Question: Assignment 3: Budgets This assignment relates to the following Course Learning Requirements: CLR #4 - Discuss, understand, and explain the budget process and its importance.

Assignment 3: Budgets

This assignment relates to the following Course Learning Requirements:

- CLR #4 - Discuss, understand, and explain the budget process and its importance.

- CLR #5 - Analyze budgets and controls for specific HR activities.

Objective of this Assignment:

This assignment will test your knowledge of Preparing Budgets

Instructions:

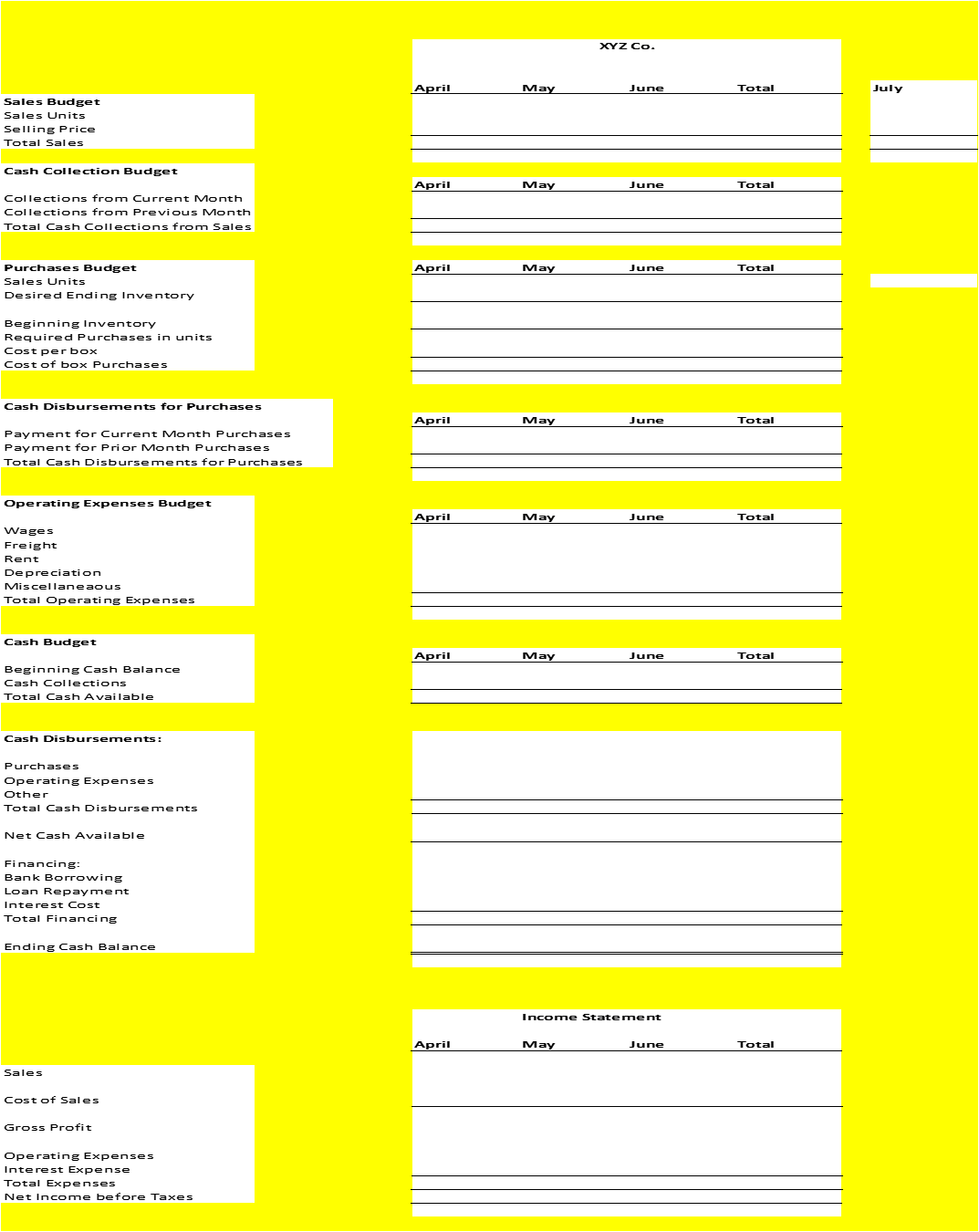

On the excel file provided there is a page that describes all the budget information required to complete a sales budget, cash collections budget, purchased budget, cash disbursements for purchases budget, operating expense budget, cash budget and an income statement.

Assignments must be submitted on or before the due date specified by the instructor. Consult the course calendar for due dates. Your assignment grade and the marked file will be available for your review through the

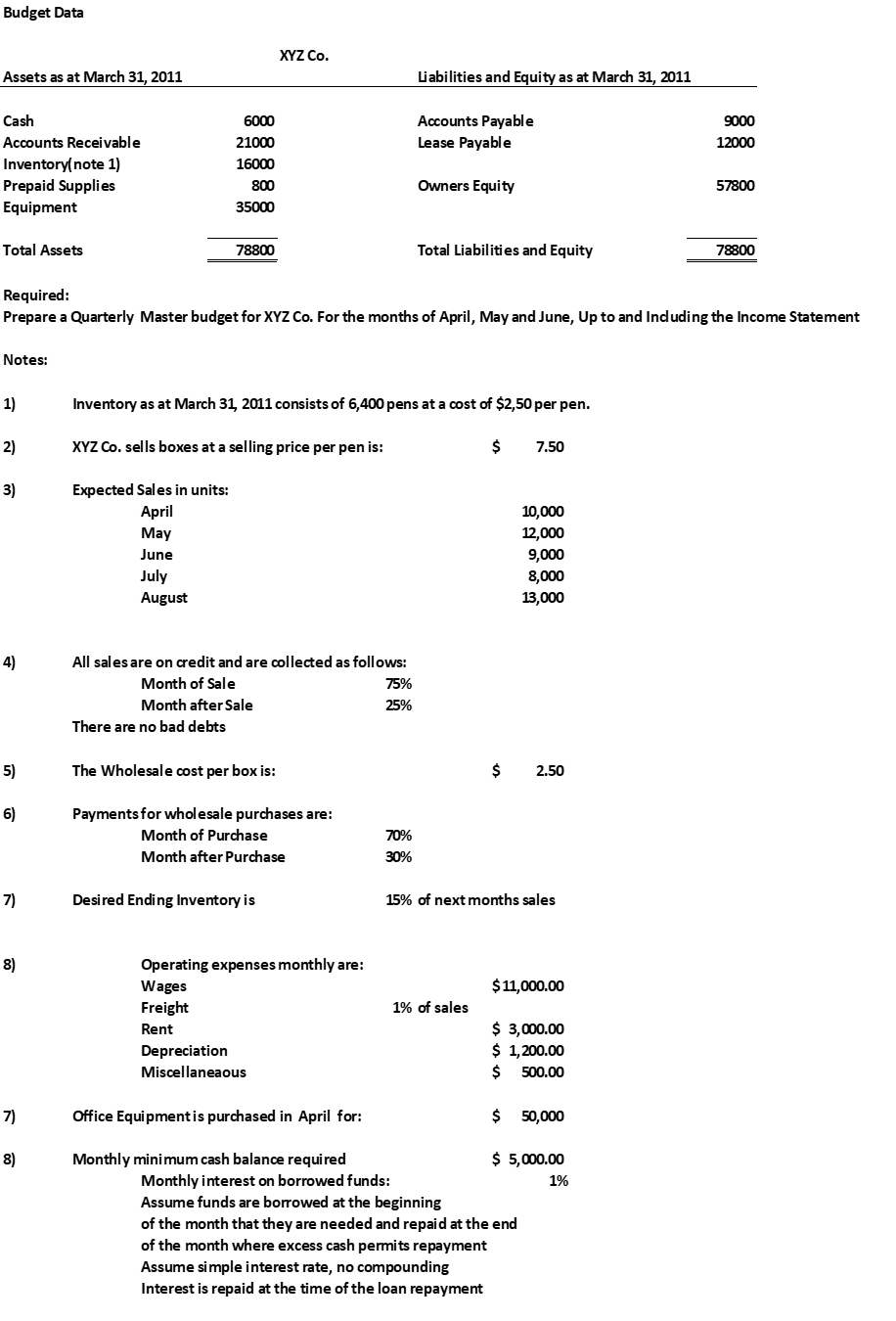

Budget Data XYZ Co. Assets as at March 31, 2011 Liabilities and Equity as at March 31, 2011 Cash 6000 Accounts Payable 9000 Accounts Receivable 21000 Lease Payable 12000 Inventory{note 1) 16000 Prepaid Supplies 800 Owners Equity 57800 Equipment 35000 Total Assets 78800 Total Liabilities and Equity 78800 Required: Prepare a Quarterly Master budget for XYZ Co. For the months of April, May and June, Up to and Induding the Income Statement Notes: 1) Inventory as at March 31, 2011 consists of 6,400 pens at a cost of 52,50 per pen. 2) XYZ Co. sells boxes at a selling price per penis: S 7.50 3) Expected Sales in units: April 10,000 May 12,000 June 9,000 July 8,000 August 13,000 4) All salesare on credit and are collected as follows: Month of Sale 5% Month afterSale 25% There are no bad debts 5) The Wholesale cost per box is: S 2.50 6) Paymentsfor wholesale purchases are: Month of Purchase 70% Month after Purchase 30% 7) Desired Ending Inventory is 15% of next months sales 8) Operating expenses monthly are: Wages $11,000.00 Freight 1% of sales Rent $ 3,000.00 Depreciation $ 1,200.00 Miscellaneaous S 500.00 7) Office Equipmentis purchased in April for: $ 50,000 8) Monthly minimum cash balance required $ 5,000.00 Monthly interest on borrowed funds: 1% Assume funds are borrowed at the beginning of the month that they are needed and repaid at the end of the month where excess cash permits repayment Assume simple interest rate, no compounding Interest is repaid at the time of the loan repayment \f