Question: Assignment 4 Q1: Find and review a recent article or news available online that describes a real-world example on topics given below: 1. Treasury Bill

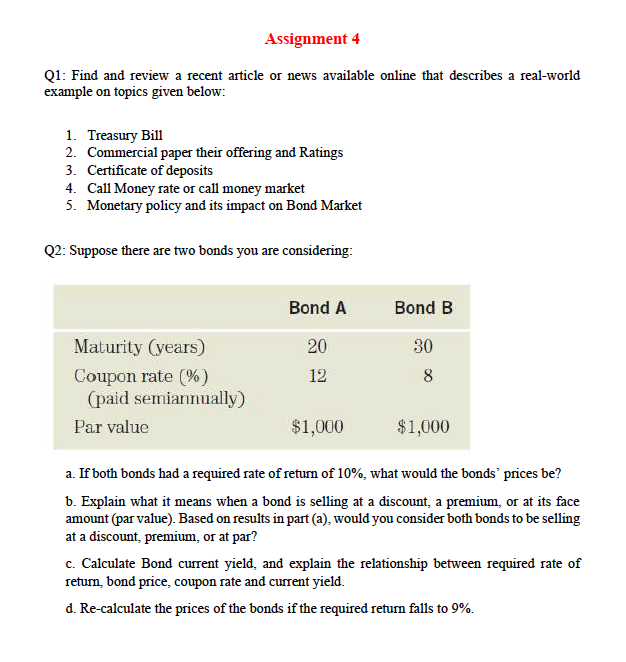

Assignment 4 Q1: Find and review a recent article or news available online that describes a real-world example on topics given below: 1. Treasury Bill 2. Commercial paper their offering and Ratings 3. Certificate of deposits 4. Call Money rate or call money market 5. Monetary policy and its impact on Bond Market Q2: Suppose there are two bonds you are considering: Bond A Bond B 20 30 8 12 Maturity (years) Coupon rate %) (paid semiannually) Par value $1,000 $1,000 a. If both bonds had a required rate of return of 10%, what would the bonds' prices be? b. Explain what it means when a bond is selling at a discount, a premium, or at its face amount (par value). Based on results in part (a), would you consider both bonds to be selling at a discount, premium, or at par? c. Calculate Bond current yield, and explain the relationship between required rate of return, bond price, coupon rate and current yield. d. Re-calculate the prices of the bonds if the required return falls to 9%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts