Question: Assignment 3 A Saved Help Save & Exit Submit You skipped this question in the previous attempt. Check my work 2 Emperor's Clothes Fashions can

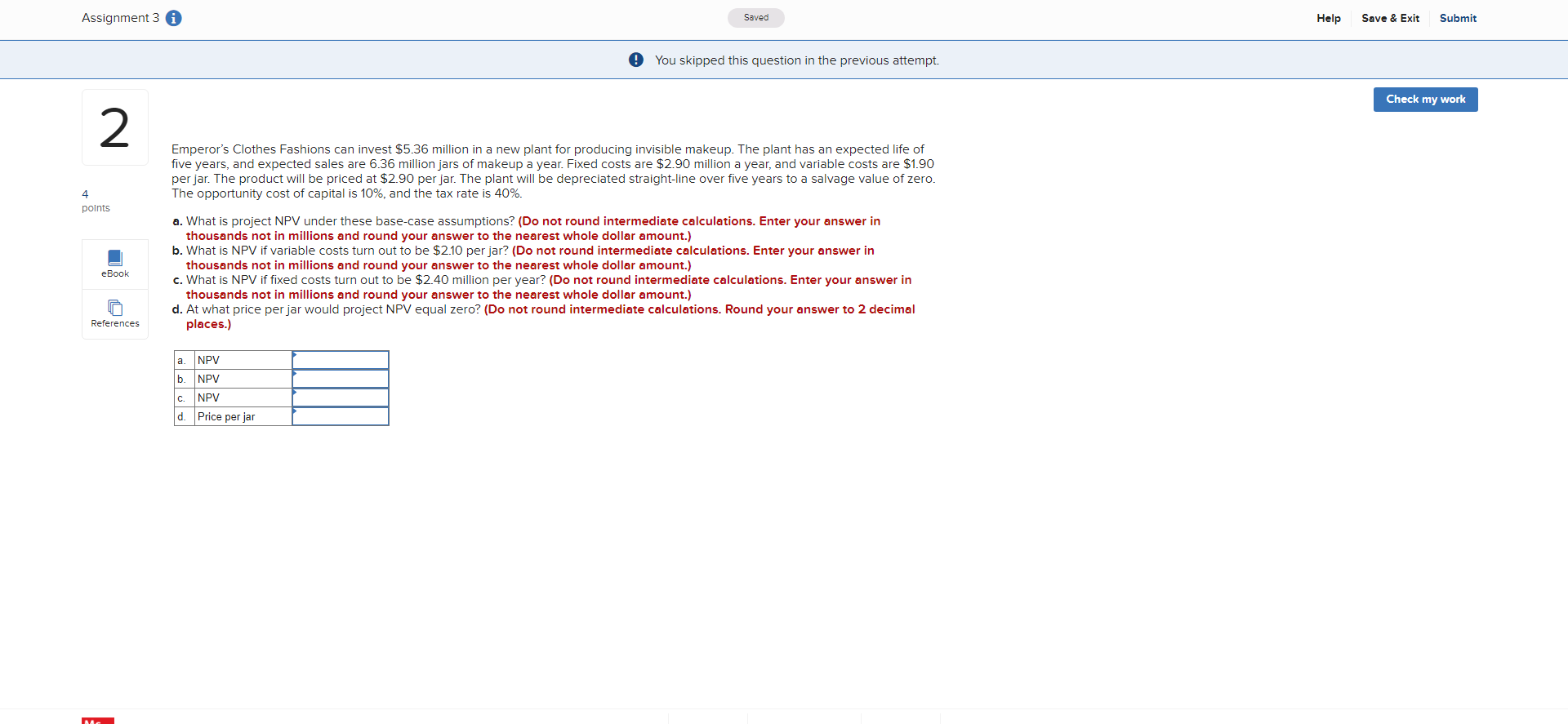

Assignment 3 A Saved Help Save & Exit Submit You skipped this question in the previous attempt. Check my work 2 Emperor's Clothes Fashions can invest $5.36 million in a new plant for producing invisible makeup. The plant has an expected life of five years, and expected sales are 6.36 million jars of makeup a year. Fixed costs are $2.90 million a year, and variable costs are $1.90 per jar. The product will be priced at $2.90 per jar. The plant will be depreciated straight-line over five years to a salvage value of zero. The opportunity cost of capital is 10%, and the tax rate is 40%. 4 points eBook a. What is project NPV under these base-case assumptions? (Do not round intermediate calculations. Enter your answer in thousands not in millions and round your answer to the nearest whole dollar amount.) b. What is NPV if variable costs turn out to be $2.10 per jar? (Do not round intermediate calculations. Enter your answer in thousands not in millions and round your answer to the nearest whole dollar amount.) c. What is NPV if fixed costs turn out to be $2.40 million per year? (Do not round intermediate calculations. Enter your answer in thousands not in millions and round your answer to the nearest whole dollar amount.) d. At what price per jar would project NPV equal zero? (Do not round intermediate calculations. Round your answer to 2 decimal places.) References a. NPV b. NPV c. NPV d. Price per jar AA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts