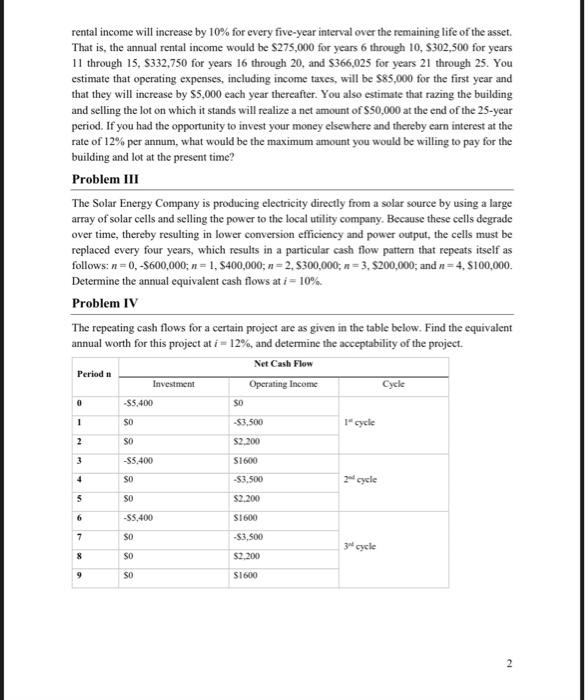

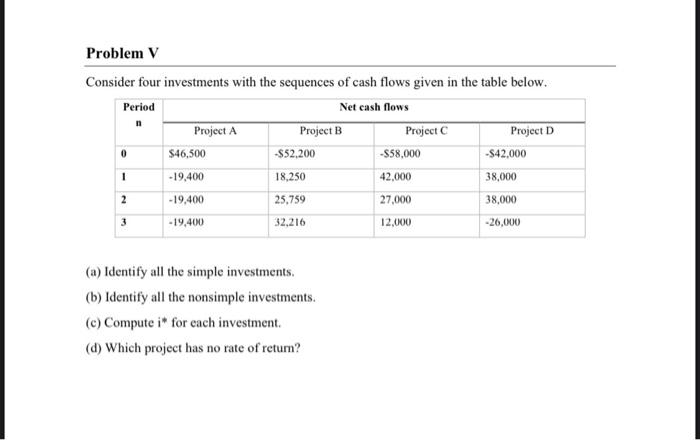

ASSIGNMENT #2 Individual - Due by Tuesday April 12 at 11.59pm Problem 1 Camptown Togs, Inc., a children's clothing manufacturer, has always found payroll processing to be costly because it must be done by a clerk. The number of piece goods coupons received by each employee is collected and the types of tasks performed by each employee are calculated. Not long ago, an industrial engineer designed a system that partially automates the process by means of a scanner that reads the piece-goods coupons. Management is enthusiastic about this system, because it utilizes some personal computer systems that were purchased recently. It is expected that this new automated system will save $45,000 per year in labor. The new system will cost about $30,000 to build and test prior to operation. It is expected that operating costs, including income taxes, will be about $5,000 per year. The system will have a five-year useful life. The expected net salvage value of the system is estimated to be $3,000 (a) Identify the cash inflows over the life of the project. (b) Identify the cash outflows over the life of the project. (e) Determine the net cash flows over the life of the project. (d) How long does it take to recover the investment? (e) If the firm's interest rate is 15% after taxes, what would be the discounted payback period for this project? Problem II Your firm is considering purchasing an old office building with an estimated remaining service life of 25 years. Recently, the tenants signed a longterm lease, which leads you to believe that the current rental income of $250,000 per year will remain constant for the first five years. Then the rental income will increase by 10% for every five-year interval over the remaining life of the asset. That is, the annual rental income would be $275,000 for years 6 through 10, S302,500 for years 11 through 15, 332,750 for years 16 through 20, and $366,025 for years 21 through 25. You estimate that operating expenses, including income taxes, will be $85,000 for the first year and that they will increase by $5,000 each year thereafter. You also estimate that razing the building and selling the lot on which it stands will realize a net amount of $50,000 at the end of the 25-year period. If you had the opportunity to invest your money elsewhere and thereby earn interest at the rate of 12% per annum, what would be the maximum amount you would be willing to pay for the building and lot at the present time? Problem III The Solar Energy Company is producing electricity directly from a solar source by using a large array of solar cells and selling the power to the local utility company. Because these cells degrade over time, thereby resulting in lower conversion efficiency and power output, the cells must be replaced every four years, which results in a particular cash flow pattern that repeats itself as follows: n=0,-5600,000; n = 1, $400,000; n = 2, $300,000; n = 3, $200,000; and n=4, S100,000 Determine the annual equivalent cash flows at i = 10% Problem IV The repeating cash flows for a certain project are as given in the table below. Find the equivalent annual worth for this project at i = 12%, and determine the acceptability of the project Net Cash Flow Period Operating Income Cycle -$5.400 -$3.500 1cycle Investment 0 SO 1 SO 2 SO S2,200 -S5.400 S1600 -$3.500 4 SO cycle 5 SO $2,200 6 -$5,400 S1600 7 SO -$3.500 3 cycle 8 SO $2200 9 S1600 2 Problem v Consider four investments with the sequences of cash flows given in the table below. Period Net cash flows Project A Project B Project C Project D 0 $46,500 -$52,200 -S58,000 -S42,000 1 -19,400 18.250 42,000 38,000 -19,400 25,759 27,000 38,000 n 2 3 -19,400 32.216 12.000 -26,000 (a) Identify all the simple investments (b) Identify all the nonsimple investments. (c) Compute is for each investment (d) Which project has no rate of retur