Question: ASSIGNMENT 3 DATE: 3 0 ( { } ^ { text { th } } ) October 2 0 2 4 .

ASSIGNMENT

DATE: text th October

INSTRUCTIONS:

You should handwritetype your solutions, scan into pdf format.

The deadline date is: Saturday, rd November at or before pm

This is a group assignment, name and registration numbers of group members should be included in the document.

No late submission will be marked

All submissions should be done on Moodle. No email submission will be accepted.

Question One

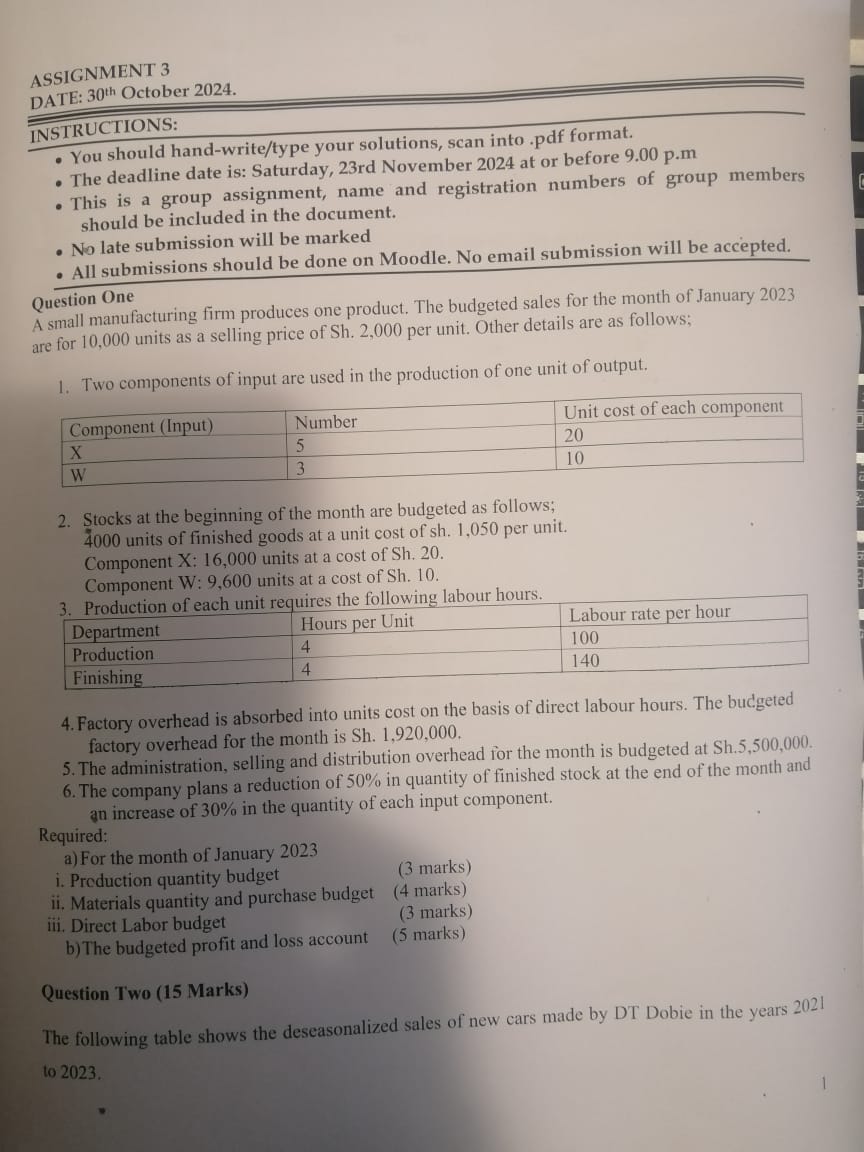

A small manufacturing firm produces one product. The budgeted sales for the month of January are for units as a selling price of Sh per unit. Other details are as follows;

Two components of input are used in the production of one unit of output.

Stocks at the beginning of the month are budgeted as follows; units of finished goods at a unit cost of sh per unit. Component X: units at a cost of Sh

Component W: units at a cost of Sh

Production of each unit requires the following labour hours.

Factory overhead is absorbed into units cost on the basis of direct labour hours. The budgeted factory overhead for the month is Sh

The administration, selling and distribution overhead for the month is budgeted at Sh

The company plans a reduction of in quantity of finished stock at the end of the month and an increase of in the quantity of each input component.

Required:

a For the month of January

i Preduction quantity budget

ii Materials quantity and purchase budget marks

iii. Direct Labor budget marks

b The budgeted profit and loss account marks

Question Two Marks

The following table shows the deseasonalized sales of new cars made by DT Dobie in the years to

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock