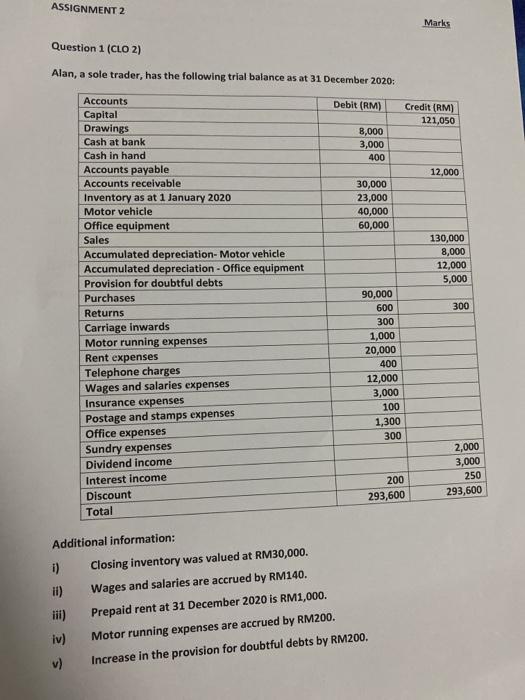

Question: ASSIGNMENT 2 Marks Question 1 (CLO 2) Alan, a sole trader, has the following trial balance as at 31 December 2020: Debit (RM) Credit (RM)

ASSIGNMENT 2 Marks Question 1 (CLO 2) Alan, a sole trader, has the following trial balance as at 31 December 2020: Debit (RM) Credit (RM) 121,050 8,000 3,000 400 12,000 30,000 23,000 40,000 60,000 130,000 8,000 12,000 5,000 Accounts Capital Drawings Cash at bank Cash in hand Accounts payable Accounts receivable Inventory as at 1 January 2020 Motor vehicle Office equipment Sales Accumulated depreciation-Motor vehicle Accumulated depreciation - Office equipment Provision for doubtful debts Purchases Returns Carriage inwards Motor running expenses Rent expenses Telephone charges Wages and salaries expenses Insurance expenses Postage and stamps expenses Office expenses Sundry expenses Dividend income Interest income Discount Total 300 90,000 600 300 1,000 20,000 400 12,000 3,000 100 1,300 300 2,000 3,000 250 293,600 200 293,600 Additional information: i) Closing inventory was valued at RM30,000. ii) Wages and salaries are accrued by RM140. Prepaid rent at 31 December 2020 is RM1,000. iv) Motor running expenses are accrued by RM200. Increase in the provision for doubtful debts by RM200. s vi) Depreciation is yet to be provided for the year. All non-current assets are to be depreciated by 10% on cost based on the balance of its account on 31 December 2020. You are required to prepare the following financial statements: a) Statement of Comprehensive Income for the year ended 31 December 2020. (15) b) Statement of Financial Position as at 31 December 2020 (show working capital calculation). (15) (Total: 30 marks) [TOTAL MARKS: 50)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts