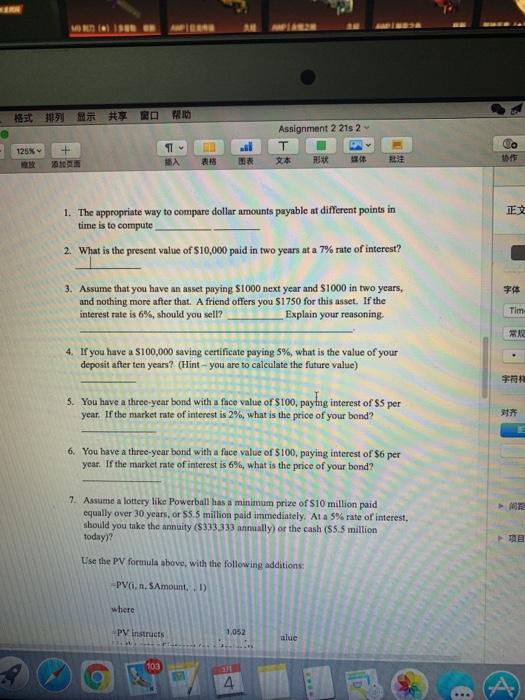

Question: + Assignment 2 215 2 T 125% RE 101 TE 1. The appropriate way to compare dollar amounts payable at different points in time is

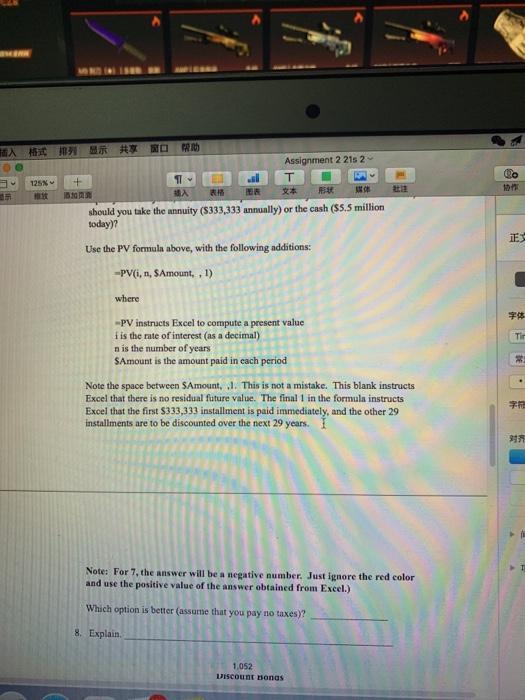

+ Assignment 2 215 2 T 125% RE 101 TE 1. The appropriate way to compare dollar amounts payable at different points in time is to compute 2. What is the present value of $10,000 paid in two years at a 7% rate of interest? 3. Assume that you have an asset paying $1000 next year and S1000 in two years, and nothing more after that. A friend offers you $1750 for this asset. If the interest rate is 6%, should you sell? Explain your reasoning Tim NE 4. If you have a $100,000 saving certificate paying 5%, what is the value of your deposit after ten years? (Hint - you are to calculate the future value) 5. You have a three-year bond with a face value of $100, payng interest of SS per year. If the market rate of interest is 2%, what is the price of your bond? 6. You have a three-year bond with a face value of S100, paying interest of $6 per year. If the market rate of interest is 6%, what is the price of your bond? 7. Assume a lottery like Powerball has a minimum prize of S10 million paid equally over 30 years, or 55.5 million paid immediately. At a 5% rate of interest, should you take the annuity (8333 333 annually) or the cash (55.5 million today) Use the PV formula above, with the following additions: -PVC, n, SAmount, 1) where PV instructs 1,052 alue 103 ... 125 , PRI Assignment 22152 + 1 EL T A. should you take the annuity (8333,333 annually) or the cash (85.5 million today? 15 E Use the PV formuln above, with the following additions: -PV(i,, $Amount. 1) where Tir 2 PV instructs Excel to compute a present value fis the rate of interest (as a decimal) n is the number of years SAmount is the amount paid in each period Note the space between SAmount, .1. This is not a mistake. This blank instructs Excel that there is no residual future value. The final in the formula instructs Excel that the first $333,333 installment is paid immediately, and the other 29 installments are to be discounted over the next 29 years. I Note: For 7, the answer will be a negative number. Just ignore the red color and use the positive value of the answer obtained from Excel.) Which option is better assume that you pay no taxes)? 8. Explain 1,052 Discount bonas

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts