Question: Assignment 1 Problem 1 Spring 2022 Taxation Gloria Edwards is a consultant. For 10 years, until June 30, 2021, she had been employed by IBM

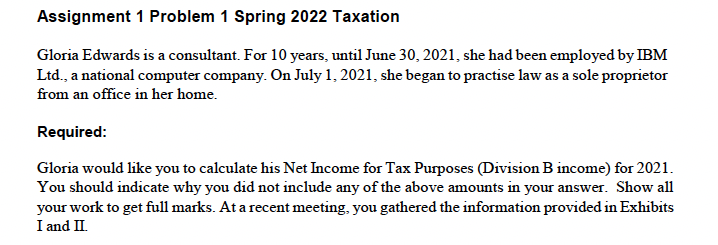

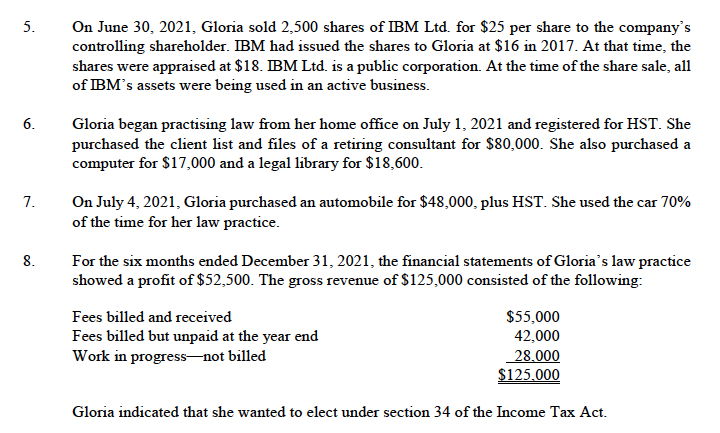

Assignment 1 Problem 1 Spring 2022 Taxation Gloria Edwards is a consultant. For 10 years, until June 30, 2021, she had been employed by IBM Ltd., a national computer company. On July 1, 2021, she began to practise law as a sole proprietor from an office in her home. Required: Gloria would like you to calculate his Net Income for Tax Purposes Division B income) for 2021. You should indicate why you did not include any of the above amounts in your answer. Show all your work to get full marks. At a recent meeting, you gathered the information provided in Exhibits I and II. 5. On June 30, 2021, Gloria sold 2,500 shares of IBM Ltd. for $25 per share to the company's controlling shareholder. IBM had issued the shares to Gloria at $16 in 2017. At that time, the shares were appraised at $18. BM Ltd. is a public corporation. At the time of the share sale, all of IBM's assets were being used in an active business. 6. Gloria began practising law from her home office on July 1, 2021 and registered for HST. She purchased the client list and files of a retiring consultant for $80,000. She also purchased a computer for $17,000 and a legal library for $18,600. 7. On July 4, 2021, Gloria purchased an automobile for $48,000, plus HST. She used the car 70% of the time for her law practice. . 8. For the six months ended December 31, 2021, the financial statements of Gloria's law practice showed a profit of $52,500. The gross revenue of $125,000 consisted of the following: Fees billed and received $55,000 Fees billed but unpaid at the year end 42,000 Work in progress-not billed 28.000 $125,000 Gloria indicated that she wanted to elect under section 34 of the Income Tax Act. Assignment 1 Problem 1 Spring 2022 Taxation Gloria Edwards is a consultant. For 10 years, until June 30, 2021, she had been employed by IBM Ltd., a national computer company. On July 1, 2021, she began to practise law as a sole proprietor from an office in her home. Required: Gloria would like you to calculate his Net Income for Tax Purposes Division B income) for 2021. You should indicate why you did not include any of the above amounts in your answer. Show all your work to get full marks. At a recent meeting, you gathered the information provided in Exhibits I and II. 5. On June 30, 2021, Gloria sold 2,500 shares of IBM Ltd. for $25 per share to the company's controlling shareholder. IBM had issued the shares to Gloria at $16 in 2017. At that time, the shares were appraised at $18. BM Ltd. is a public corporation. At the time of the share sale, all of IBM's assets were being used in an active business. 6. Gloria began practising law from her home office on July 1, 2021 and registered for HST. She purchased the client list and files of a retiring consultant for $80,000. She also purchased a computer for $17,000 and a legal library for $18,600. 7. On July 4, 2021, Gloria purchased an automobile for $48,000, plus HST. She used the car 70% of the time for her law practice. . 8. For the six months ended December 31, 2021, the financial statements of Gloria's law practice showed a profit of $52,500. The gross revenue of $125,000 consisted of the following: Fees billed and received $55,000 Fees billed but unpaid at the year end 42,000 Work in progress-not billed 28.000 $125,000 Gloria indicated that she wanted to elect under section 34 of the Income Tax Act

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts