Question: Assignment 2 1. Youre General Manger in a reputed Information Technological Company. The Board of Directors are willing to invest for a new project &

Assignment 2

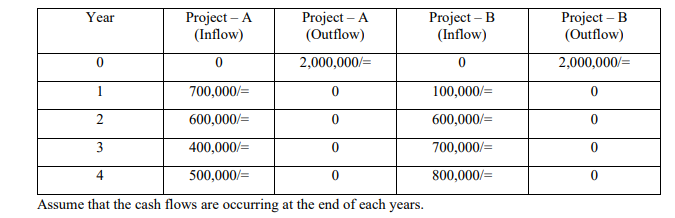

1. Youre General Manger in a reputed Information Technological Company. The Board of Directors are willing to invest for a new project & two clients (Project A & Project B) have invited your company. The cost of capital is 10%. Following are the expected cash flows from Project S & Project L

I. What is the more profitable project to invest based on payback period method?

II. What is the more profitable project to invest based on Average Rate Of Return method?

III. What is the more profitable project to invest based on Net Present Value method?

IV. What is your selection? Give the reasons

Year Project - A (Inflow) 0 Project - A (Outflow) 2,000,000/= Project - B (Inflow) Project - B (Outflow) 0 0 2,000,000/= 1 0 0 2 0 0 3 0 0 700,000/= 100,000/= 600,000/= 600,000/= 400,000/= 700,000/= 4 500,000/= 0 800,000/= Assume that the cash flows are occurring at the end of each years. 0

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock