Question: assignment 2. Critically discuss whether the CAPM makes portfolio theory redundant. 3. You are considering investing in two securities, X and Y, and have the

assignment

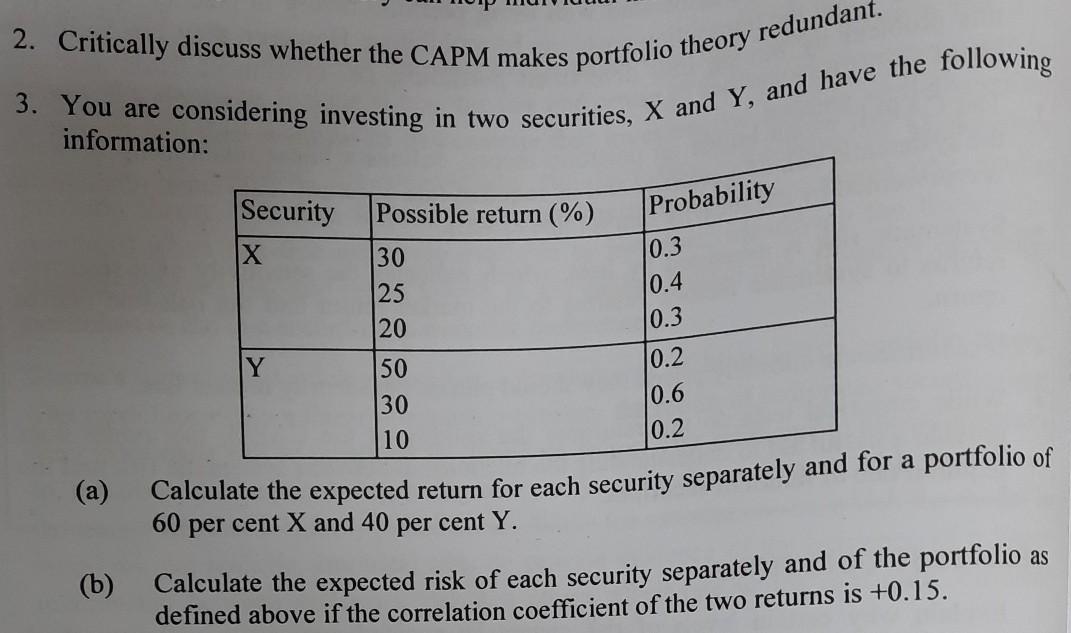

2. Critically discuss whether the CAPM makes portfolio theory redundant. 3. You are considering investing in two securities, X and Y, and have the following information: Security Possible return (%) X 30 Probability 0.3 0.4 0.3 25 20 50 0.2 30 0.6 10 0.2 Calculate the expected return for each security separately and for a portfolio of 60 per cent X and 40 per cent Y. Calculate the expected risk of each security separately and of the portfolio as defined above if the correlation coefficient of the two returns is +0.15. (a) (b)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts