Question: In order to identify when, where, and how potential misstatements can occur, an auditor must obtain an understanding of the entity's intemal control structure.

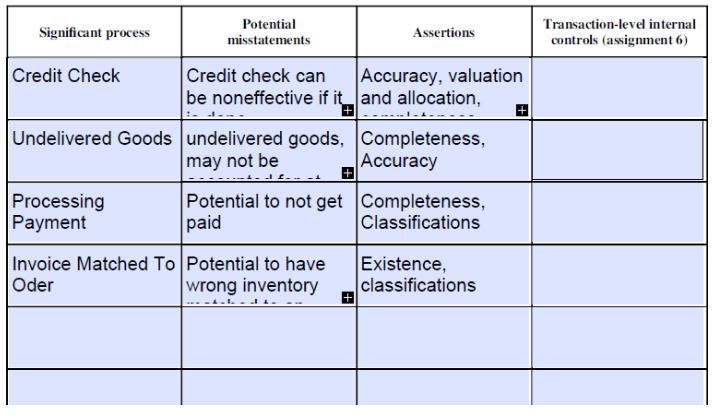

In order to identify when, where, and how potential misstatements can occur, an auditor must obtain an understanding of the entity's intemal control structure. This understanding covers the internal controls at the entity level, as well as at the transaction level. Entity-level controls include areas such as management integrity, policies and procedures, and monitoring of control activities. Transaction-level controls are those performed during the processing of accounting transactions. By documenting the flow of transactions in an accounting process, the auditor understands the stages where errors can occur. The entire process is reviewed, from the initiation of the transaction through to the recording in the general ledger (G/L). Often several accounting processes can be linked together into one seamless flow of transactions (see figure 4.1). ORDER PROCESSING RECEIVING INVOICING PAYMENTS Initiation: Order requested Purchase order approved Purchase order Goods arrive Reporting: Goods receipted sent Potential Transaction-level internal Significant process Assertions misstatements controls (assignment 6) Credit Check Credit check can be noneffective if itand allocation, Accuracy, valuation Undelivered Goods undelivered goods, Completeness, may not be Accuracy Processing Payment Potential to not get Completeness, paid Classifications Invoice Matched To Potential to have Oder Existence, wrong inventory classifications Identifying controls Learning objective To mitigate the risk of misstatement, companies should establish a strong control environment or tone at the top. Internal controls at the transaction level should be designed to prevent or detect the material misstatements that could occur within the flow of transactions. Auditors are required to obtain an understanding of these risks and controls. Required Use the working paper from assignment 5 (A51) to complete this assignment. In column four, include the transaction-level internal controls that Cloud 9 Ltd. has implemented to prevent and/or detect potential errors (based on the understanding of internal controls you gained in assignment 4). In order to identify when, where, and how potential misstatements can occur, an auditor must obtain an understanding of the entity's intemal control structure. This understanding covers the internal controls at the entity level, as well as at the transaction level. Entity-level controls include areas such as management integrity, policies and procedures, and monitoring of control activities. Transaction-level controls are those performed during the processing of accounting transactions. By documenting the flow of transactions in an accounting process, the auditor understands the stages where errors can occur. The entire process is reviewed, from the initiation of the transaction through to the recording in the general ledger (G/L). Often several accounting processes can be linked together into one seamless flow of transactions (see figure 4.1). ORDER PROCESSING RECEIVING INVOICING PAYMENTS Initiation: Order requested Purchase order approved Purchase order Goods arrive Reporting: Goods receipted sent Potential Transaction-level internal Significant process Assertions misstatements controls (assignment 6) Credit Check Credit check can be noneffective if itand allocation, Accuracy, valuation Undelivered Goods undelivered goods, Completeness, may not be Accuracy Processing Payment Potential to not get Completeness, paid Classifications Invoice Matched To Potential to have Oder Existence, wrong inventory classifications Identifying controls Learning objective To mitigate the risk of misstatement, companies should establish a strong control environment or tone at the top. Internal controls at the transaction level should be designed to prevent or detect the material misstatements that could occur within the flow of transactions. Auditors are required to obtain an understanding of these risks and controls. Required Use the working paper from assignment 5 (A51) to complete this assignment. In column four, include the transaction-level internal controls that Cloud 9 Ltd. has implemented to prevent and/or detect potential errors (based on the understanding of internal controls you gained in assignment 4).

Step by Step Solution

3.50 Rating (163 Votes )

There are 3 Steps involved in it

There are many definitions of control because it affects the constituencies of a corporation in various ways and at different levels of aggregation Everyone in a corporation has responsibility for con... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

635e25193ac28_181833.pdf

180 KBs PDF File

635e25193ac28_181833.docx

120 KBs Word File