Question: Assignment 5 - Discounted Cash Flows Method Done: View To do: Make a submission Assignments Copper Corporation has projected that their performance for the next

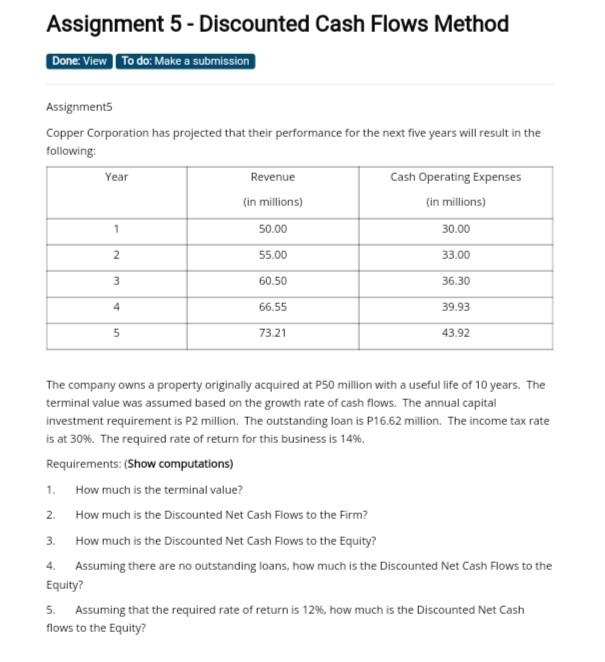

Assignment 5 - Discounted Cash Flows Method Done: View To do: Make a submission Assignments Copper Corporation has projected that their performance for the next five years will result in the following: Revenue Cash Operating Expenses (in millions) (in millions) 50.00 30.00 Year 2 55.00 33.00 3 60.50 36.30 4 66.55 39.93 5 73.21 43.92 The company owns a property originally acquired at P50 million with a useful life of 10 years. The terminal value was assumed based on the growth rate of cash flows. The annual capital investment requirement is P2 million. The outstanding loan is P16.62 million. The income tax rate is at 30%. The required rate of return for this business is 14%. Requirements: (Show computations) 1. How much is the terminal value? How much is the Discounted Net Cash Flows to the Firm? 3. How much is the Discounted Net Cash Flows to the Equity? 4. Assuming there are no outstanding loans, how much is the Discounted Net Cash Flows to the Equity? 5. Assuming that the required rate of return is 12%, how much is the Discounted Net Cash flows to the Equity? 2. Assignment 5 - Discounted Cash Flows Method Done: View To do: Make a submission Assignments Copper Corporation has projected that their performance for the next five years will result in the following: Revenue Cash Operating Expenses (in millions) (in millions) 50.00 30.00 Year 2 55.00 33.00 3 60.50 36.30 4 66.55 39.93 5 73.21 43.92 The company owns a property originally acquired at P50 million with a useful life of 10 years. The terminal value was assumed based on the growth rate of cash flows. The annual capital investment requirement is P2 million. The outstanding loan is P16.62 million. The income tax rate is at 30%. The required rate of return for this business is 14%. Requirements: (Show computations) 1. How much is the terminal value? How much is the Discounted Net Cash Flows to the Firm? 3. How much is the Discounted Net Cash Flows to the Equity? 4. Assuming there are no outstanding loans, how much is the Discounted Net Cash Flows to the Equity? 5. Assuming that the required rate of return is 12%, how much is the Discounted Net Cash flows to the Equity? 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts