Question: Assignment 2 : Forex Hedging Transactions Kiwi Corporation, a U . S . enterprise, sold product to a customer in New Zealand on 1 February

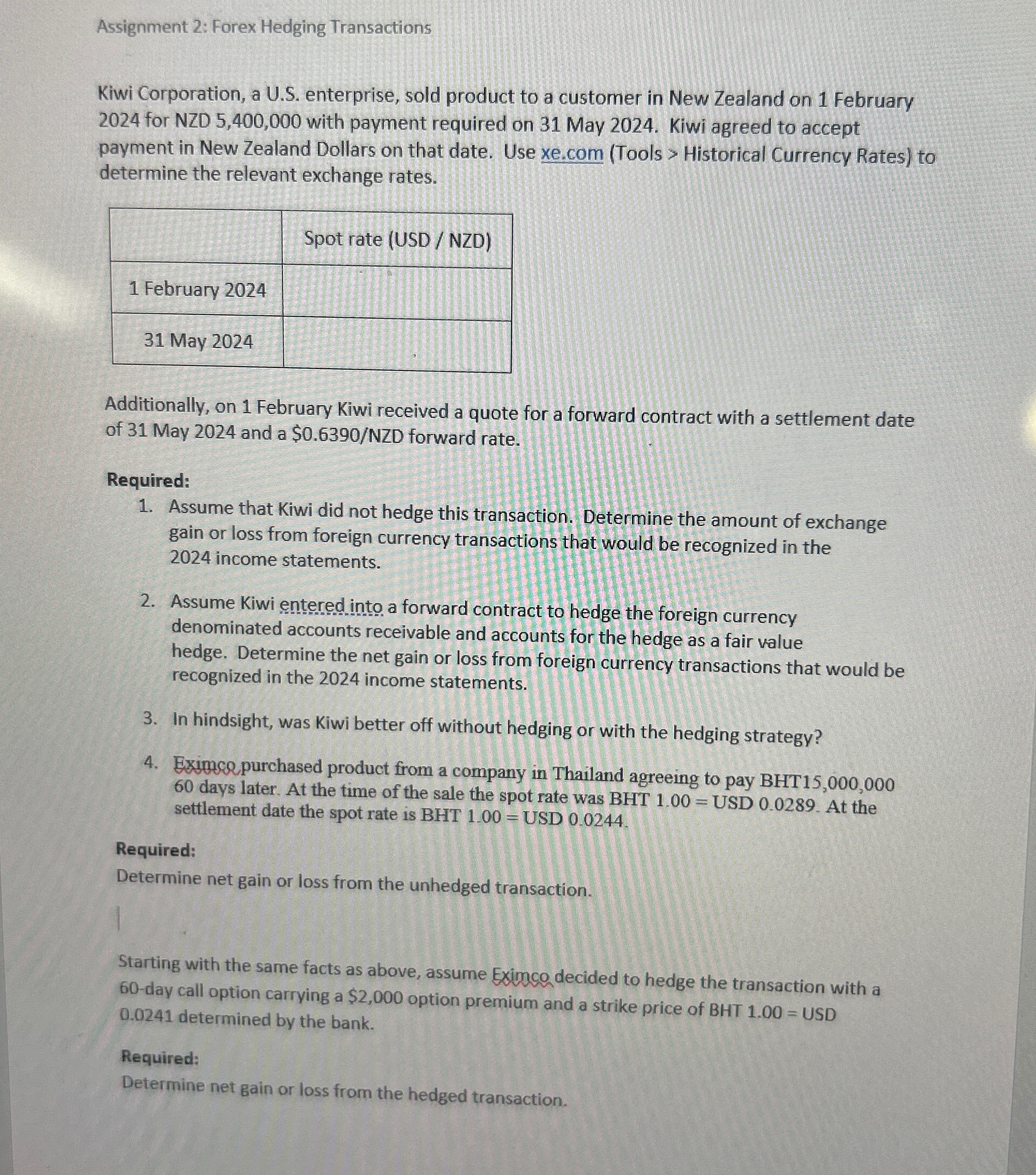

Assignment : Forex Hedging Transactions

Kiwi Corporation, a US enterprise, sold product to a customer in New Zealand on February for NZD with payment required on May Kiwi agreed to accept payment in New Zealand Dollars on that date. Use

xecom Tools Historical Currency Rates to determine the relevant exchange rates.

tableSpot rate USD NZD February May

Additionally, on February Kiwi received a quote for a forward contract with a settlement date of May and a $ NZD forward rate.

Required:

Assume that Kiwi did not hedge this transaction. Determine the amount of exchange gain or loss from foreign currency transactions that would be recognized in the income statements.

Assume Kiwi entered into a forward contract to hedge the foreign currency denominated accounts receivable and accounts for the hedge as a fair value hedge. Determine the net gain or loss from foreign currency transactions that would be recognized in the income statements.

In hindsight, was Kiwi better off without hedging or with the hedging strategy?

Eximce purchased product from a company in Thailand agreeing to pay BHT days later. At the time of the sale the spot rate was BHT USD At the settlement date the spot rate is BHT USD

Required:

Determine net gain or loss from the unhedged transaction.

Starting with the same facts as above, assume Eximco decided to hedge the transaction with a day call option carrying a $ option premium and a strike price of BHT USD determined by the bank.

Required:

Determine net gain or loss from the hedged transaction.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock