Question: Assignment # 1 : Analysis Case - Reporting deferred taxes When a company prepares its tax return for a particular year, the revenues and expenses

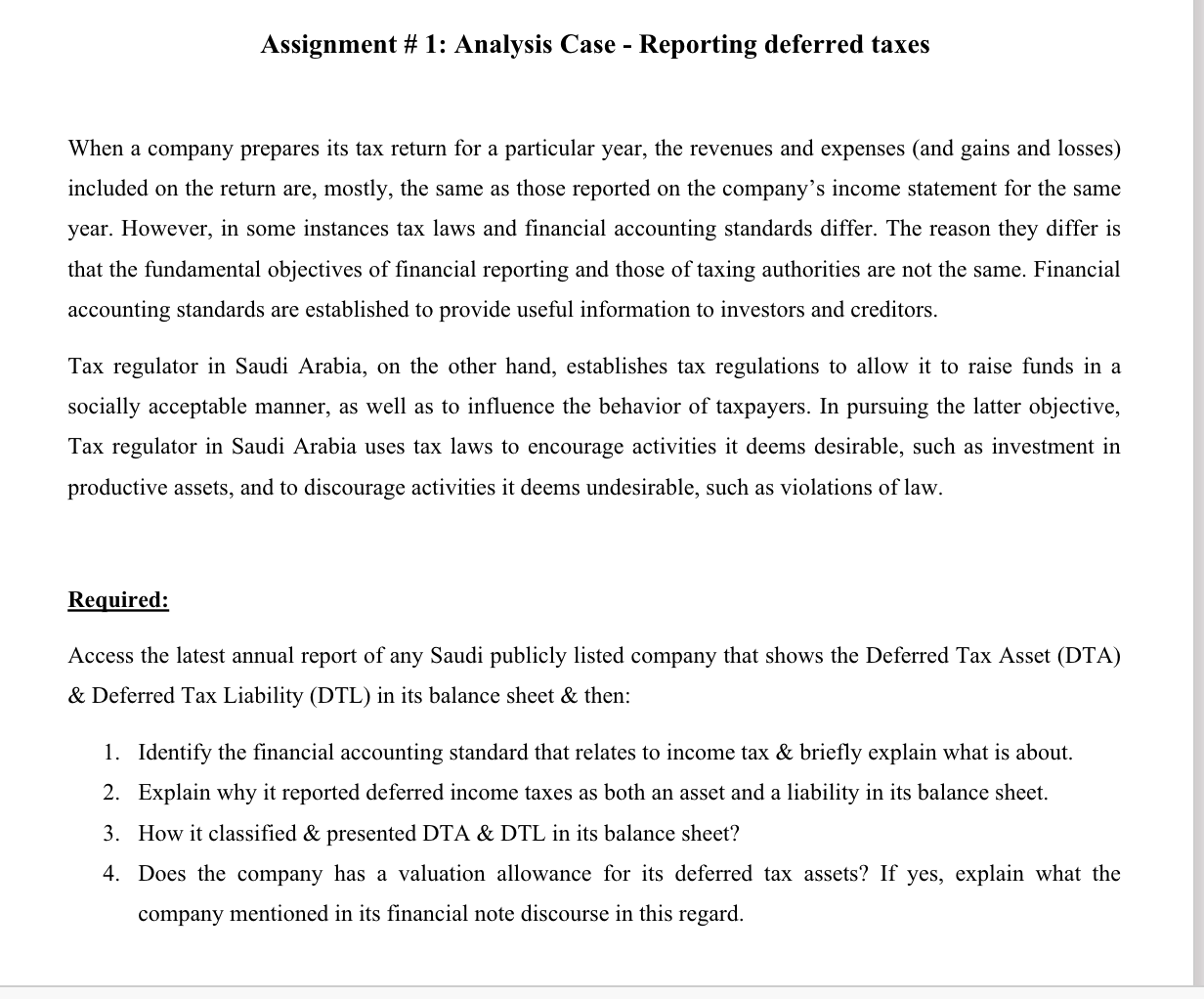

Assignment # : Analysis Case Reporting deferred taxes

When a company prepares its tax return for a particular year, the revenues and expenses and gains and losses

included on the return are, mostly, the same as those reported on the company's income statement for the same

year. However, in some instances tax laws and financial accounting standards differ. The reason they differ is

that the fundamental objectives of financial reporting and those of taxing authorities are not the same. Financial

accounting standards are established to provide useful information to investors and creditors.

Tax regulator in Saudi Arabia, on the other hand, establishes tax regulations to allow it to raise funds in a

socially acceptable manner, as well as to influence the behavior of taxpayers. In pursuing the latter objective,

Tax regulator in Saudi Arabia uses tax laws to encourage activities it deems desirable, such as investment in

productive assets, and to discourage activities it deems undesirable, such as violations of law.

Required:

Access the latest annual report of any Saudi publicly listed company that shows the Deferred Tax Asset DTA

& Deferred Tax Liability DTL in its balance sheet & then:

Identify the financial accounting standard that relates to income tax & briefly explain what is about.

Explain why it reported deferred income taxes as both an asset and a liability in its balance sheet.

How it classified & presented DTA & DTL in its balance sheet?

Does the company has a valuation allowance for its deferred tax assets? If yes, explain what the

company mentioned in its financial note discourse in this regard.

Compare between companies Almarai and Nadec years and

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock