Question: ASSIGNMENT - 2 5% IN THE FINAL GRADE DUE before October 22 nd,2022@11.59 PM Problem:1 (JOB ORDER COSTING) The Collins Company uses a job-order costing

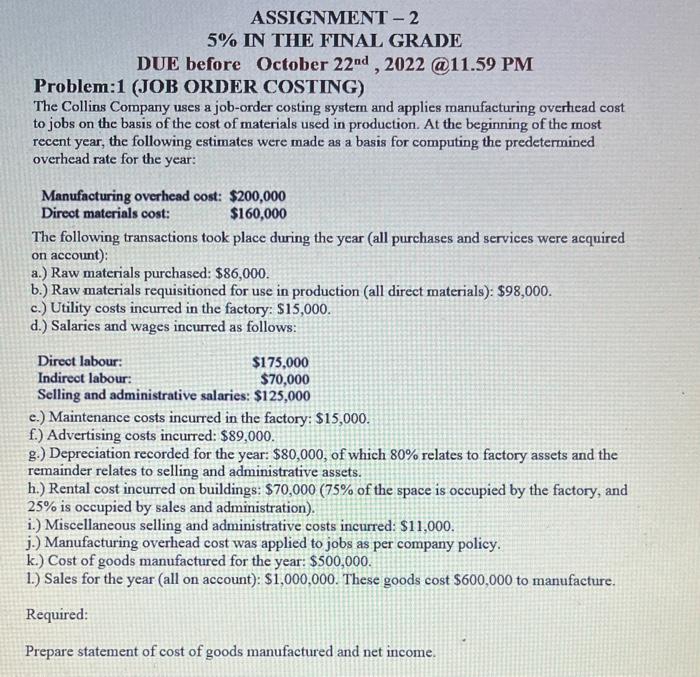

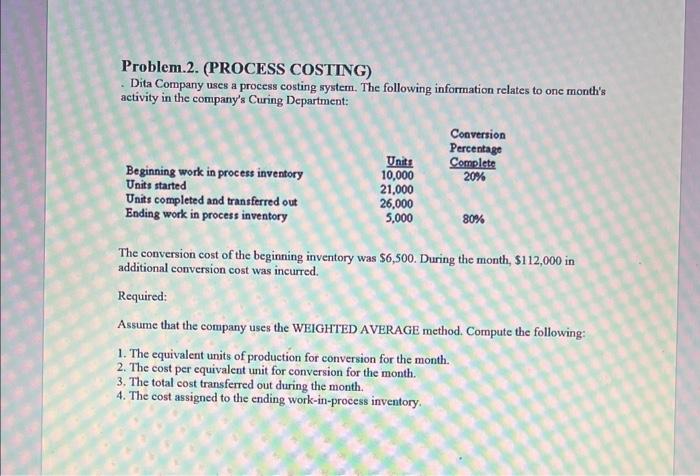

ASSIGNMENT - 2 5\% IN THE FINAL GRADE DUE before October 22 nd,2022@11.59 PM Problem:1 (JOB ORDER COSTING) The Collins Company uses a job-order costing system and applies manufacturing overhead cost to jobs on the basis of the cost of materials used in production. At the beginning of the most recent year, the following estimates were made as a basis for computing the predetermined overhead rate for the year: The following transactions took place during the year (all purchases and services were acquired on account): a.) Raw materials purchased: $86,000. b.) Raw materials requisitioned for use in production (all direct materials): $98,000. c.) Utility costs incurred in the factory: $15,000. d.) Salaries and wages incurred as follows: e.) Maintenance costs incurred in the factory: $15,000. f.) Advertising costs incurred: $89,000. g.) Depreciation recorded for the year: $80,000, of which 80% relates to factory assets and the remainder relates to selling and administrative assets. h.) Rental cost incurred on buildings: $70,000(75% of the space is occupied by the factory, and 25% is occupied by sales and administration). i.) Miscellaneous selling and administrative costs incurred: $11,000. j.) Manufacturing overhead cost was applied to jobs as per company policy. k.) Cost of goods manufactured for the year: $500,000. 1.) Sales for the year (all on account): $1,000,000. These goods cost $600,000 to manufacture. Required: Prepare statement of cost of goods manufactured and net income. Problem.2. (PROCESS COSTING) - Dita Company uses a process costing system. The following information relates to one month's activity in the company's Curing Department: The conversion cost of the beginning inventory was $6,500. During the month, $112,000 in additional conversion cost was incurred. Required: Assume that the company uses the WEIGHTED AVERAGE method, Compute the following: 1. The equivalent units of production for conversion for the month. 2. The cost per equivalent unit for conversion for the month. 3. The total cost transferred out during the month. 4. The cost assigned to the ending work-in-process inventory. ASSIGNMENT - 2 5\% IN THE FINAL GRADE DUE before October 22 nd,2022@11.59 PM Problem:1 (JOB ORDER COSTING) The Collins Company uses a job-order costing system and applies manufacturing overhead cost to jobs on the basis of the cost of materials used in production. At the beginning of the most recent year, the following estimates were made as a basis for computing the predetermined overhead rate for the year: The following transactions took place during the year (all purchases and services were acquired on account): a.) Raw materials purchased: $86,000. b.) Raw materials requisitioned for use in production (all direct materials): $98,000. c.) Utility costs incurred in the factory: $15,000. d.) Salaries and wages incurred as follows: e.) Maintenance costs incurred in the factory: $15,000. f.) Advertising costs incurred: $89,000. g.) Depreciation recorded for the year: $80,000, of which 80% relates to factory assets and the remainder relates to selling and administrative assets. h.) Rental cost incurred on buildings: $70,000(75% of the space is occupied by the factory, and 25% is occupied by sales and administration). i.) Miscellaneous selling and administrative costs incurred: $11,000. j.) Manufacturing overhead cost was applied to jobs as per company policy. k.) Cost of goods manufactured for the year: $500,000. 1.) Sales for the year (all on account): $1,000,000. These goods cost $600,000 to manufacture. Required: Prepare statement of cost of goods manufactured and net income. Problem.2. (PROCESS COSTING) - Dita Company uses a process costing system. The following information relates to one month's activity in the company's Curing Department: The conversion cost of the beginning inventory was $6,500. During the month, $112,000 in additional conversion cost was incurred. Required: Assume that the company uses the WEIGHTED AVERAGE method, Compute the following: 1. The equivalent units of production for conversion for the month. 2. The cost per equivalent unit for conversion for the month. 3. The total cost transferred out during the month. 4. The cost assigned to the ending work-in-process inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts