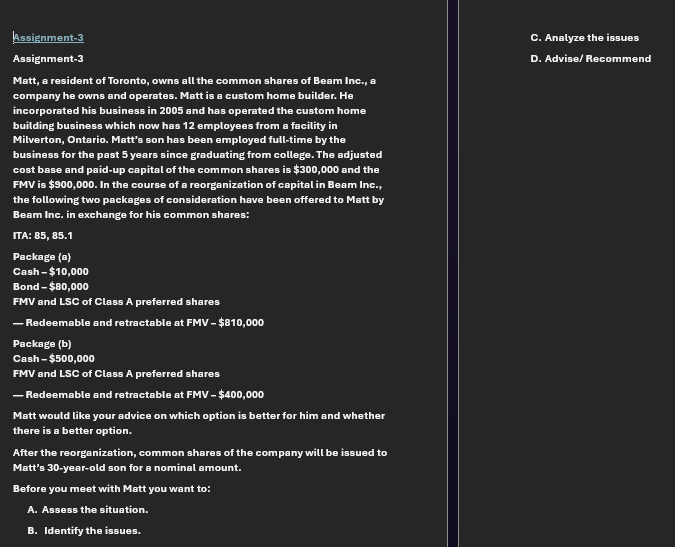

Question: Assignment - 3 Assignment - 3 Matt, a resident of Toronto, owns all the common shares of Beam Inc., a company he owns and operates.

Assignment Assignment Matt, a resident of Toronto, owns all the common shares of Beam Inc., a company he owns and operates. Matt is a custom home builder. He incorporated his business in and has operated the custom home building business which now has employees from a facility in Milverton, Ontario. Matts son has been employed fulltime by the business for the past years since graduating from college. The adjusted cost base and paidup capital of the common shares is $ and the FMV is $ In the course of a reorganization of capital in Beam Inc., the following two packages of consideration have been offered to Matt by Beam Inc. in exchange for his common shares: ITA: Package a Cash $ Bond $ FMV and LSC of Class A preferred shares Redeemable and retractable at FMV $ Package b Cash $ FMV and LSC of Class A preferred shares Redeemable and retractable at FMV $ Matt would like your advice on which option is better for him and whether there is a better option. After the reorganization, common shares of the company will be issued to Matts yearold son for a nominal amount. Before you meet with Matt you want to: A Assess the situation. BIdentify the issues. C Analyze the issues D Advise Recommend Assignment Assignment Matt, a resident of Toronto, owns all the common shares of Beam Inc., a company he owns and operates. Matt is a custom home builder. He incorporated his business in and has operated the custom home building business which now has employees from a facility in Milverton, Ontario. Matt's son has been employed fulltime by the business for the past years since graduating from college. The adjusted cost base and paidup capital of the common shares is $ and the FMV is $ In the course of a reorganization of capital in Beam Inc., the following two packages of consideration have been offered to Matt by Beam Inc. in exchange for his common shares: ITA: Package a Cash $ Bond$ FMV and LSC of Class A preferred shares Redeemable and retractable at FMV $ Package b Cash $ FMV and LSC of Class A preferred shares Redeemable and retractable at FMV $ Matt would like your advice on which option is better for him and whether there is a better option. After the reorganization, common shares of the company will be issued to Matt's yearold son for a nominal amount. Before you meet with Matt you want to: A Assess the situation. B Identify the issues. C Analyze the issues D Advise Recommend

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock