Question: Assignment: 1) complete the accountants worksheet excel (pictured below) 2) on a separate sheet, INCOME STATEMENT 3) on a separate sheet, RETAINED EARNINGS 4) on

Assignment:

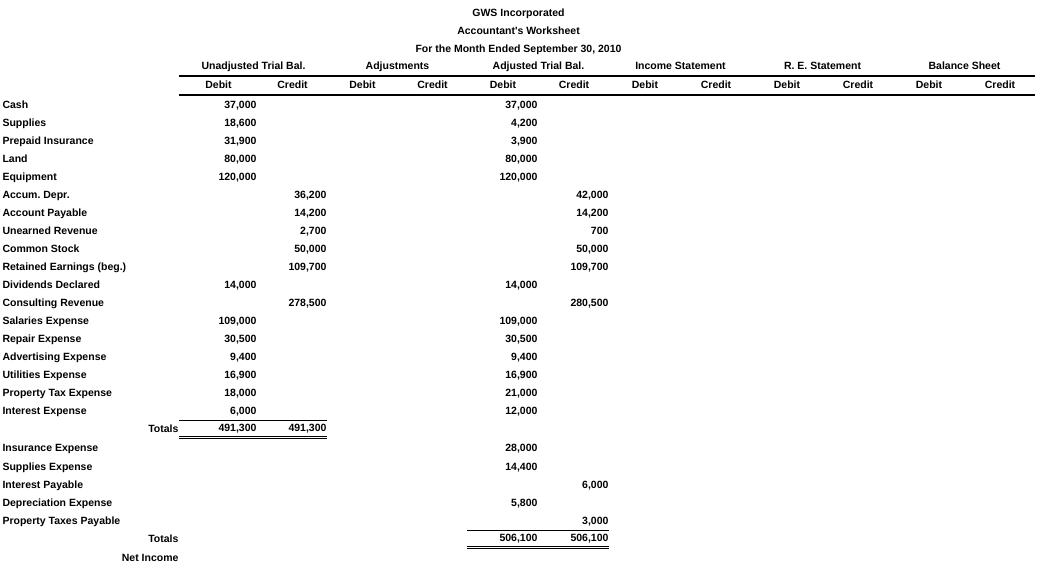

1) complete the accountants worksheet excel (pictured below)

2) on a separate sheet, INCOME STATEMENT

3) on a separate sheet, RETAINED EARNINGS

4) on a separate sheet, BALANCE SHEET

5) on a separate sheet, ADJUSTING/CLOSING ENTRIES

6) POST CLOSING TRIAL BALANCE*

Income Statement Debit Credit R. E. Statement Debit Credit Balance Sheet Debit Credit Unadjusted Trial Bal. Debit Credit 37,000 18,600 31,900 80,000 120,000 36,200 14,200 GWS Incorporated Accountant's Worksheet For the Month Ended September 30, 2010 Adjustments Adjusted Trial Bal. Debit Credit Debit Credit 37,000 4,200 3,900 80,000 120,000 42.000 Cash Supplies Prepaid Insurance Land Equipment Accum. Depr. Account Payable Unearned Revenue Common Stock Retained Earnings (beg.) Dividends Declared Consulting Revenue Salaries Expense Repair Expense Advertising Expense Utilities Expense Property Tax Expense Interest Expense 2,700 50,000 109,700 14,200 700 50,000 109,700 14,000 14,000 278.500 280,500 109,000 30,500 9,400 16,900 18,000 6,000 491,300 109,000 30,500 9,400 16,900 21,000 12,000 Totals 491,300 28,000 14,400 Insurance Expense Supplies Expense Interest Payable Depreciation Expense Property Taxes Payable 6,000 5,800 3,000 506,100 Totals 506,100 Net Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts