Question: Assignment 18 Integrating Forecasting and Valuation The following information is available for Teri Inc. for the fiscal years started on January 1, 2017, and January

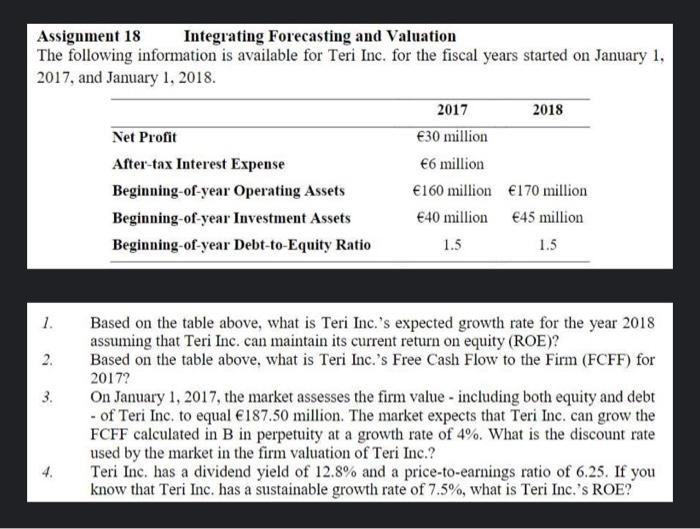

Assignment 18 Integrating Forecasting and Valuation The following information is available for Teri Inc. for the fiscal years started on January 1, 2017, and January 1, 2018. 2017 2018 Net Profit 30 million After-tax Interest Expense 6 million Beginning-of-year Operating Assets 160 million 170 million Beginning-of-year Investment Assets 40 million 45 million Beginning-of-year Debt-to-Equity Ratio 1.5 1.5 1. 2. 3. Based on the table above, what is Teri Inc.'s expected growth rate for the year 2018 assuming that Teri Inc. can maintain its current return on equity (ROE)? Based on the table above, what is Teri Inc.'s Free Cash Flow to the Firm (FCFF) for 2017? On January 1, 2017, the market assesses the firm value - including both equity and debt - of Teri Inc. to equal 187.50 million. The market expects that Teri Inc. can grow the FCFF calculated in B in perpetuity at a growth rate of 4%. What is the discount rate used by the market in the firm valuation of Teri Inc.? Teri Inc. has a dividend yield of 12.8% and a price-to-earnings ratio of 6.25. If you know that Teri Inc. has a sustainable growth rate of 7.5%, what is Teri Inc.'s ROE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts