Question: Assignment 2-2. There are three bonds on a fixed income market: 1) Bond A is a newly issued classical coupon bond with fixed coupon rate

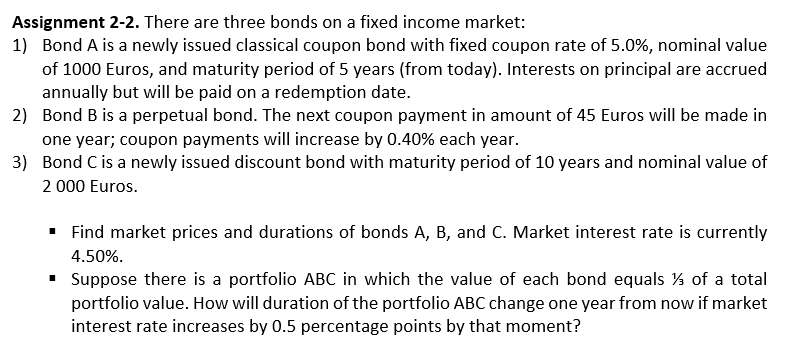

Assignment 2-2. There are three bonds on a fixed income market: 1) Bond A is a newly issued classical coupon bond with fixed coupon rate of 5.0%, nominal value of 1000 Euros, and maturity period of 5 years (from today). Interests on principal are accrued annually but will be paid on a redemption date. 2) Bond B is a perpetual bond. The next coupon payment in amount of 45 Euros will be made in one year; coupon payments will increase by 0.40% each year. 3) Bond C is a newly issued discount bond with maturity period of 10 years and nominal value of 2000 Euros. - Find market prices and durations of bonds A, B, and C. Market interest rate is currently 4.50%. - Suppose there is a portfolio ABC in which the value of each bond equals 1/3 of a total portfolio value. How will duration of the portfolio ABC change one year from now if market interest rate increases by 0.5 percentage points by that moment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts