Question: Assignment 28: Entries for Bonds Payable and Installment Note Transactions *PLEASE HELP WITH HIGHLIGHTED ERRORS. INCLUDE FORMULAS ON HOW TO SOLVE WHEN NEEDED. Thank you!

Assignment 28: Entries for Bonds Payable and Installment Note Transactions

*PLEASE HELP WITH HIGHLIGHTED ERRORS. INCLUDE FORMULAS ON HOW TO SOLVE WHEN NEEDED. Thank you!

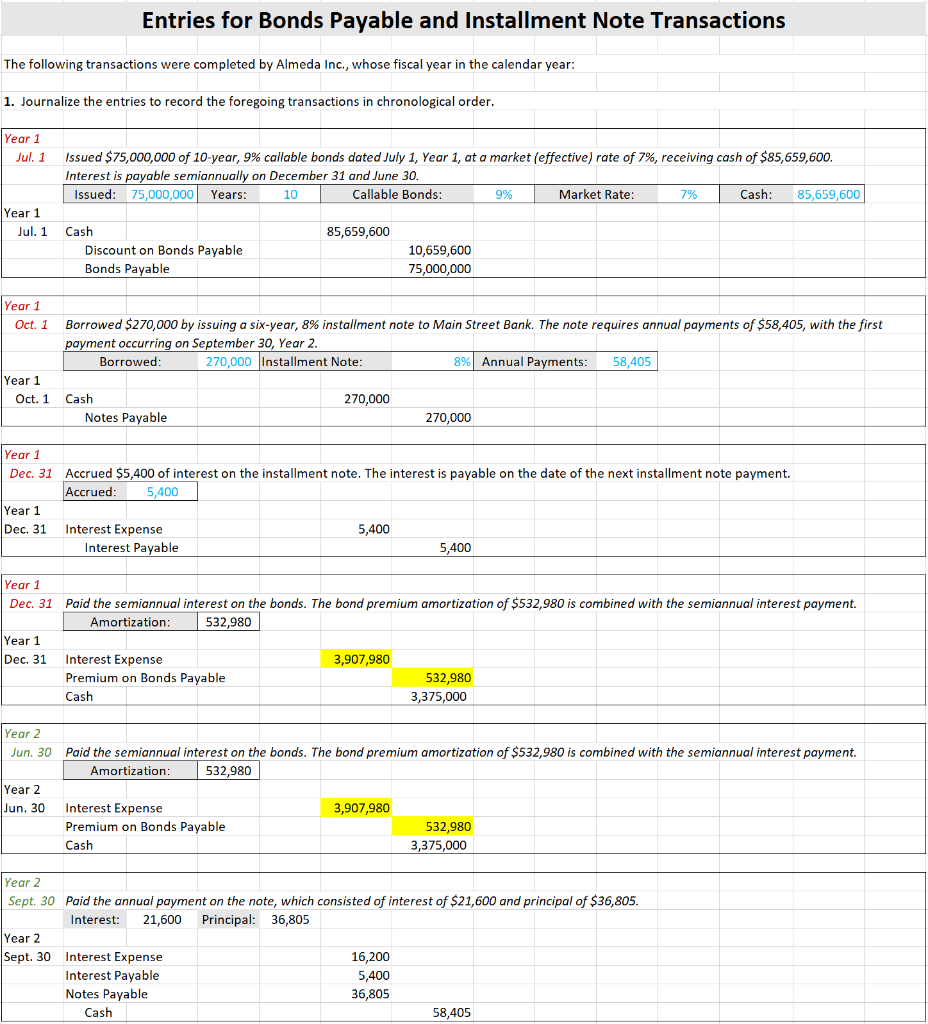

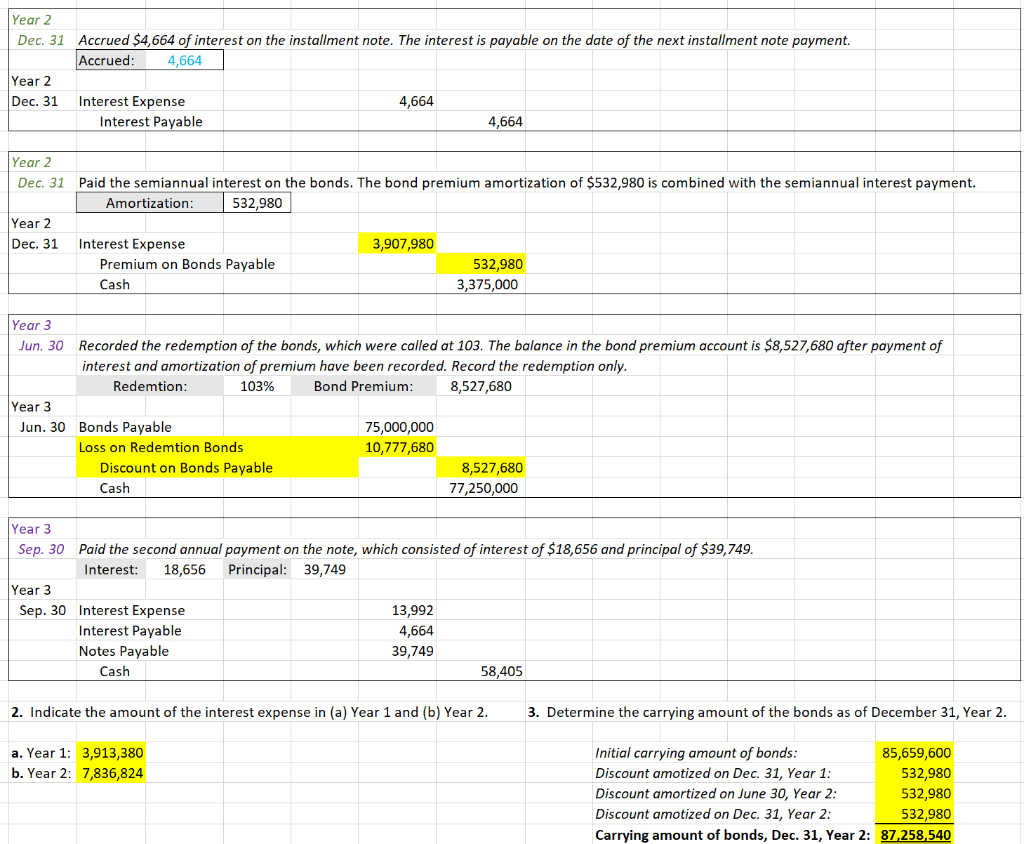

Entries for Bonds Payable and Installment Note Transactions The following transactions were completed by Almeda Inc., whose fiscal year in the calendar year: 1. Journalize the entries to record the foregoing transactions in chronological order. Year 1 Issued $75,000,000 of 10-year, 9% callable bonds dated July 1, Year 1, at a market (effective) rate of 7%, receiving cash of $85,659,600. Interest is payable semiannually on December 31 and June 30. Issued: 75,000,000 Years: 10 Callable Bonds: 9% Market Rate: 7% Cash: 85,659,600 Year 1 Jul. 1 85,659,600 Cash Discount on Bonds Payable Bonds Payable 10,659,600 75,000,000 Year 1 Oct. 1 Borrowed $270,000 by issuing a six-year, 8% installment note to Main Street Bank. The note requires annual payments of $58,405, with the first payment occurring on September 30, Year 2. Borrowed: 270,000 Installment Note: 8% Annual Payments: 58,405 Year 1 Oct. 1 Cash 270,000 Notes Payable 270,000 Year 1 Dec. 31 Accrued $5,400 of interest on the installment note. The interest is payable on the date of the next installment note payment. Accrued: 5,400 Year 1 Dec. 31 Interest Expense 5,400 Interest Payable 5,400 Year 1 Dec. 31 Paid the semiannual interest on the bonds. The bond premium amortization of $532,980 is combined with the semiannual interest payment. Amortization: 532,980 Year 1 Dec. 31 Interest Expense 3,907,980 Premium on Bonds Payable 532,980 Cash 3,375,000 Year 2 Jun. 30 Paid the semiannual interest on the bonds. The bond premium amortization of $532,980 is combined with the semiannual interest payment. Amortization: 532,980 Year 2 Jun. 30 Interest Expense 3,907,980 Premium on Bonds Payable 532,980 Cash 3,375,000 Year 2 Sept. 30 Paid the annual payment on the note, which consisted of interest of $21,600 and principal of $36,805. Interest: 21,600 Principal: 36,805 Year 2 Sept. 30 Interest Expense 16,200 Interest Payable Notes Payable 36,805 Cash 58,405 5,400 Year 2 Dec. 31 Accrued $4,664 of interest on the installment note. The interest is payable on the date of the next installment note payment Accrued: 4,664 Year 2 Dec. 31 Interest Expense 4,664 Interest Payable 4,664 Year 2 Dec. 31 Paid the semiannual interest on the bonds. The bond premium amortization of $532,980 is combined with the semiannual interest payment. Amortization: 532,980 Year 2 Dec. 31 Interest Expense 3,907,980 Premium on Bonds Payable 532,980 Cash 3,375,000 Year 3 Jun 30 Recorded the redemption of the bonds, which were called at 103. The balance in the bond premium account is $8,527,680 after payment of interest and amortization of premium have been recorded. Record the redemption only. Redemtion: 103% Bond Premium: 8,527,680 Year 3 Jun. 30 Bonds Payable 75,000,000 Loss on Redemtion Bonds 10,777,680 Discount on Bonds Payable 8,527,680 Cash 77,250,000 Year 3 Sep. 30 Paid the second annual payment on the note, which consisted of interest of $18,656 and principal of $39,749. Interest: 18,656 Principal: 39,749 Year 3 Sep. 30 Interest Expense 13,992 Interest Payable 4,664 Notes Payable 39,749 Cash 58,405 2. Indicate the amount of the interest expense in (a) Year 1 and (b) Year 2. 3. Determine the carrying amount of the bonds as of December 31, Year 2. a. Year 1: 3,913,380 b. Year 2: 7,836,824 Initial carrying amount of bonds: 85,659,600 Discount amotized on Dec. 31, Year 1: 532,980 Discount amortized on June 30, Year 2: 532,980 Discount amotized on Dec. 31, Year 2: 532,980 Carrying amount of bonds, Dec. 31, Year 2: 87,258,540

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts