Question: Assignment 3 A Saved Help Save & Exit Submit You received partial credit In the previous attempt. View previous attempt Check my work m. Your

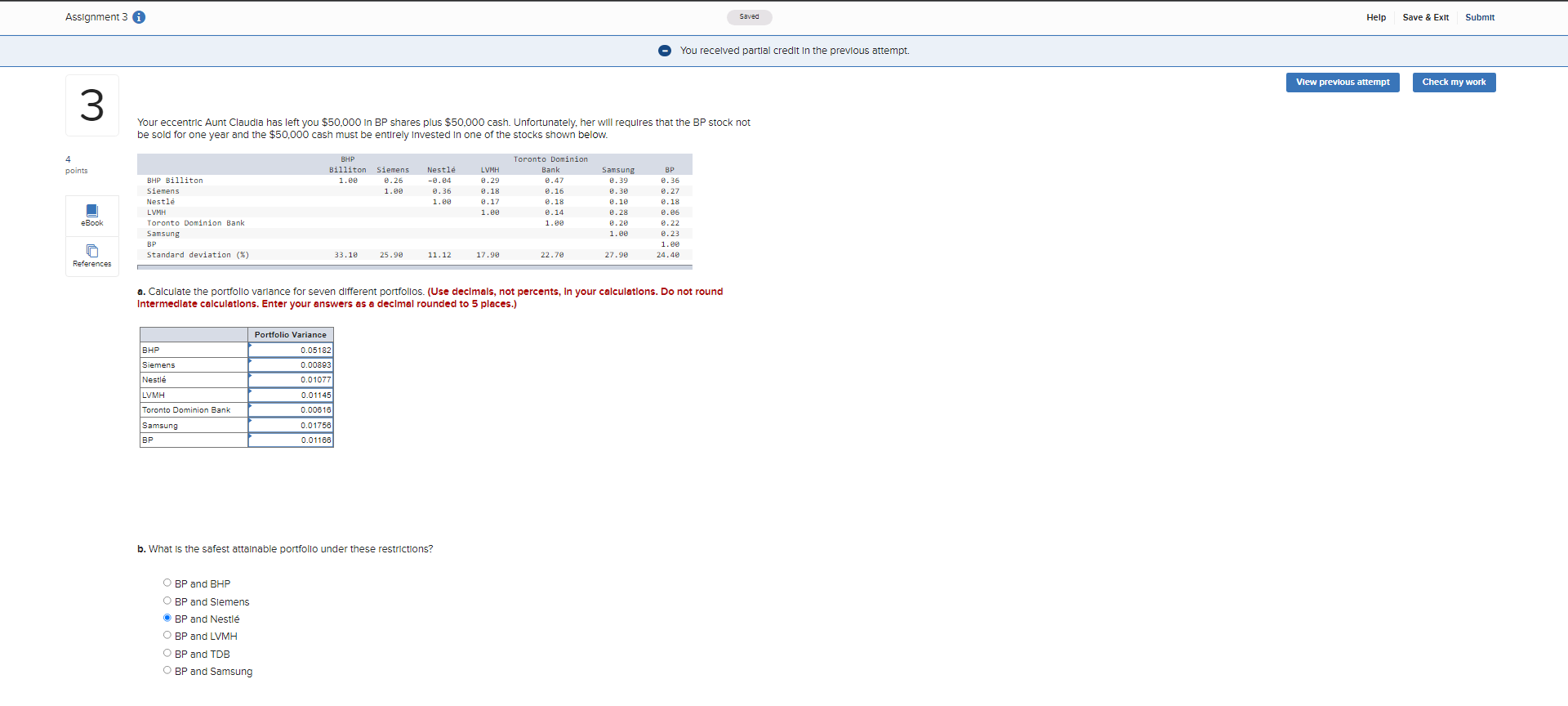

Assignment 3 A Saved Help Save & Exit Submit You received partial credit In the previous attempt. View previous attempt Check my work m. Your eccentric Aunt Claudia has left you $50,000 in BP shares plus $50,000 cash. Unfortunately, her will requires that the BP stock not be sold for one year and the $50,000 cash must be entirely Invested in one of the stocks shown below. 4 points BHP Billiton Siemens 1.00 0.26 1.00 Nestl -0.84 @.36 1.80 LVMH 9.29 8.18 0.17 1.89 BHP Billiton Siemens Nestl LVMH Toronto Dominion Bank Samsung BP Standard deviation (%) Toronto Dominion Bank 0.47 0.16 8.18 0.14 1.00 Samsung 2.39 0.30 0.10 0.28 0.28 1.ee BP 0.36 0.27 0.18 0.06 0.22 0.23 1.se 24.40 eBook 33.18 25.99 11.12 17.99 22.70 27.99 References a. Calculate the portfolio variance for seven different portfolios. (Use decimals, not percents, In your calculations. Do not round Intermediate calculations. Enter your answers as a decimal rounded to 5 places.) BHP Siemens Nestl LVMH Portfolio Variance 0.05182 0.00893 0.01077 0.01145 0.00616 0.01750 Toronto Dominion Bank Samsung BP 0.01168 b. What is the safest attainable portfolio under these restrictions? O BP and BHP O BP and Siemens BP and Nestl O BP and LVMH O BP and TDB O BP and Samsung

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts