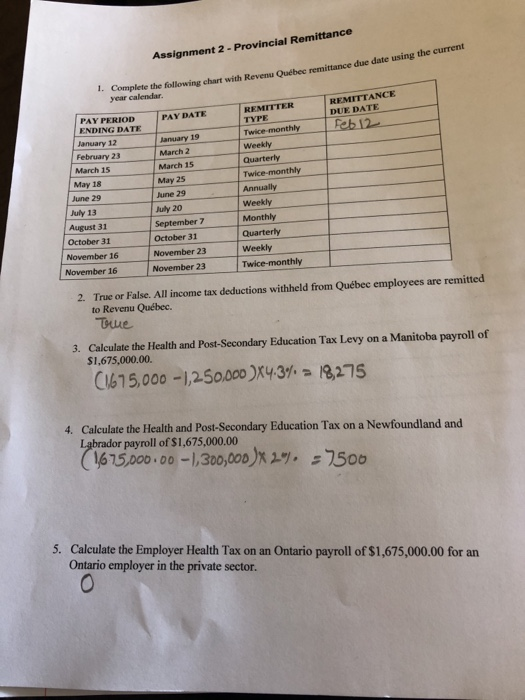

Question: Assignment 2 - Provincial Remittance Complete the following chart with Revenu Oudheeremittance due date using the curren year calendar. REMITTANCE DUE DATE I Feb 12

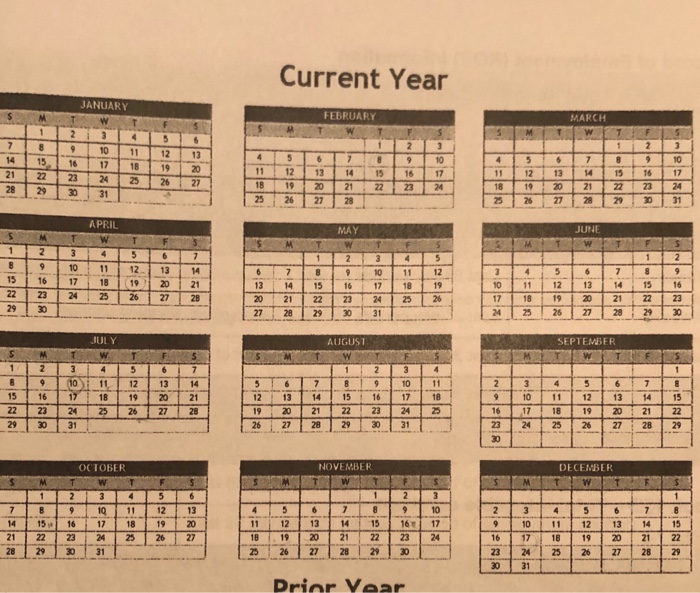

Assignment 2 - Provincial Remittance Complete the following chart with Revenu Oudheeremittance due date using the curren year calendar. REMITTANCE DUE DATE I Feb 12 PAY PERIOD PAY DATE ENDING DATE January 12 January 19 February 23 March 2 March 15 March 15 May 18 May 25 June 29 June 29 July 13 I suty 20 August 31 September 7 October 31 October 31 November 16 November 23 November 16 November 23 REMITTER TYPE Twice-monthly Weekly Quarterly Twice-monthly Annually Weekly Monthly Quarterly Weekly Twice-monthly 2. True or False. All income tax deductions withheld from Qubec employees are remitted to Revenu Qubec The 3. Calculate the Health and Post-Secondary Education Tax Levy on a Manitoba payroll of $1,675,000.00 C1675,000 -1,250,000 X4.3%. = 18,275 4. Calculate the Health and Post-Secondary Education Tax on a Newfoundland and Labrador payroll of $1,675,000.00 (1675,000.00 -1,300,000 X 2). 7500 5. Calculate the Employer Health Tax on an Ontario payroll of $1,675,000.00 for an Ontario employer in the private sector. Current Year JANUARY FEBRUARY MARCH Na 15 16 2017 25 APRIL JUPIE 27712 / 23 AUGUST SEPTEMBER 10 11 12 13 14 5 - EN 6 13 7 14 8 15 9 16 10 17 11 18 OCTOBER NOVEMBER DECEMBER 5678910 MON Prior Year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts