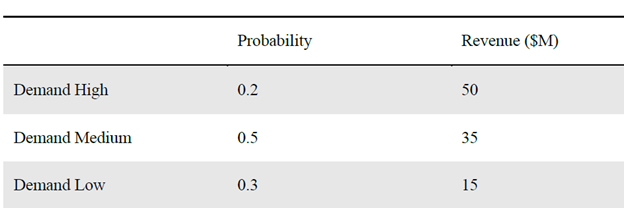

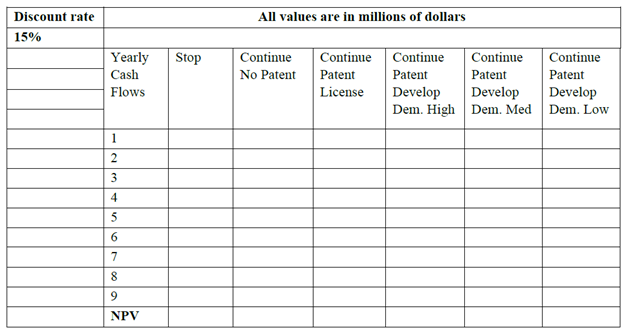

| Revisit the BMAC research & development (R & D) decision case study above and continue your analysis by addressing the following questions (approximately 500 words, excluding figures, excel spreadsheets and references). 1. Using your decision tree (from assignment 2) and the folding back the tree procedure, calculate the expected monetary value (EMV) of the two options at the root of the BMACs decision problem i.e. (A) Continue with the R &D project at a cost of $ 2 Million or (B) Stop R & D project at no cost. Which alternative or strategy should BMAC pursue in order to maximize their revenues? 2. It may be expected that the EMV and hence your recommended strategy for BMAC obtained in in question 1 above critically depends on uncertain variables or chance events that are not within the control of the decision maker. Therefore, conduct a sensitivity analysis on your recommended strategy for BMAC and briefly explain the implications of your results to BMAC's decision problem. Guidance Organise your answer on an excel spreadsheet and construct a sensitivity graph. Remember to copy and paste your results/sensitivity graph into your submission. 3. Now consider a more realistic scenario for BMAC in which the costs and revenues, if they decide to continue with the project, will be spread out over time. In particular, if BMAC decides to continue the project, they will have to come up with the $2 million this year (Year 1). Then there will be a year of waiting (Year 2) before they know if they are successful (that is, the patent is granted). If they decide to license the technology, they would receive the $25 million distributed as $5 million per year beginning in Year 3. On the other hand, if they decide to sell the product directly, they will have to invest $5 million in each of Years 3 and 4 (to make up the total investment of $10 million). Their net proceeds from selling the product, then, would be evenly distributed over years 5 through 9. Now modify your decision tree (1) above to take account of the time value of money (that is, replace net revenues with NPVs). Question: Calculate the (discounted) EMV of your recommended strategy and recommend the strategy or alternative that BMAC should pursue in order to maximize the NPV. Guidance: Assume a discount rate of 15% and calculate the Net present value (NPV) at the end of each branch of the decision tree. To obtain the NPVs at the end of each branch of the decision tree, organize your answer on an excel spreadsheet using the template below. |