Question: Assignment # 5 A - Capital Budgeting You have recently begun employment as a financial analyst for Ace Auto Parts, a major auto parts supplier.

Assignment #A Capital Budgeting

You have recently begun employment as a financial analyst for Ace Auto Parts, a major auto parts supplier.

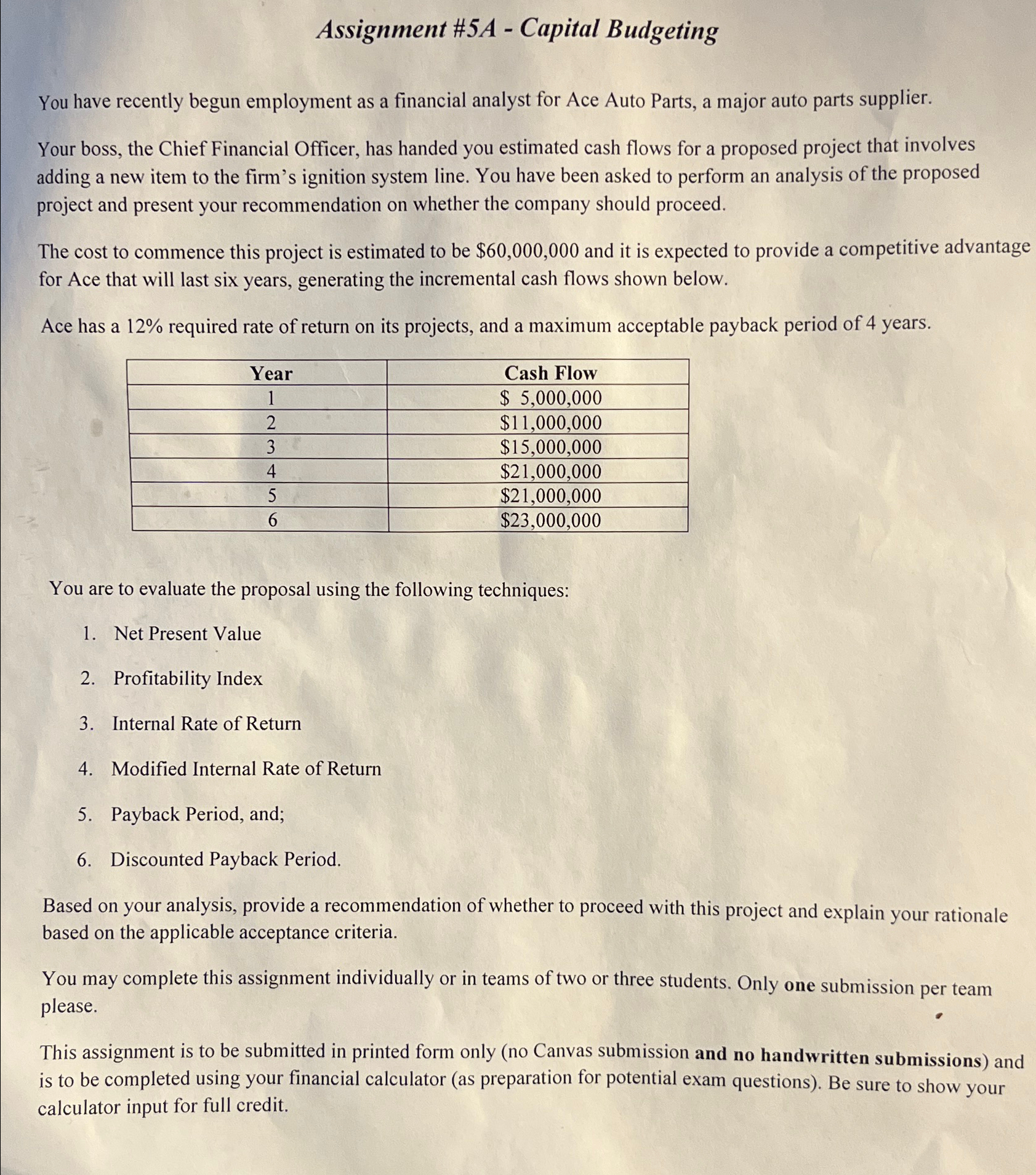

Your boss, the Chief Financial Officer, has handed you estimated cash flows for a proposed project that involves adding a new item to the firm's ignition system line. You have been asked to perform an analysis of the proposed project and present your recommendation on whether the company should proceed.

The cost to commence this project is estimated to be $ and it is expected to provide a competitive advantage for Ace that will last six years, generating the incremental cash flows shown below.

Ace has a required rate of return on its projects, and a maximum acceptable payback period of years.

tableYearCash Flow$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock