Question: Assignment 4 - Chapter 6 COM204 -Fall 2020 Question 1 Ivan Manufacturing purchased equipment and a delivery van on January 1, 2020. The equipment cost

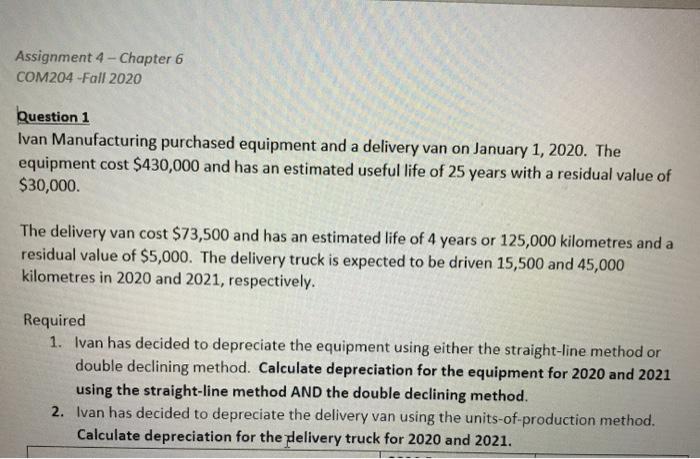

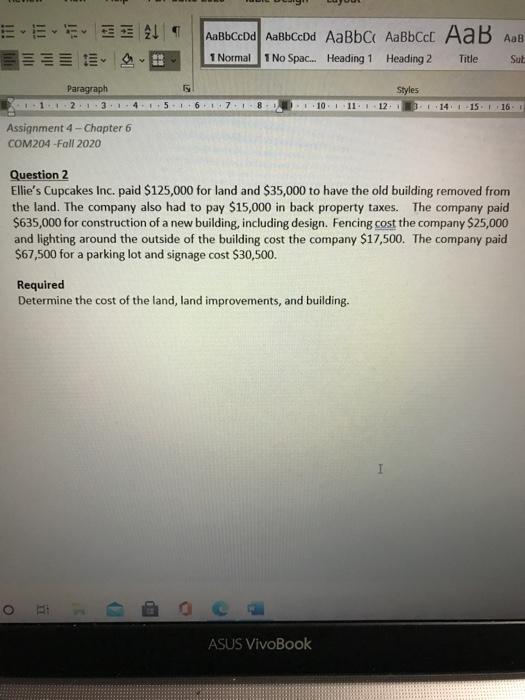

Assignment 4 - Chapter 6 COM204 -Fall 2020 Question 1 Ivan Manufacturing purchased equipment and a delivery van on January 1, 2020. The equipment cost $430,000 and has an estimated useful life of 25 years with a residual value of $30,000. The delivery van cost $73,500 and has an estimated life of 4 years or 125,000 kilometres and a residual value of $5,000. The delivery truck is expected to be driven 15,500 and 45,000 kilometres in 2020 and 2021, respectively. Required 1. Ivan has decided to depreciate the equipment using either the straight-line method or double declining method. Calculate depreciation for the equipment for 2020 and 2021 using the straight-line method AND the double declining method. 2. Ivan has decided to depreciate the delivery van using the units-of-production method. Calculate depreciation for the delivery truck for 2020 and 2021. | bC AaBbccc 1 No Spac... Heading 1 Heading 2 1 Normal Title Sut Paragraph 2:13. Styles 5 12 14: 15 16 Assignment 4 - Chapter 6 COM204 -Fall 2020 Question 2 Ellie's Cupcakes Inc. paid $125,000 for land and $35,000 to have the old building removed from the land. The company also had to pay $15,000 in back property taxes. The company paid $635,000 for construction of a new building, including design. Fencing cost the company $25,000 and lighting around the outside of the building cost the company $17,500. The company paid $67,500 for a parking lot and signage cost $30,500. Required Determine the cost of the land, land improvements, and building. BD ASUS VivoBook

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts