Question: Assignment 45 Name: Submission guideline: This worksheet and the Spreadsheet with Solver including your settings. A financial advisor at Diehl Investments identified two companies that

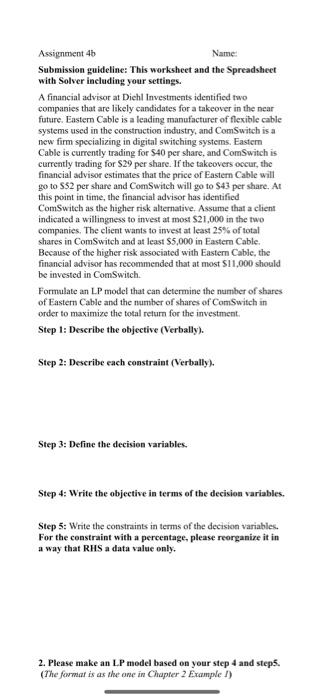

Assignment 45 Name: Submission guideline: This worksheet and the Spreadsheet with Solver including your settings. A financial advisor at Diehl Investments identified two companies that are likely candidates for a takeover in the near future. Eastern Cable is a leading manufacturer of flexible cable systems used in the construction industry, and ComSwitch is a new firm specializing in digital switching systems. Easter Cable is currently trading for 540 per share and ComSwitch is currently trading for S29 per share. If the takeovers occur, the financial advisor estimates that the price of Eastern Cable will go to S52 per share and ComSwitch will go to S43 per share. At this point in time, the financial advisor has identified ComSwitch as the higher risk alternative. Assume that a client indicated a willingness to invest at most $21,000 in the two compani The client wants to invest at least 25% of total shares in ComSwitch and at least 55,000 in Eastern Cable. Because of the higher risk associated with Eastern Cable, the financial advisor has recommended that at most $11,000 should be invested in ComSwitch. Formulate an LP model that can determine the number of shares of Eastern Cable and the number of shares of ComSwitch in order to maximize the total return for the investment Step 1: Describe the objective (Verbally). Step 2: Describe each constraint (Verbally). Step 3: Define the decision variables. Step 4: Write the objective in terms of the decision variables. Step 5: Write the constraints in terms of the decision variables. For the constraint with a percentage, please reorganise it in a way that RHS a data value only. 2. Please make an LP model based on your step 4 and steps. (The format is as the one in Chapter 2 Example !) Assignment 45 Name: Submission guideline: This worksheet and the Spreadsheet with Solver including your settings. A financial advisor at Diehl Investments identified two companies that are likely candidates for a takeover in the near future. Eastern Cable is a leading manufacturer of flexible cable systems used in the construction industry, and ComSwitch is a new firm specializing in digital switching systems. Easter Cable is currently trading for 540 per share and ComSwitch is currently trading for S29 per share. If the takeovers occur, the financial advisor estimates that the price of Eastern Cable will go to S52 per share and ComSwitch will go to S43 per share. At this point in time, the financial advisor has identified ComSwitch as the higher risk alternative. Assume that a client indicated a willingness to invest at most $21,000 in the two compani The client wants to invest at least 25% of total shares in ComSwitch and at least 55,000 in Eastern Cable. Because of the higher risk associated with Eastern Cable, the financial advisor has recommended that at most $11,000 should be invested in ComSwitch. Formulate an LP model that can determine the number of shares of Eastern Cable and the number of shares of ComSwitch in order to maximize the total return for the investment Step 1: Describe the objective (Verbally). Step 2: Describe each constraint (Verbally). Step 3: Define the decision variables. Step 4: Write the objective in terms of the decision variables. Step 5: Write the constraints in terms of the decision variables. For the constraint with a percentage, please reorganise it in a way that RHS a data value only. 2. Please make an LP model based on your step 4 and steps. (The format is as the one in Chapter 2 Example !)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts