Question: Assignment 4/5 It 3 Question 2 25 Marks The statement of comprehensive income of Jonathon Ltd for the year ended 30 June 2020 shows the

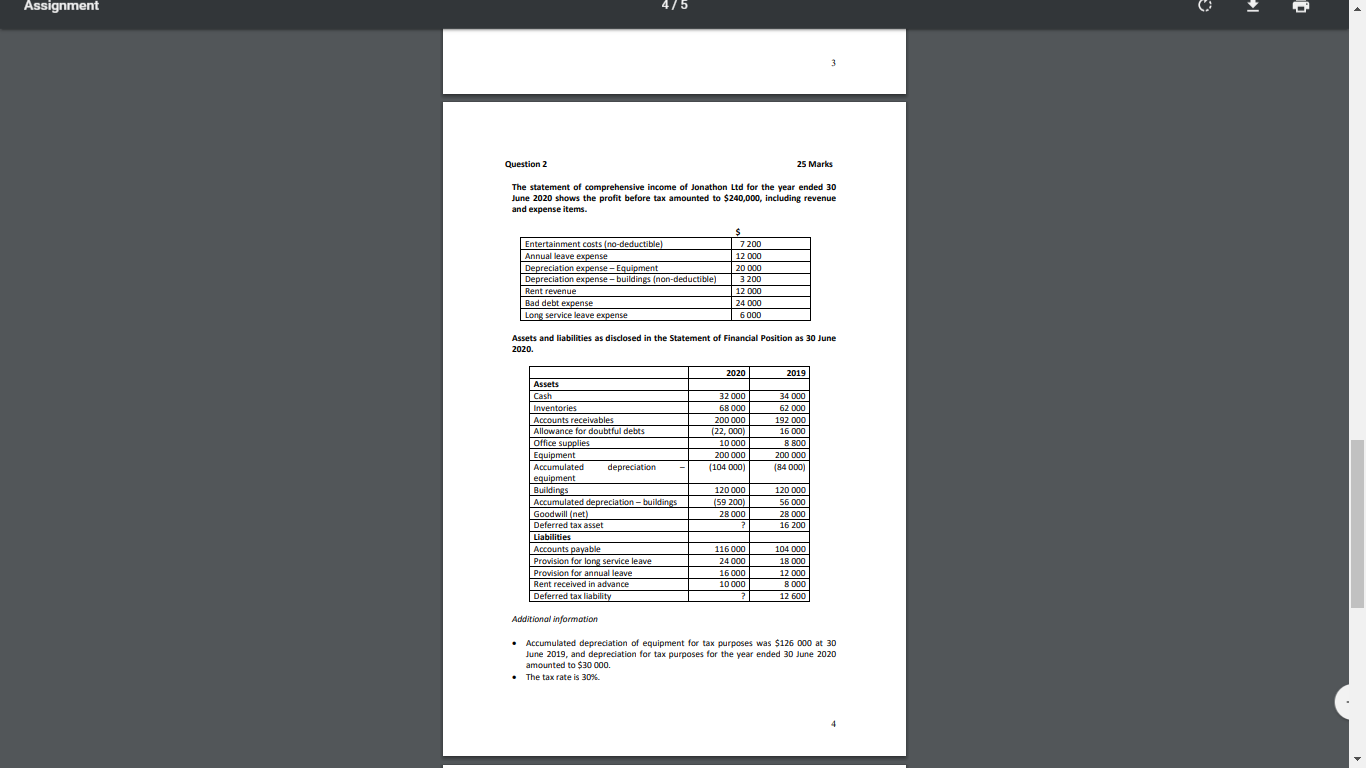

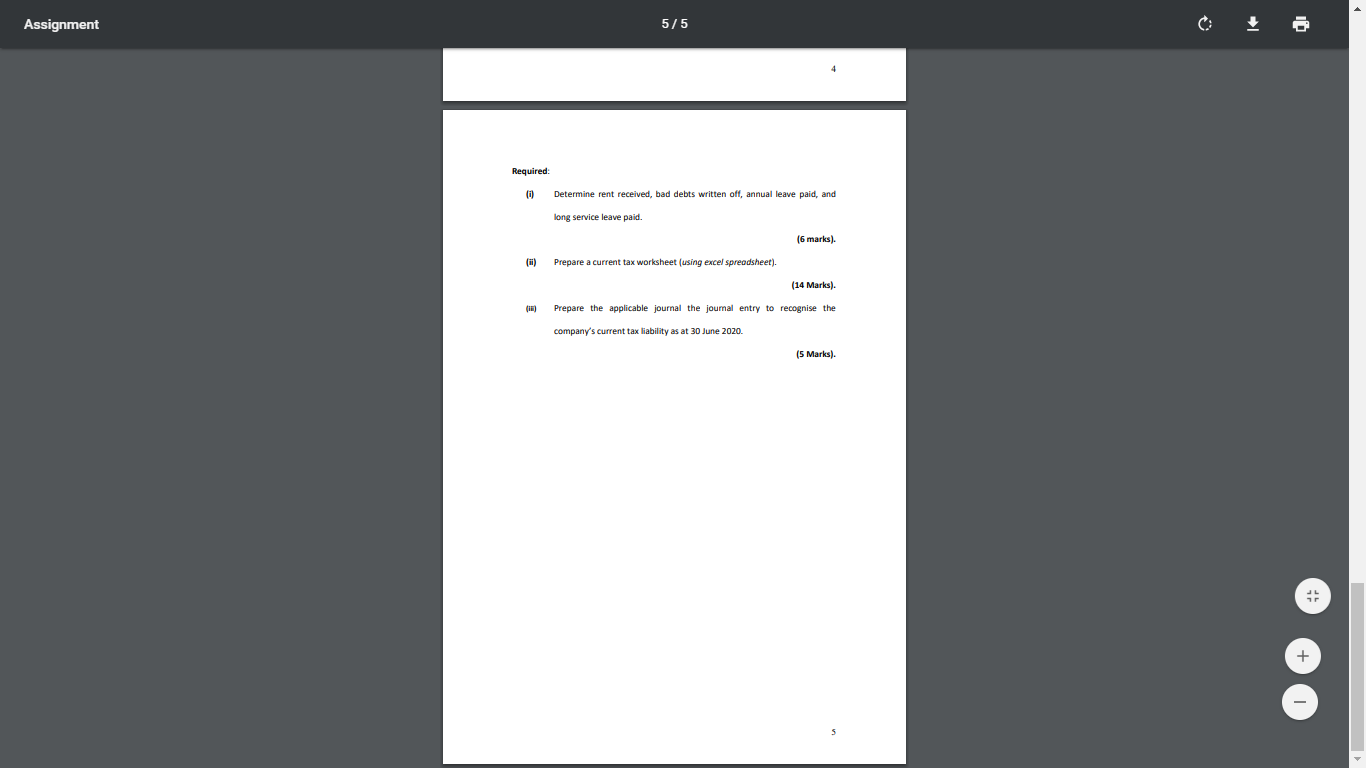

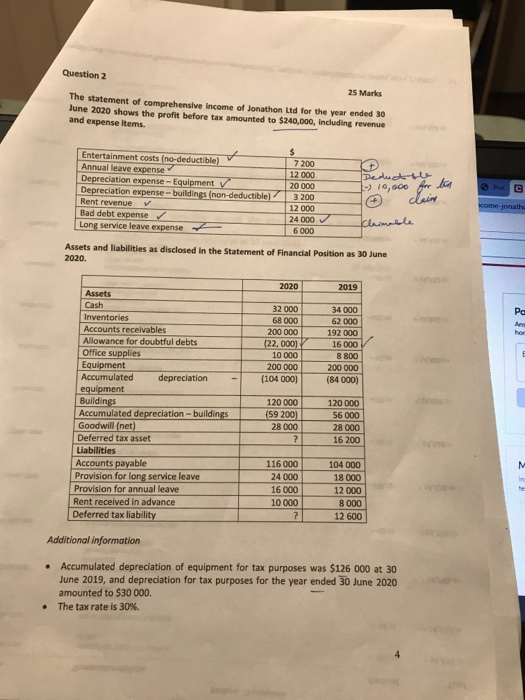

Assignment 4/5 It 3 Question 2 25 Marks The statement of comprehensive income of Jonathon Ltd for the year ended 30 June 2020 shows the profit before tax amounted to $240,000, including revenue and expense items. Entertainment costs (no-deductible) Annual leave expense Depreciation expense-Equipment Depreciation expense-buildings (non-deductible) Rent revenue Bad debt expense Long service leave expense $ 7200 12 000 20 000 3200 12 000 24 000 6 000 Assets and liabilities as disclosed in the Statement of Financial Position as 30 June 2020. 2020 2019 32 000 68 000 200 000 (22, 000) 10 000 200 000 (104 000) 34 000 62 000 192 000 16 000 8 800 200 000 (84000) Assets Cash Inventories Accounts receivables Allowance for doubtful debts Office supplies Equipment Accumulated depreciation equipment Buildings Accumulated depreciation-buildings Goodwill(net) Deferred tax asset Liabilities Accounts payable Provision for long service leave Provision for annual leave Rent received in advance Deferred tax liability 120 000 (59 200) 28 000 ? 120 000 56 000 28 000 16 200 116 000 24 000 16 000 10 000 ? 104 000 18 000 12 000 8 000 12 600 Additional information Accumulated depreciation of equipment for tax purposes was $126 000 at 30 June 2019, and depreciation for tax purposes for the year ended 30 June 2020 amounted to $30 000 The tax rate is 30% Assignment 5/5 Required (i) Determine rent received, bad debts written off, annual leave paid, and long service leave paid. (6 marks). (ii) Prepare a current tax worksheet (using excel spreadsheet). (14 Marks). (in) Prepare the applicable journal the journal entry to recognise the company's current tax liability as at 30 June 2020. (5 Marks). + + Question 2 25 Marks The statement of comprehensive income of Jonathon Ltd for the year ended 30 June 2020 shows the profit before tax amounted to $240,000, including revenue and expense Items $ Entertainment costs (no-deductible) Annual leave expense Depreciation expense-Equipment Depreciation expense - buildings (non-deductible) Rent revenue Bad debt expense Long service leave expense 7200 12 000 20 000 3 200 12 000 24 000 6 000 Deduct the - 10,000 for las chain Clamable come jonath Assets and liabilities as disclosed in the Statement of Financial Position as 30 June 2020. 2020 2019 Pc And her 32 000 68 000 200 000 (22. 000) 10 000 200 000 (104 000) 34 000 62 000 192 000 16 000 8 800 200 000 (84000) Assets Cash Inventories Accounts receivables Allowance for doubtful debts Office supplies Equipment Accumulated depreciation equipment Buildings Accumulated depreciation - buildings Goodwill (net) Deferred tax asset Liabilities Accounts payable Provision for long service leave Provision for annual leave Rent received in advance Deferred tax liability 120 000 (59 200) 28 000 ? 120 000 56 000 28 000 16 200 In 116 000 24 000 16 000 10 000 ? 104 000 18 000 12 000 8 000 12 600 Additional information Accumulated depreciation of equipment for tax purposes was $126 000 at 30 June 2019, and depreciation for tax purposes for the year ended 30 June 2020 amounted to $30 000 The tax rate is 30%. Required: 0 Determine rent received, bad debts written off, annual leave paid, and long service leave paid. (6 marks). C () Prepare a current tax worksheet (using excel spreadsheet). -endo o (14 Marks) Prepare the applicable journal the journal entry to recognise the company's current tax liability as at 30 June 2020. (5 Marks). estio our estions stion ont bo

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts