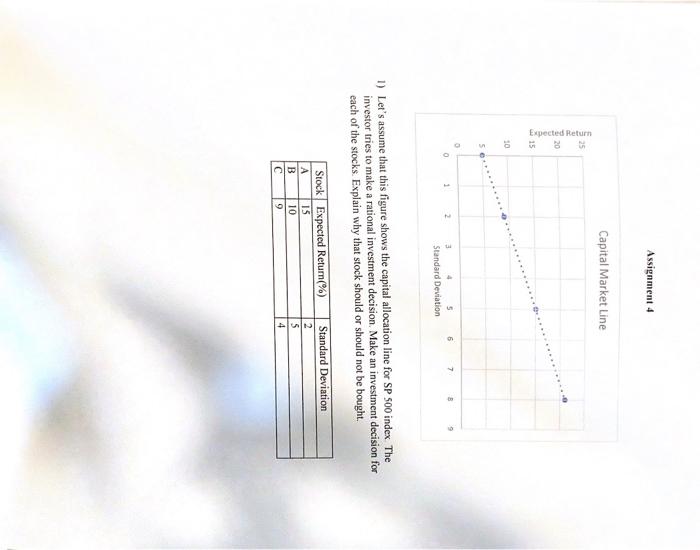

Question: Assignment 4 1) Let's assume that this figure shows the capital allocation line for SP 500 index. The investor tries to make a rational investment

Assignment 4 1) Let's assume that this figure shows the capital allocation line for SP 500 index. The investor tries to make a rational investment decision. Make an investment decision for each of the stocks. Explain why that stock should or should not be bought. 2) Download monthly data of the two stocks from Yahoo. finance for the period 01.01. 201401.01 2020, and calculate the followings. a. Average Return of each stock b. Variance and Standard Deviation of each stock c. Sharpe Ratio of each stock (Assume that annual rf=2% ) d. Covariance of two stocks e. If you are expected to choose only one of them which one should be chosen? f. Find out the weights which make the Sharpe Ratio maximum? g. Find out the weights which make the variance of the portfolio minimum? (Hint: Try to choose two stocks which are lowly correlated and preferably negatively correlated stocks. The less the correlation, the higher the diversification benefit)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts