Question: Assignment 1 - Chapter 1 and 2+ 1. Identify the purpose of the following components of the commencement process O Information necessary to pay an

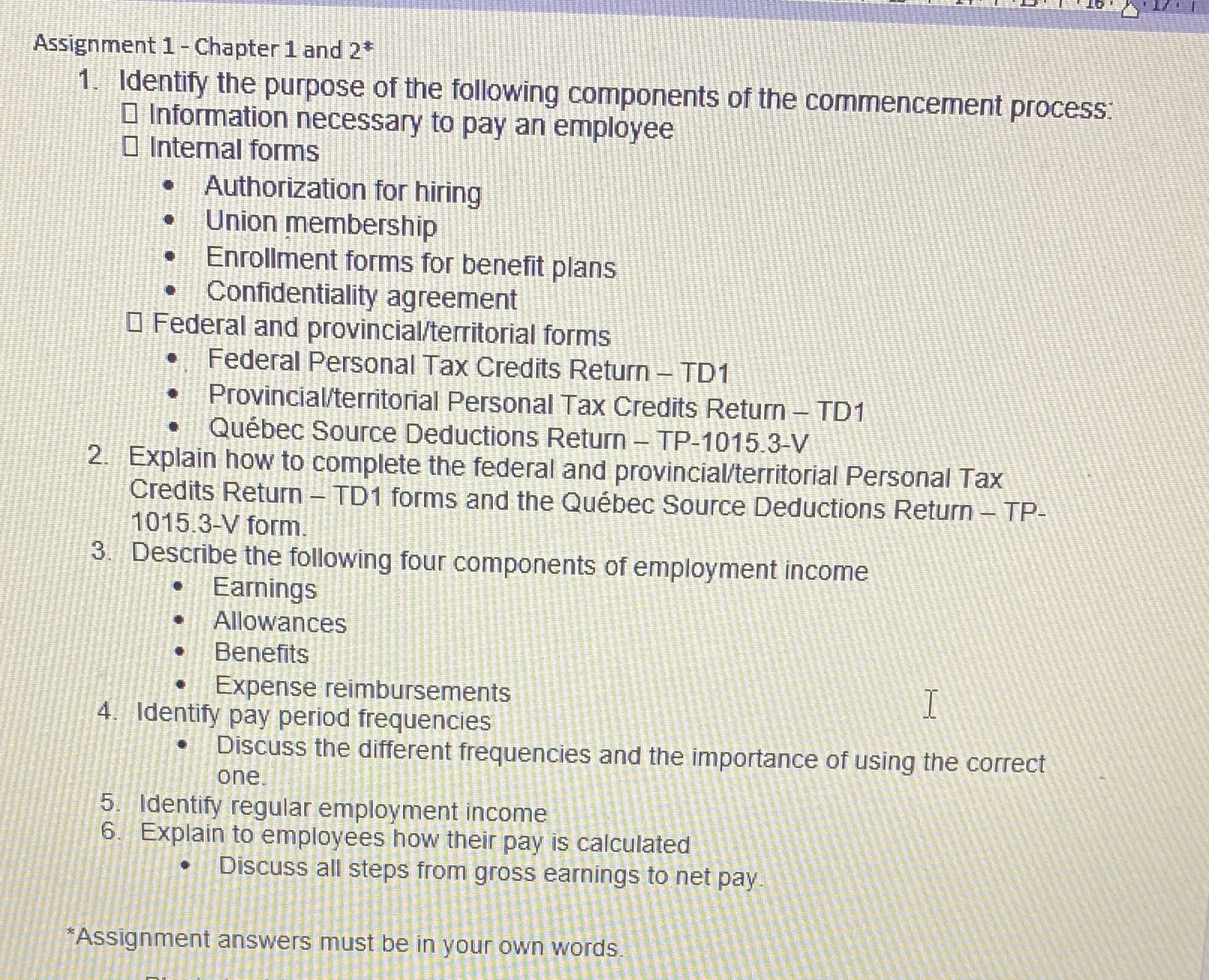

Assignment 1 - Chapter 1 and 2+ 1. Identify the purpose of the following components of the commencement process O Information necessary to pay an employee 0 Internal forms Authorization for hiring Union membership . Enrollment forms for benefit plans Confidentiality agreement 0 Federal and provincial/territorial forms . Federal Personal Tax Credits Return - TD1 Provincial/territorial Personal Tax Credits Return - TD1 Quebec Source Deductions Return - TP-1015.3-V 2. Explain how to complete the federal and provincial/territorial Personal Tax Credits Return - TD1 forms and the Quebec Source Deductions Return - TP- 1015.3-V form. 3. Describe the following four components of employment income Earnings Allowances Benefits Expense reimbursements I 4. Identify pay period frequencies . Discuss the different frequencies and the importance of using the correct one. 5. Identify regular employment income 6. Explain to employees how their pay is calculated .Discuss all steps from gross earnings to net pay *Assignment answers must be in your own words

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts