Question: Assignment 2 Posting Transactions Overview Now that you have identified the various accounts and where they belong on the financial statements, we need to add

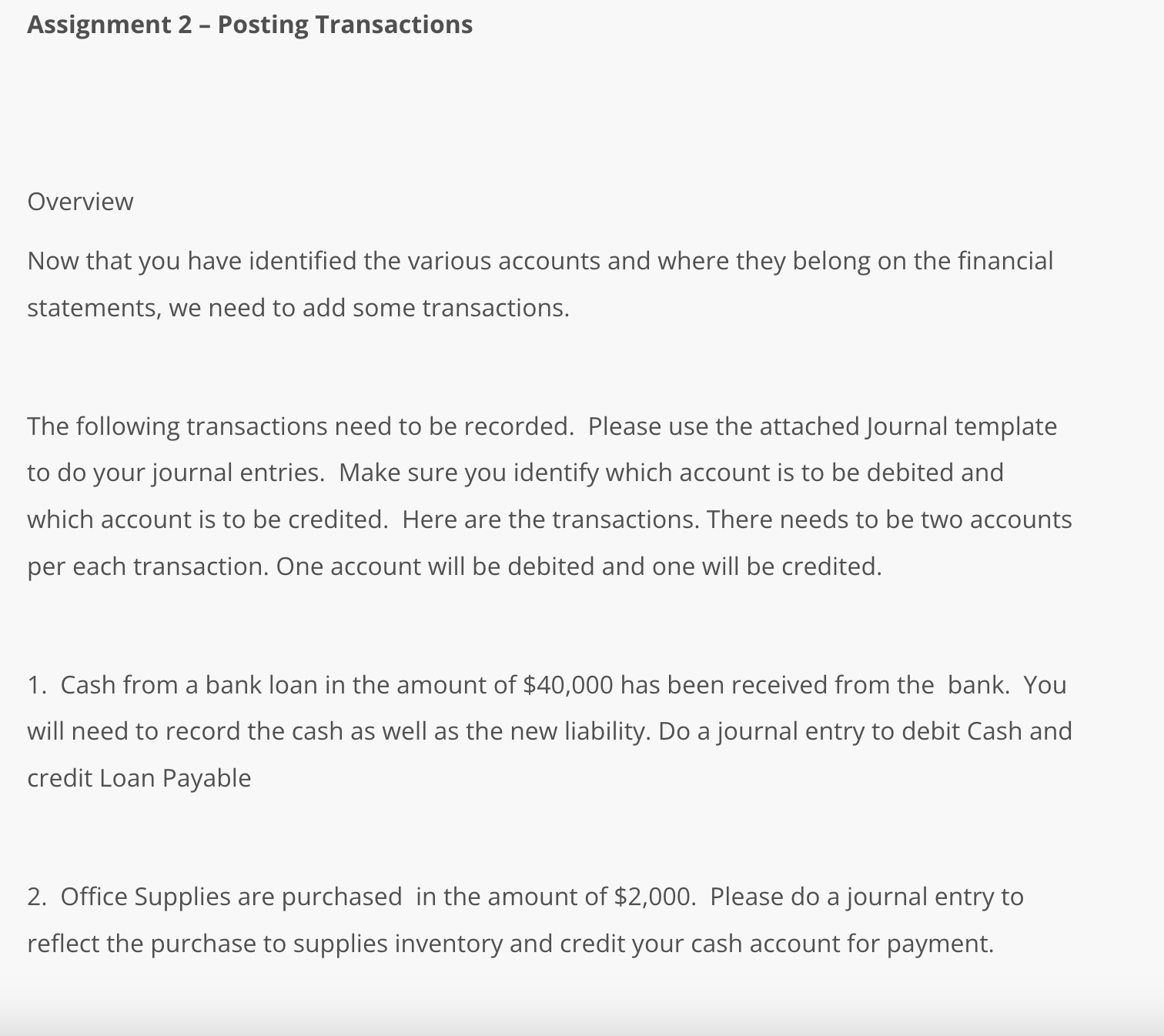

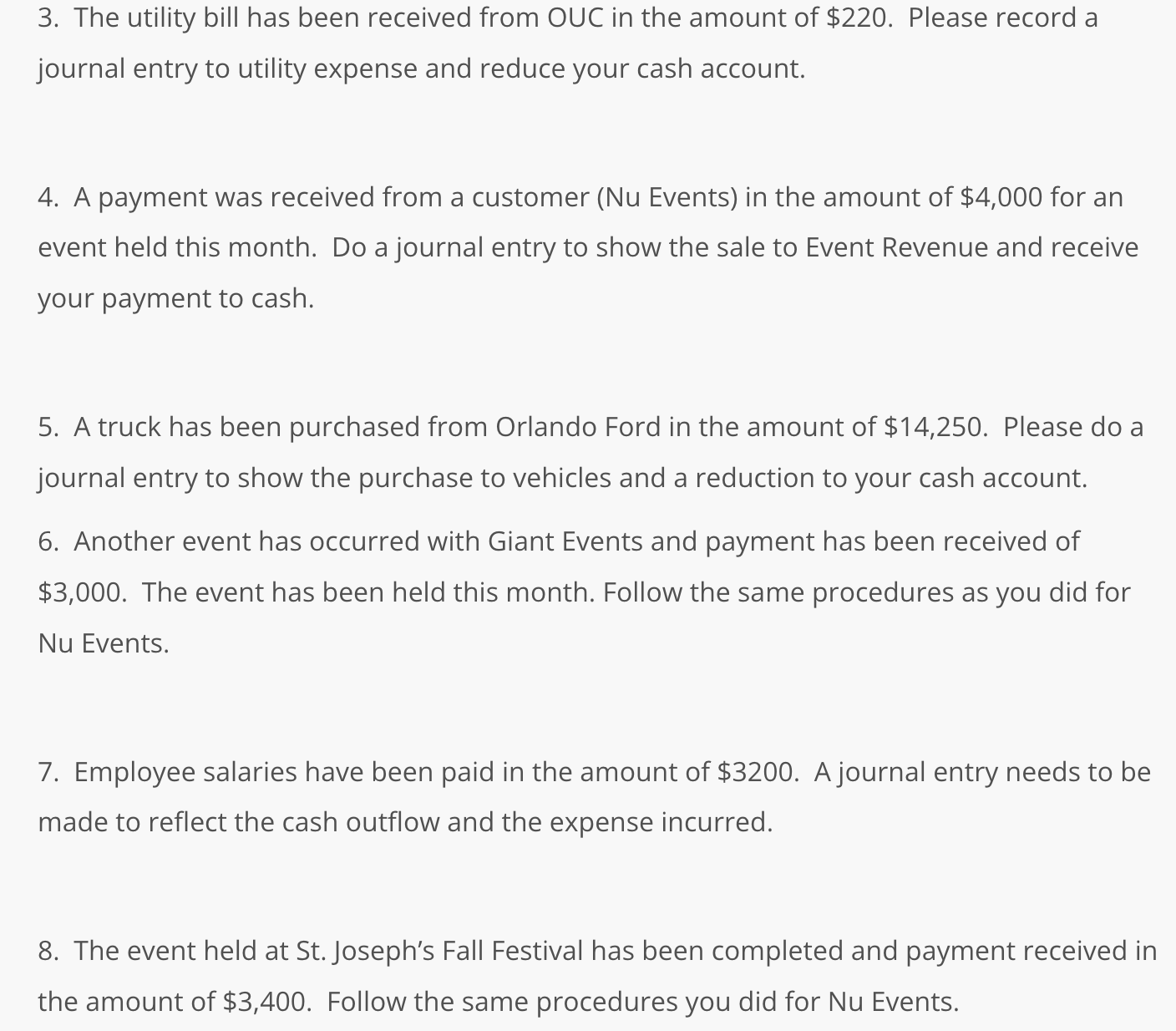

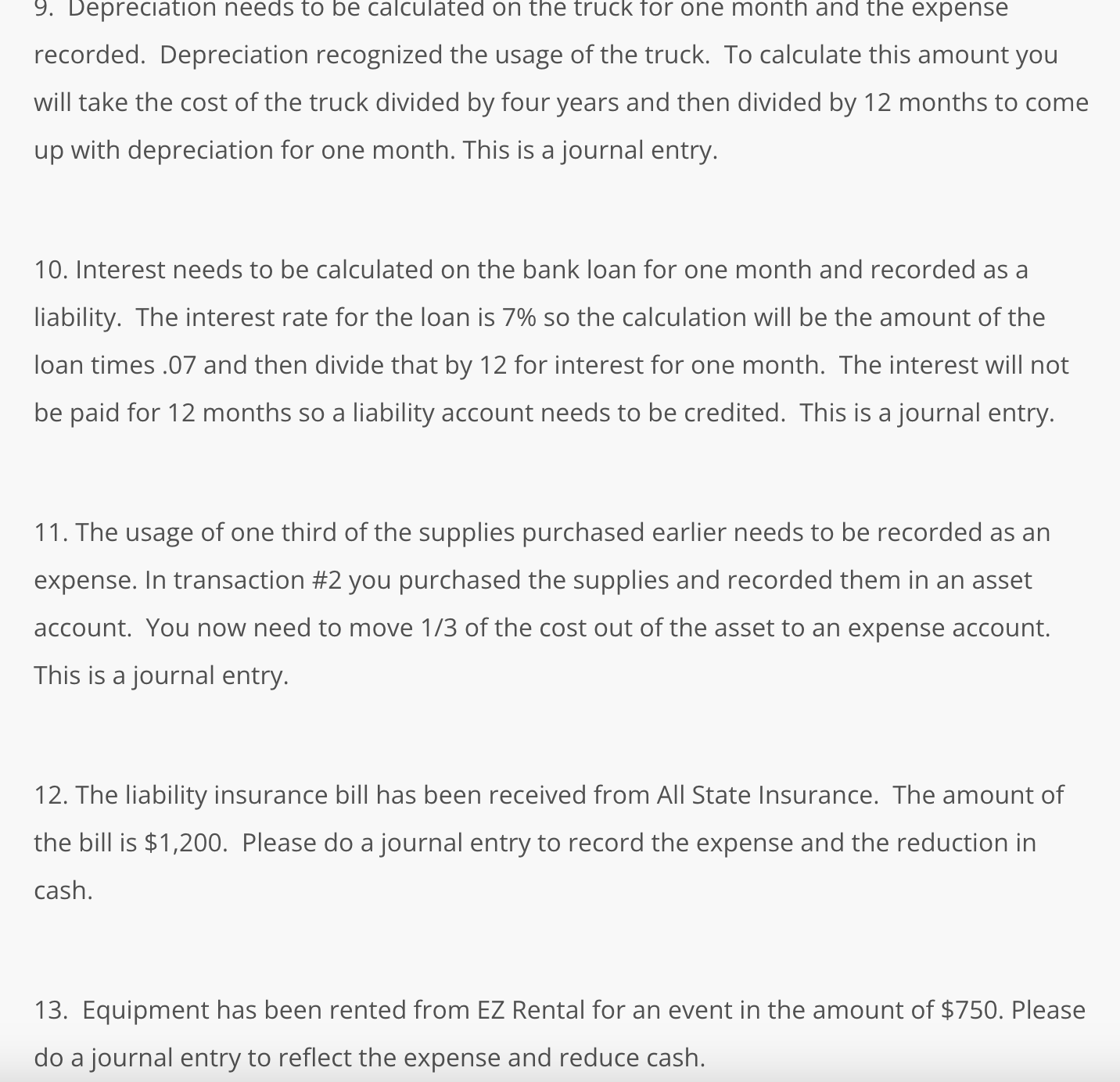

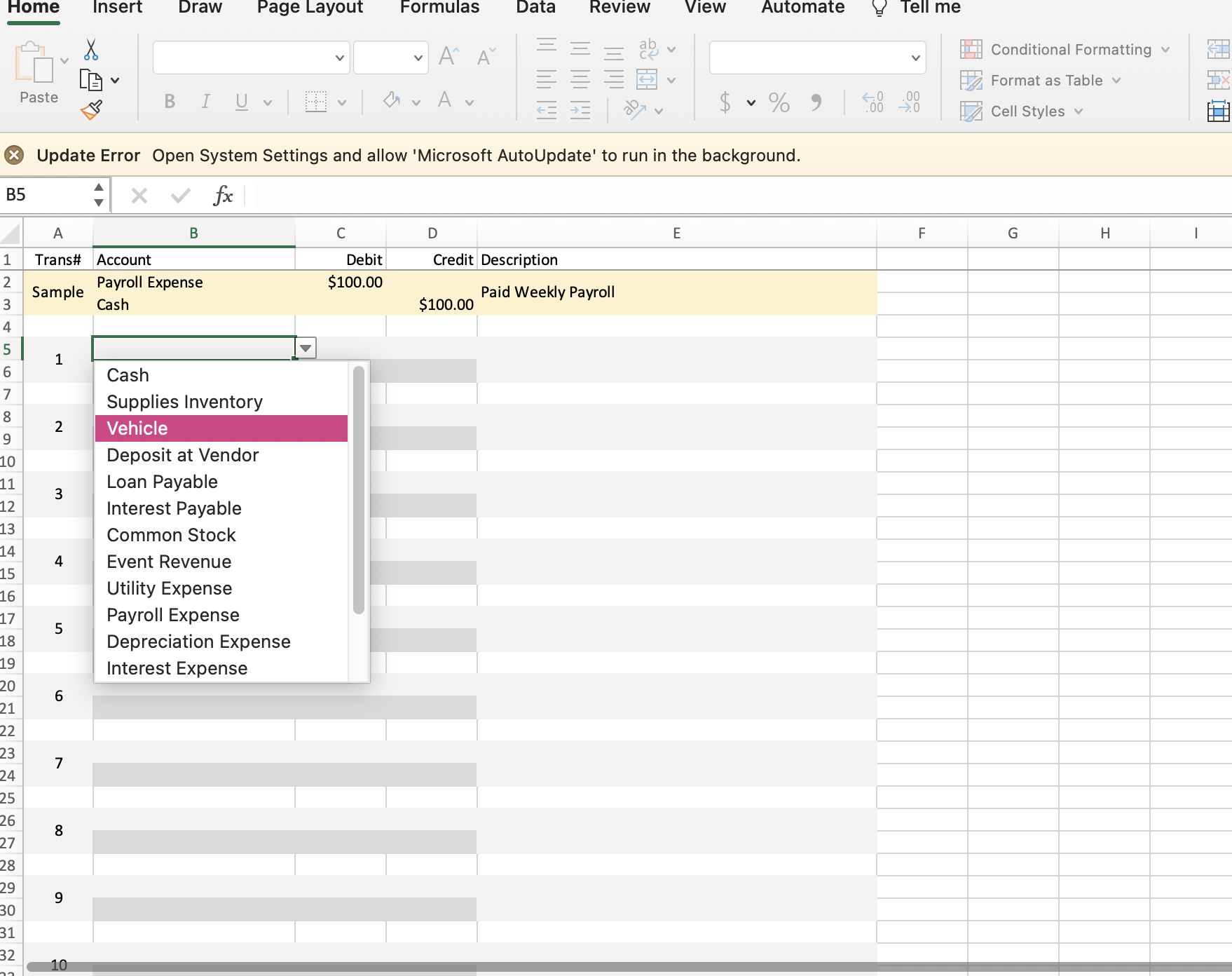

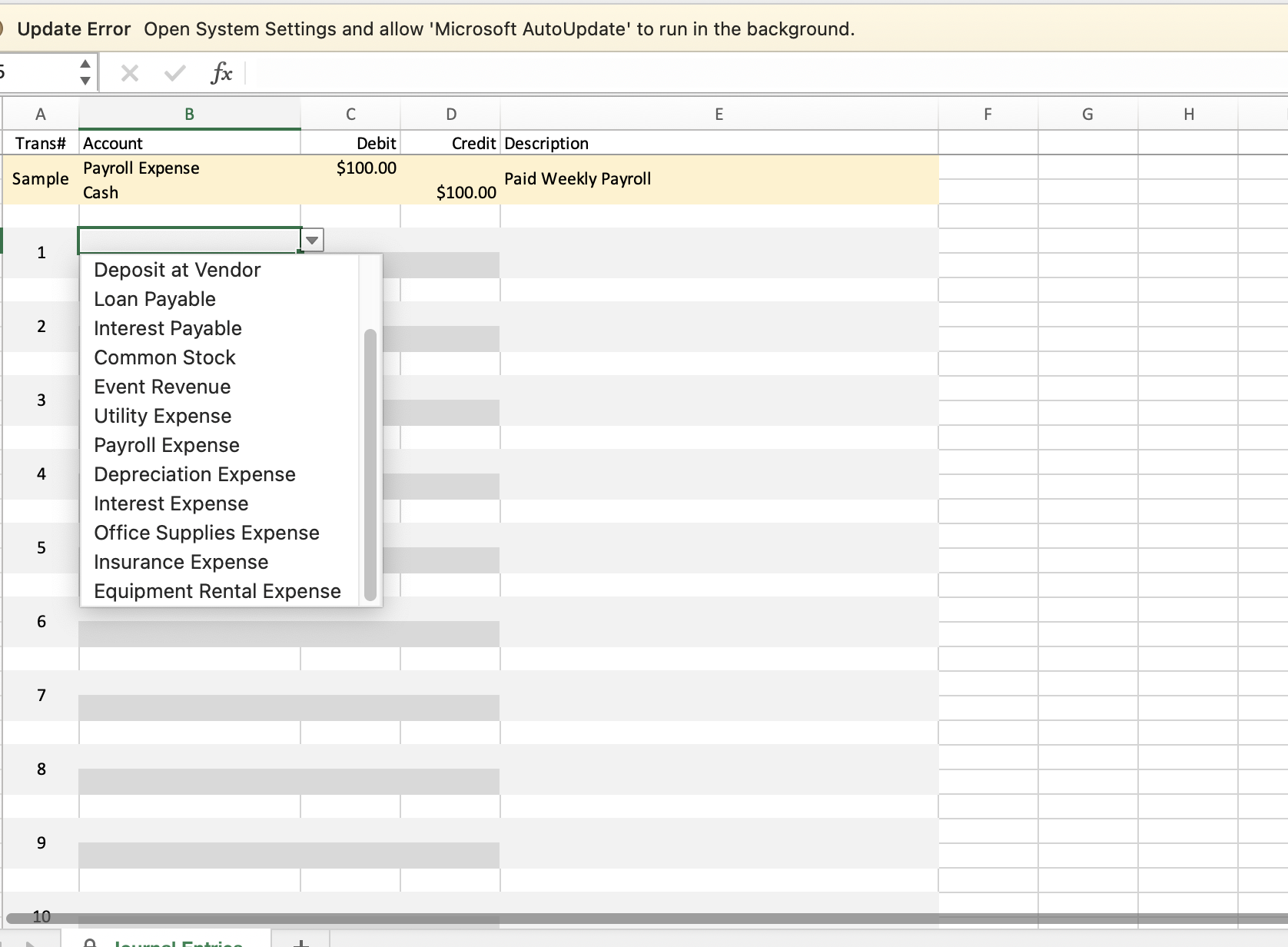

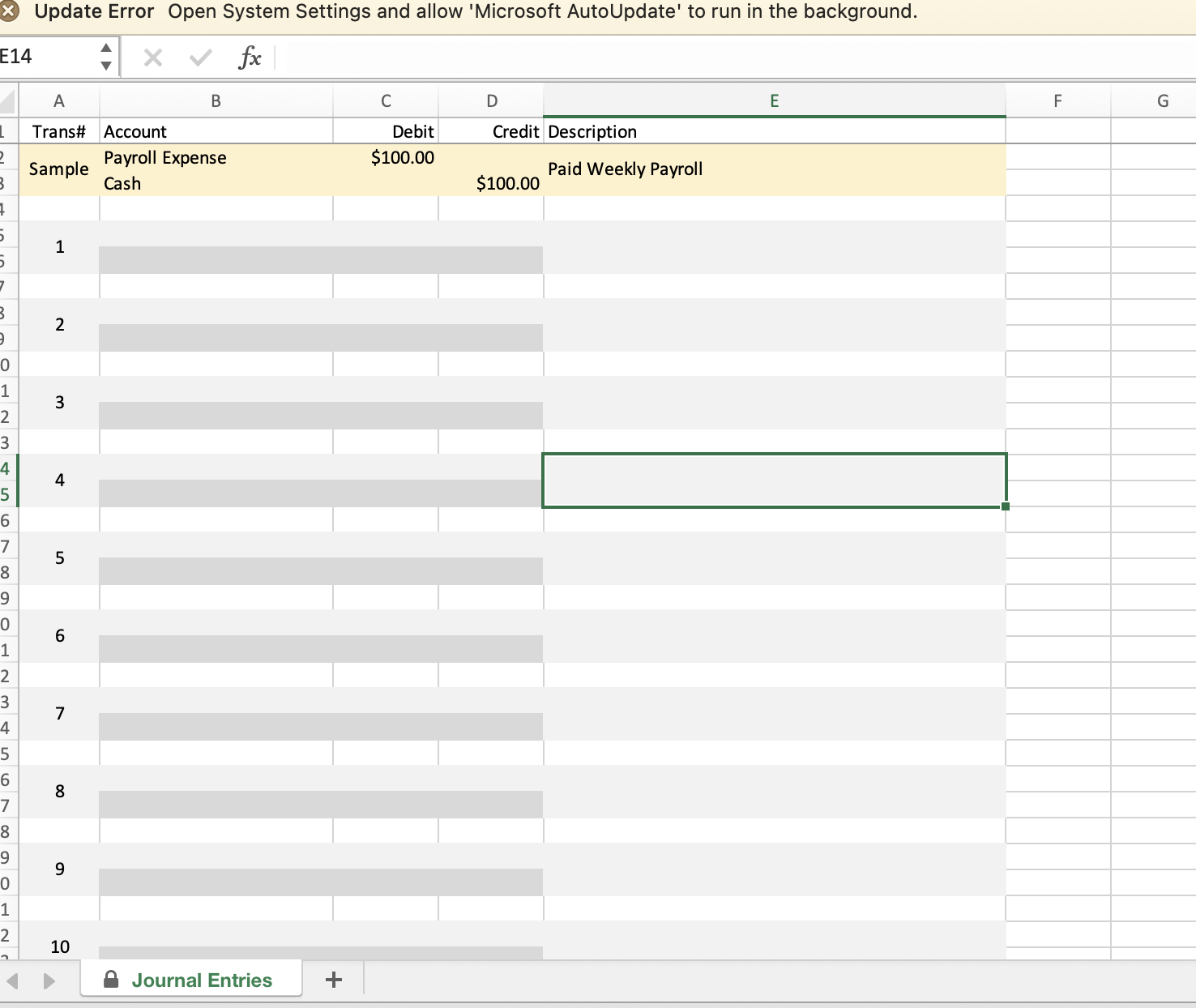

Assignment 2 Posting Transactions Overview Now that you have identified the various accounts and where they belong on the financial statements, we need to add some transactions. The following transactions need to be recorded. Please use the attachedJournal template to do yourjournal entries. Make sure you identify which account is to be debited and which account is to be credited. Here are the transactions. There needs to be two accounts per each transaction. One account will be debited and one will be credited. 1. Cash from a bank loan in the amount of $40,000 has been received from the bank. You will need to record the cash as well as the new liability. Do a journal entry to debit Cash and credit Loan Payable 2. Office Supplies are purchased in the amount of $2,000. Please do a journal entry to reflect the purchase to supplies inventory and credit your cash account for payment. 3. The utility bill has been received from OUC in the amount of $220. Please record a journal entry to utility expense and reduce your cash account. 4. A payment was received from a customer (Nu Events) in the amount of $4,000 for an event held this month. Do a journal entry to show the sale to Event Revenue and receive your payment to cash. 5. A truck has been purchased from Orlando Ford in the amount of $14,250. Please do a journal entry to show the purchase to vehicles and a reduction to your cash account. 6. Another event has occurred with Giant Events and payment has been received of $3,000. The event has been held this month. Follow the same procedures as you did for Nu Events. 7. Employee salaries have been paid in the amount of $3200. Ajournal entry needs to be made to reflect the cash outflow and the expense incurred. 8. The event held at St.joseph's Fall Festival has been completed and payment received in the amount of $3,400. Follow the same procedures you did for Nu Events. 9. Ueprecnation needs to be calculated on the truck tor one month and the expense recorded. Depreciation recognized the usage of the truck. To calculate this amount you will take the cost ofthe truck divided by four years and then divided by 12 months to come up with depreciation for one month. This is a journal entry. 10. Interest needs to be calculated on the bank loan for one month and recorded as a liability. The interest rate for the loan is 7% so the calculation will be the amount of the loan times .07 and then divide that by 12 for interest for one month. The interest will not be paid for 12 months so a liability account needs to be credited. This is a journal entry. 11.The usage of one third of the supplies purchased earlier needs to be recorded as an expense. In transaction #2 you purchased the supplies and recorded them in an asset account. You now need to move 1/3 of the cost out ofthe asset to an expense account. This is a journal entry. 12. The liability insurance bill has been received from All State Insurance. The amount of the bill is $1,200. Please do a journal entry to record the expense and the reduction in cash. 13. Equipment has been rented from E2 Rental for an event in the amount of $750. Please do ajournal entry to reflect the expense and reduce cash. 14. A small event has been completed for the Orange County Public Schools and payment was received for $1,000. Follow the same procedures you did for Nu Events. '15. A deposit was made on the Sound Stage arena for an upcoming event in the amount of $500. Please do a journal entry to show the deposit to Deposit at Vendor and a reduction in cash. 16. The President of the company has given the company $20,000 in exchange for common stock. Instructions: Once these transactions have been recorded, submit the Excel template to the assignment. Home Insert Draw Page Layout Formulas Data Review View Automate U Tell me E : _ ab v _ - _ V '_' D V x v v A A _ : i (r v [ :I Conditional Formatting |_. EB V E E E ._, V '7 Format as Table v E Paste v v v v 0 .. B I g 0 A _: _: b9 v $ 4) 3 W 'v' m Cell Styles v Egg 0 Update Error Open System Settings and allow 'Microsoft AutoUpdate' to run in the background. 35 : fx A B C D E F G H | 1 Transit Account Debit Credit Description 2 Sample Payroll Expense $10000 Paid Weekly Payroll 3 Cash $10000 4 5 I 1 | : 5 Cash ; Supplies Inventory 9 2 10 Deposit at Vendor 11 3 Loan Payable 12 Interest Payable 13 Common Stock 14 15 4 Event Revenue 16 Utility Expense 17 5 Payroll Expense 18 Depreciation Expense 19 Interest Expense 20 6 21 22 23 7 24 25 26 B 27 28 29 9 30 31 32 1-: l Update Error Open System Settings and allow 'Microsoft AutoUpdate' to run in the background. 5 3 fx A B C D E Transit Account Debit Credit Description Sample Payroll Expense $10030 Paid Weekly Payroll Cash $100 00 I1I:JL Deposit at Vendor Loan Payable 2 Interest Payable Common Stock Event Revenue Utility Expense Payroll Expense 4 Depreciation Expense Interest Expense Office Supplies Expense 5 Insurance Expense Equipment Rental Expense 6 7 B 9 * Update Error Open System Settings and allow 'Microsoft AutoUpdate' to run in the background. E14 X V fx A B C D E F G Trans# Account Debit Credit Description Sample Payroll Expense $100.00 Cash $100.00 Paid Weekly Payroll N W 4 UT 8 9 10 D Journal Entries +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts