Question: Assignment 11 Portfolios and Diversification Submit using Assignment tab in eLearning by uploading your completed excel file. Open a new (fresh) excel workbook to perform

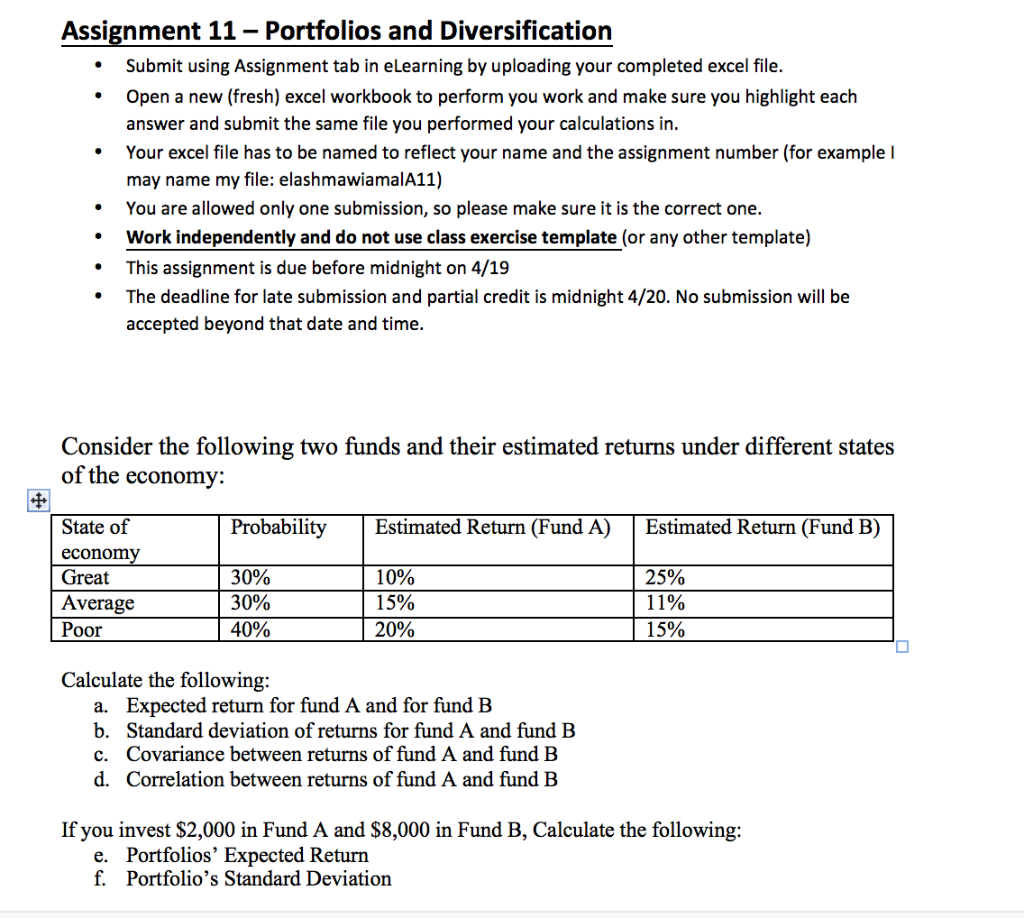

Assignment 11 Portfolios and Diversification Submit using Assignment tab in eLearning by uploading your completed excel file. Open a new (fresh) excel workbook to perform you work and make sure you highlight each answer and submit the same file you performed your calculations in Your excel file has to be named to reflect your name and the assignment number (for example I may name my file: elashmawiamalA11) You are allowed only one submission, so please make sure it is the correct one. Work independently and do not use class exercise template (or any other template) This assignment is due before midnight on 4/19 The deadline for late submission and partial credit is midnight 4/20. No submission will be accepted beyond that date and time. Consider the following two funds and their estimated returns under different states of the economy: ProbabilityEstimated Return (Fund A)Estimated Return (Fund B) State of econom Great Average Poor 10% I 5% 20% 30% 30% 40% 25% 11% 15% Calculate the following: a. Expected return for fund A and for fund B b. Standard deviation of returns for fund A and fund B c. Covariance between returns of fund A and fund B d. Correlation between returns of fund A and fund B If you invest $2,000 in Fund A and $8,000 in Fund B, Calculate the following: e. Portfolios' Expected Return f. Portfolio's Standard Deviation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts