Question: Assignment 4 1. Why do bond prices go down when interest rates go up? Don't investors like high interest rates? 2. A two-year bond with

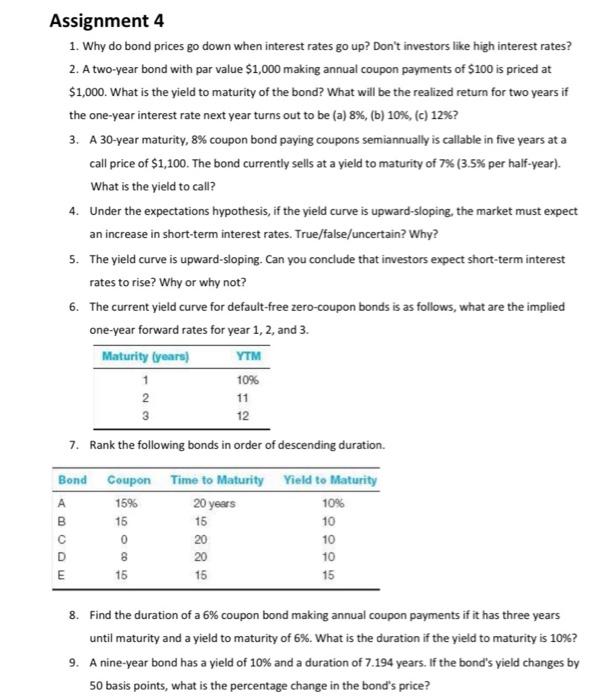

Assignment 4 1. Why do bond prices go down when interest rates go up? Don't investors like high interest rates? 2. A two-year bond with par value $1,000 making annual coupon payments of $100 is priced at $1,000. What is the yield to maturity of the bond? What will be the realized return for two years if the one-year interest rate next year turns out to be (a) 8%, (b) 10%, (c) 12%? 3. A 30-year maturity, 8% coupon bond paying coupons semiannually is callable in five years at a call price of $1,100. The bond currently sells at a yield to maturity of 7% (3.5% per half-year). What is the yield to call? 4. Under the expectations hypothesis, if the yield curve is upward-sloping, the market must expect an increase in short-term interest rates. True/false/uncertain? Why? 5. The yield curve is upward-sloping. Can you conclude that investors expect short-term interest rates to rise? Why or why not? 6. The current yield curve for default-free zero-coupon bonds is as follows, what are the implied one-year forward rates for year 1, 2, and 3. Maturity (years) YTM 1 10% 2 3 12 7. Rank the following bonds in order of descending duration 11 Bond Coupon Time to Maturity Yield to Maturity 15% 20 years 10% B 16 15 10 0 20 10 D 8 20 10 E 15 15 15 8. Find the duration of a 6% coupon bond making annual coupon payments if it has three years until maturity and a yield to maturity of 6%. What is the duration if the yield to maturity is 10%? 9. A nine-year bond has a yield of 10% and a duration of 7.194 years. If the bond's yield changes by 50 basis points, what is the percentage change in the bond's price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts