Question: Assignment 2- Taxes Answer Sheet RRSP Calculations: Calculate how much your tax refund will be from Assignment 2: Taxes Answer Sheet investing in an RRSP

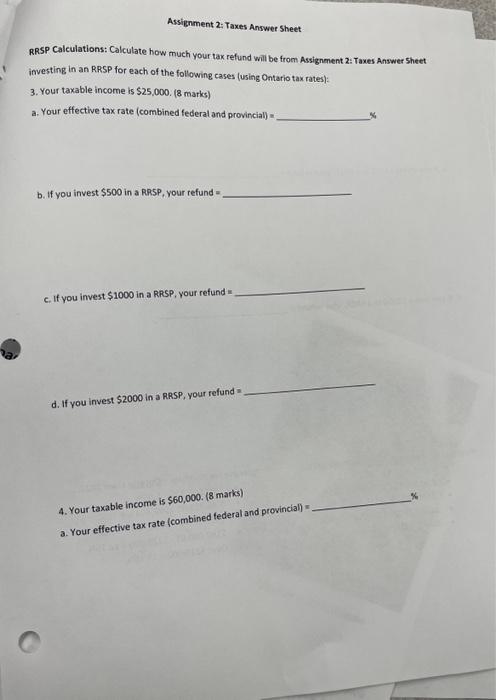

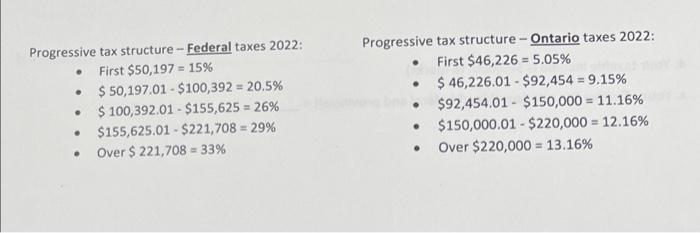

Assignment 2- Taxes Answer Sheet RRSP Calculations: Calculate how much your tax refund will be from Assignment 2: Taxes Answer Sheet investing in an RRSP for each of the following cases (using Ontario tax rates): 3. Your taxable income is $25,000. (8 marks) a. Your effective tax rate (combined federal and provincial) = 34 b. If you invest $500 in a RRSP, your refund = c. If you invest $1000 in a RRSP, your refund = d. If you invest $2000 in a RRSP, your refund = 4. Your taxable income is $60,000. (8 marks) 3. Your effective tax rate (combined federal and provincial) = Progressive tax structure - Federal taxes 2022: Progressive tax structure - Ontario taxes 2022: - First $50,197=15% - First $46,226=5.05% - $50,197.01$100,392=20.5% - $46,226.01$92,454=9.15% - $100,392.01$155,625=26% - $92,454.01$150,000=11.16% - $155,625.01$221,708=29% - $150,000.01$220,000=12.16% - Over $221,708=33% - Over $220,000=13.16%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts