely have a higher expected return on the capital allocation line?

A No because Investor B has a lower risk tolerance

No because Investor has a higher risk tolerance

Yes

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock