Question: ASSIGNMENT 1 Work out the following problems. Please turn them in to me by 6:30 pm Monday, February 17, 2020. Use of Tables is NOT

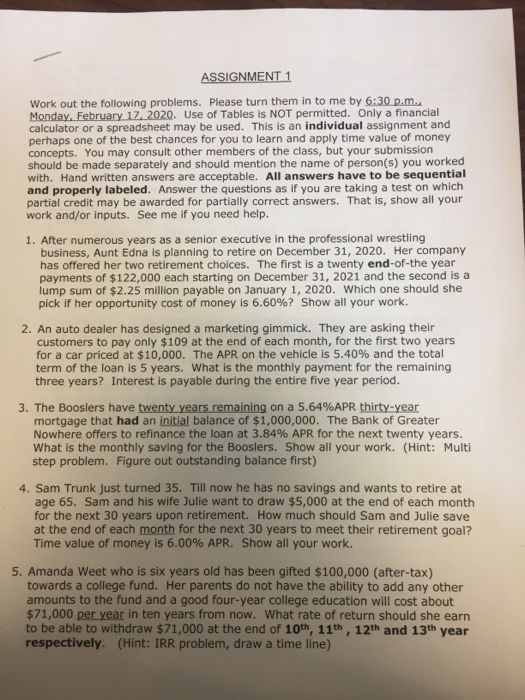

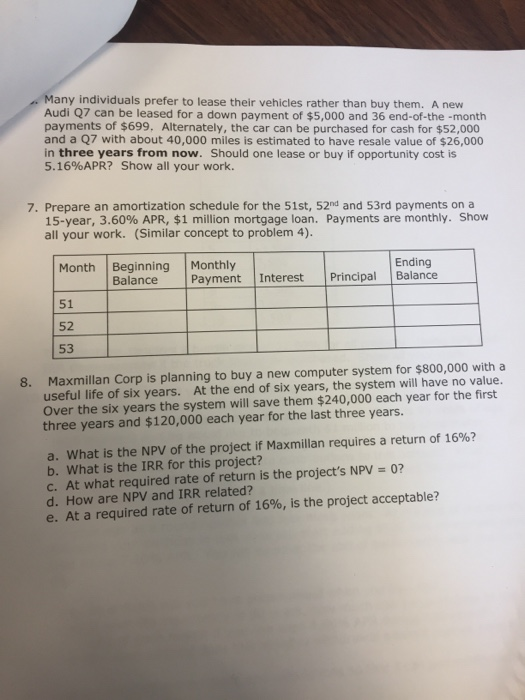

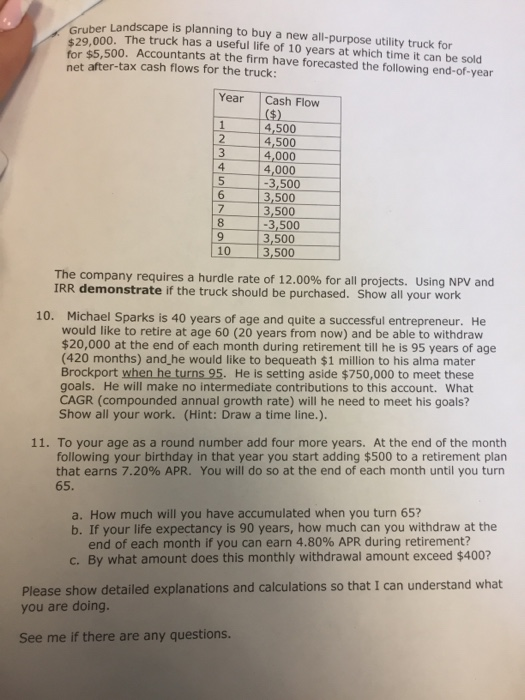

ASSIGNMENT 1 Work out the following problems. Please turn them in to me by 6:30 pm Monday, February 17, 2020. Use of Tables is NOT permitted. Only a financial calculator or a spreadsheet may be used. This is an individual assignment and perhaps one of the best chances for you to learn and apply time value of money concepts. You may consult other members of the class, but your submission should be made separately and should mention the name of person(s) you worked with. Hand written answers are acceptable. All answers have to be sequential and properly labeled Answer the questions as if you are taking a test on which partial credit may be awarded for partially correct answers. That is, show all your work and/or inputs. See me if you need help. 1. After numerous years as a senior executive in the professional wrestling business, Aunt Edna is planning to retire on December 31, 2020. Her company has offered her two retirement choices. The first is a twenty end-of-the year payments of $122,000 each starting on December 31, 2021 and the second is a lump sum of $2.25 million payable on January 1, 2020. Which one should she pick if her opportunity cost of money is 6.60%? Show all your work. 2. An auto dealer has designed a marketing gimmick. They are asking their customers to pay only $109 at the end of each month, for the first two years for a car priced at $10,000. The APR on the vehicle is 5.40% and the total term of the loan is 5 years. What is the monthly payment for the remaining three years? Interest is payable during the entire five year period. 3. The Booslers have twenty years remaining on a 5.64%APR thirty-year mortgage that had an initial balance of $1,000,000. The Bank of Greater Nowhere offers to refinance the loan at 3.84% APR for the next twenty years. What is the monthly saving for the Booslers. Show all your work. (Hint: Multi step problem. Figure out outstanding balance first) 4. Sam Trunk just turned 35. Till now he has no savings and wants to retire at age 65. Sam and his wife Julie want to draw $5,000 at the end of each month for the next 30 years upon retirement. How much should Sam and Julie save at the end of each month for the next 30 years to meet their retirement goal? Time value of money is 6.00% APR. Show all your work. 5. Amanda Weet who is six years old has been gifted $100,000 (after-tax) towards a college fund. Her parents do not have the ability to add any other amounts to the fund and a good four-year college education will cost about $71,000 per year in ten years from now. What rate of return should she earn to be able to withdraw $71,000 at the end of 10th, 11th, 12th and 13th year respectively. (Hint: IRR problem, draw a time line) Many individuals prefer to lease their vehicles rather than buy them. A new Audi Q7 can be leased for a down payment of $5,000 and 36 end-of-the-month payments of $699. Alternately, the car can be purchased for cash for $52,000 and a Q7 with about 40,000 miles is estimated to have resale value of $26,000 in three years from now. Should one lease or buy if opportunity cost is 5.16%APR? Show all your work. 7. Prepare an amortization schedule for the 51st, 52nd and 53rd payments on a 15-year, 3.60% APR, $1 million mortgage loan. Payments are monthly. Show all your work. (Similar concept to problem 4). Month Beginning Balance Monthly Payment Ending Balance Interest Principal 8. Maxmillan Corp is planning to buy a new computer system for $800,000 with a useful life of six years. At the end of six years, the system will have no value. Over the six years the system will save them $240,000 each year for the first three years and $120,000 each year for the last three years. a. What is the NPV of the project if Maxmillan requires a return of 16%? b. What is the IRR for this project? C. At what required rate of return is the project's NPV = 0? d. How are NPV and IRR related? e. At a required rate of return of 16%, is the project acceptable? Gruber Landscape is planning to buy a new all-purpose utility truck for 229.000. The truck has a useful life of 10 years at which time it can be sold for $5.500. Accountants at the firm have forecasted the following end-of-year net after-tax cash flows for the truck: Year Cash Flow von AWN 4,500 4,500 4,000 4,000 -3,500 3,500 3,500 8 1-3,500 3,500 103,500 The company requires a hurdle rate of 12.00% for all projects. Using NPV and IRR demonstrate if the truck should be purchased. Show all your work 10. Michael Sparks is 40 years of age and quite a successful entrepreneur. He would like to retire at age 60 (20 years from now) and be able to withdraw $20,000 at the end of each month during retirement till he is 95 years of age (420 months) and he would like to bequeath $1 million to his alma mater Brockport when he turns 95. He is setting aside $750,000 to meet these goals. He will make no intermediate contributions to this account. What CAGR (compounded annual growth rate) will he need to meet his goals? Show all your work. (Hint: Draw a time line.). 11. To your age as a round number add four more years. At the end of the month following your birthday in that year you start adding $500 to a retirement plan that earns 7.20% APR. You will do so at the end of each month until you turn 65. a. How much will you have accumulated when you turn 65? b. If your life expectancy is 90 years, how much can you withdraw at the end of each month if you can earn 4.80% APR during retirement? C. By what amount does this monthly withdrawal amount exceed $400? Please show detailed explanations and calculations so that I can understand what you are doing. See me if there are any questions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts