Question: Assignment 3 Pass Through Assignment To complete this assignment, read the information below and then complete the 2019 partnership tax return (form 1065) including the

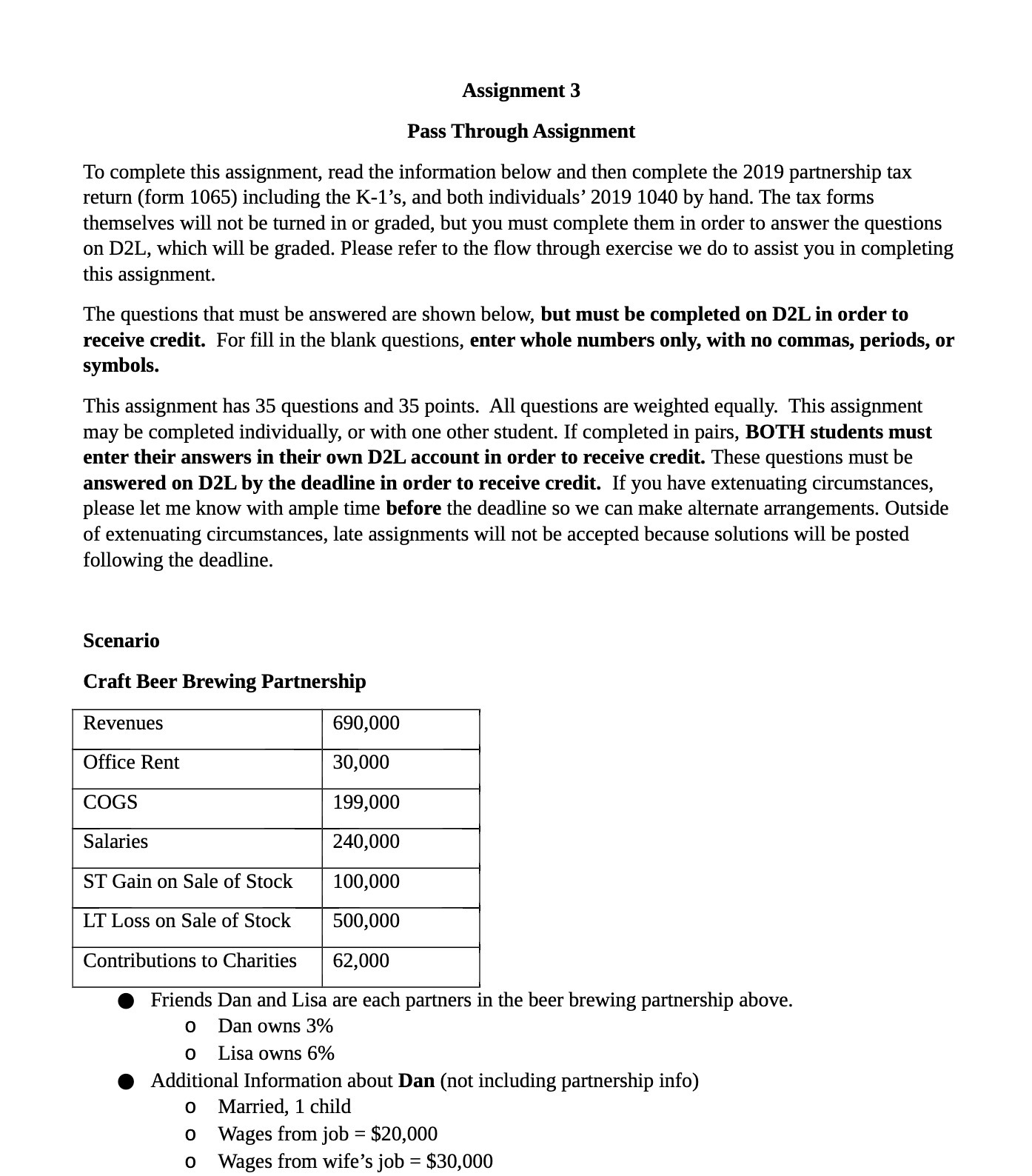

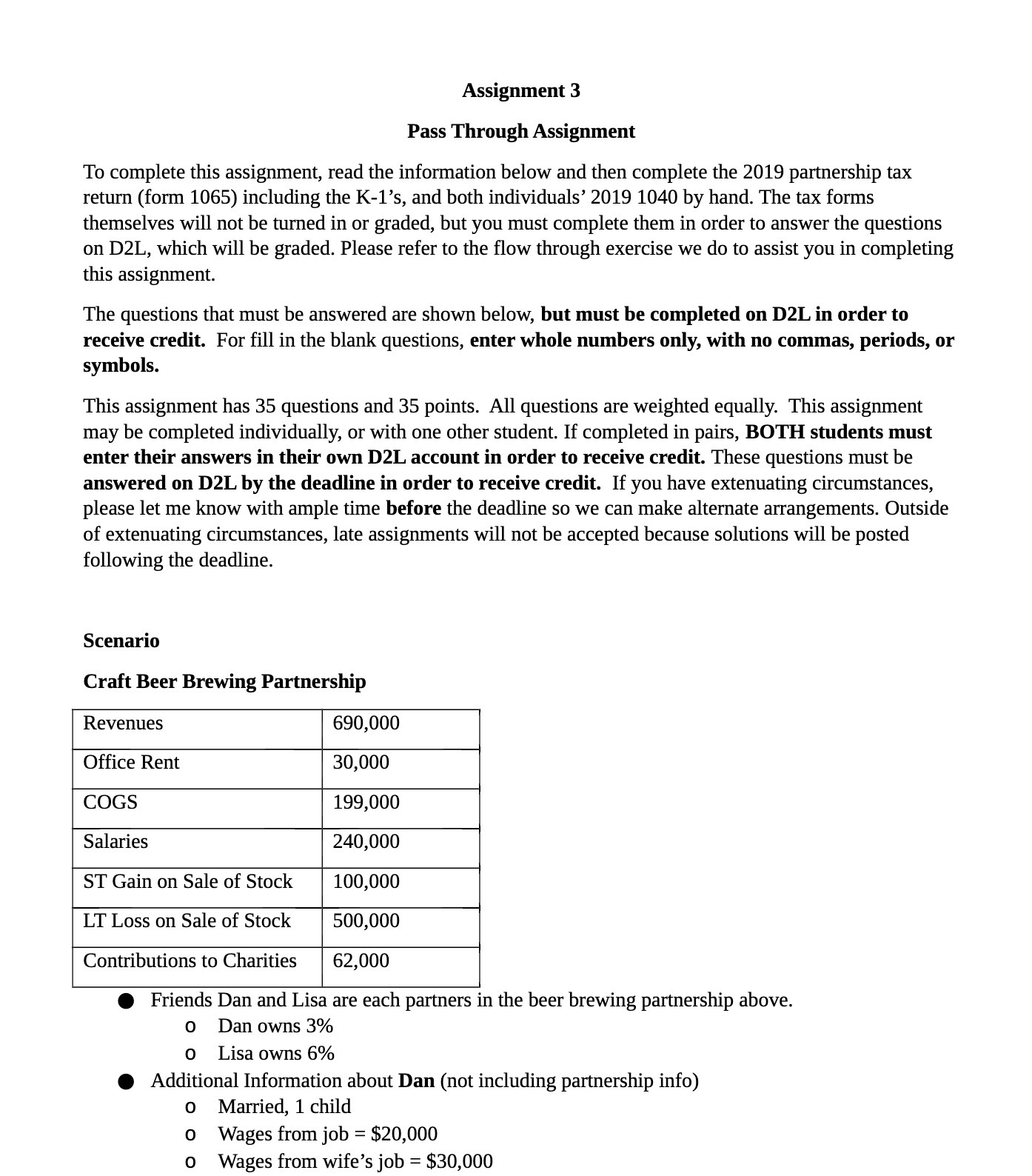

Assignment 3 Pass Through Assignment To complete this assignment, read the information below and then complete the 2019 partnership tax return (form 1065) including the K1's, and both individuals' 2019 1040 by hand. The tax forms themselves will not be turned in or graded, but you must complete them in order to answer the questions on D2L, which will be graded. Please refer to the ow through exercise we do to assist you in completing this assignment. The questions that must be answered are shown below, but must be completed on D2L in order to receive credit. For fill in the blank questions, enter whole numbers only, with no commas, periods, or symbols. This assignment has 35 questions and 35 points. All questions are weighted equally. This assignment may be completed individually, or with one other student. If completed in pairs, BOTH students must enter their answers in their own D2L account in order to receive credit. These questions must be answered on D2L by the deadline in order to receive credit. If you have extenuating circumstances, please let me know with ample time before the deadline so we can make alternate arrangements. Outside of extenuating circumstances, late assignments will not be accepted because solutions will be posted following the deadline. Scenario Craft Beer Brewing Partnership 0 Friends Dan and Lisa are each partners in the beer brewing partnership above. 0 Dan owns 3% 0 Lisa owns 6% 0 Additional Information about Dan (not including partnership info) 0 Married, 1 child 0 Wages from job = $20,000 0 Wages from wife's job = $30,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts