Question: Assignment #5 Work this problem out using an Excel spreadsheet. Short answer questions can be answered right in a cell in the spreadsheet so you

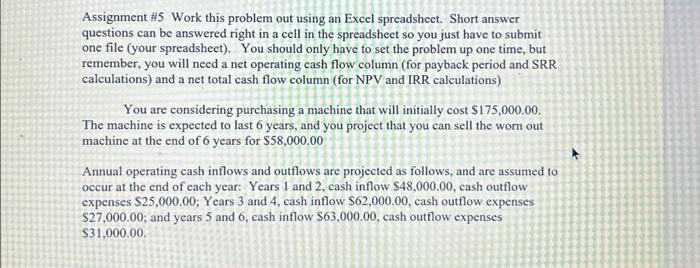

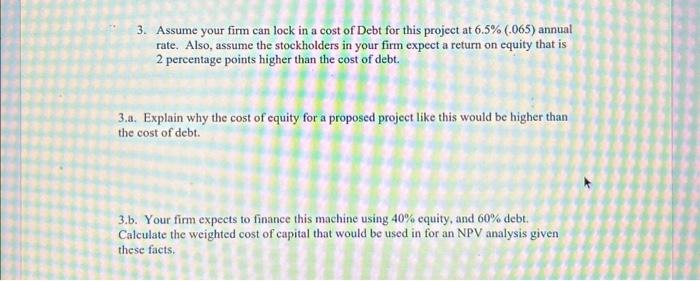

Assignment #5 Work this problem out using an Excel spreadsheet. Short answer questions can be answered right in a cell in the spreadsheet so you just have to submit one file (your spreadsheet). You should only have to set the problem up one time, but remember, you will need a net operating cash flow column (for payback period and SRR calculations) and a net total cash flow column (for NPV and IRR calculations) You are considering purchasing a machine that will initially cost $175,000.00. The machine is expected to last 6 years, and you project that you can sell the worn out machine at the end of 6 years for $58,000.00 Annual operating cash inflows and outflows are projected as follows, and are assumed to occur at the end of each year: Years I and 2, cash inflow $48,000.00, cash outflow expenses $25,000.00; Years 3 and 4 , cash inflow $62,000.00, cash outflow expenses $27,000.00; and years 5 and 6 , cash inflow $63,000.00, cash outflow expenses $31,000.00. 3. Assume your firm can lock in a cost of Debt for this project at 6.5%(.065) annual rate. Also, assume the stockholders in your firm expect a return on equity that is 2 percentage points higher than the cost of debt. 3.a. Explain why the cost of equity for a proposed project like this would be higher than the cost of debt. 3.b. Your firm expects to finance this machine using 40% equity, and 60% debt. Calculate the weighted cost of capital that would be used in for an NPV analysis given these facts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts