Question: Assignment 12 - Cash Flow Estimation and Risk Analysis 5. Risk analysis in capital budgeting Aa Aa Projects differ in risk, and risk analysis is

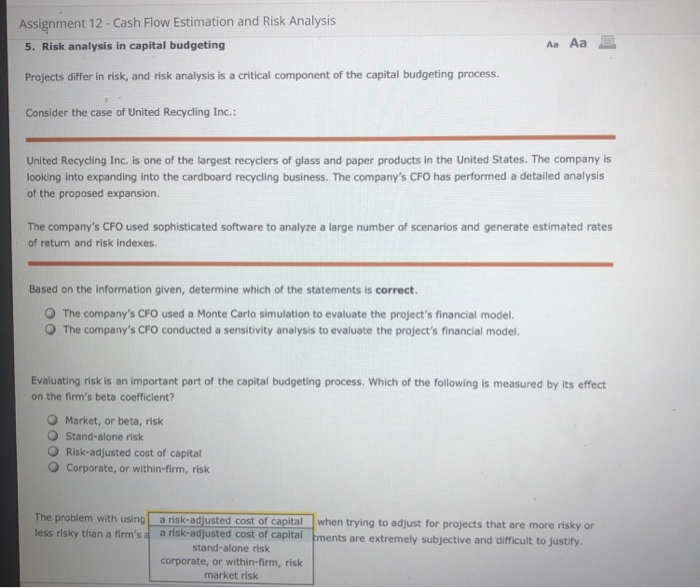

Assignment 12 - Cash Flow Estimation and Risk Analysis 5. Risk analysis in capital budgeting Aa Aa Projects differ in risk, and risk analysis is a critical component of the capital budgeting process. Consider the case of United Recycling Inc.: United Recycling Inc. is one of the largest recyclers of glass and paper products in the United States. The company is looking into expanding into the cardboard recycling business. The company's CFO has performed a detailed analysis of the proposed expansion The company's CFO used sophisticated software to analyze a large number of scenarios and generate estimated rates of return and risk indexes. Based on the information given, determine which of the statements is correct. The company's CFO used a Monte Carlo simulation to evaluate the project's financial model. The company's CFO conducted a sensitivity analysis to evaluate the project's financial model. Evaluating risk is an important part of the capital budgeting process. Which of the following is measured by its effect on the firm's beta coefficient? Market, or beta, risk Stand-alone risk Risk-adjusted cost of capital Corporate, or within-firm, risk The problem with using a risk-adjusted cost of capital when trying to adjust for projects that are more risky or less risky than a firm's a a risk-adjusted cost of capital tments are extremely subjective and difficult to justify. stand-alone risk corporate, or within-firm, risk market risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts