Question: Assignment #1-Value 5% On December 1, 2021, George and Myra started a corporation called Caper Rental Equipment. The new corporation began operations immediately as

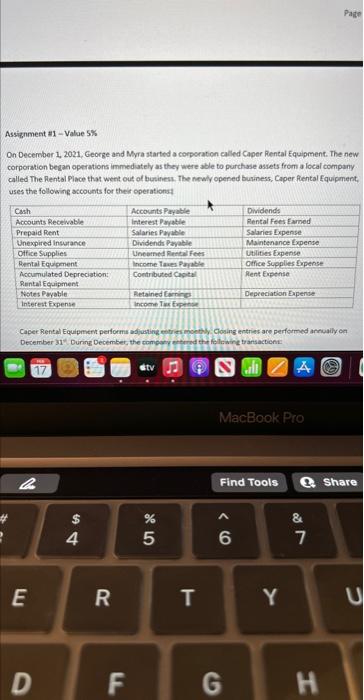

Assignment #1-Value 5% On December 1, 2021, George and Myra started a corporation called Caper Rental Equipment. The new corporation began operations immediately as they were able to purchase assets from a local company called The Rental Place that went out of business. The newly opened business, Caper Rental Equipment, uses the following accounts for their operations Cash Accounts Payable Accounts Receivable Interest Payable Prepaid Rent Salaries Payable Unexpired Insurance Dividends Payable Office Supplies Rental Equipment Accumulated Depreciation: Rental Equipment Notes Payable Interest Expense Unearned Rental Fees Income Taxes Payable Contributed Capital Retained Earning Income Tax Expense Dividends Rental Fees Earned Salaries Expense Maintenance Expense Utilities Expense Office Supplies Expense Rent Expense Depreciation Expense Caper Rental Equipment performs adjusting entries monthly. Closing entries are performed annually on December 31 During December, the company ente transactions a $ 54 4 55 % tv MacBook Pro Find Tools 96 & 6 7 A Share E R T Y U D F G H Page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts