Question: Assignment 5.4 Exercises Problem 5: Determining Issue Costs 5 Points A growing company wants to raise $275 million in a new stock issue. Its investment

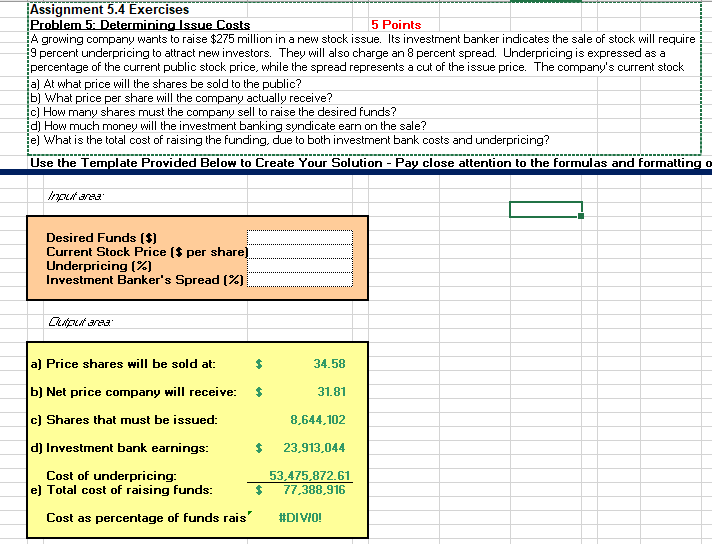

Assignment 5.4 Exercises Problem 5: Determining Issue Costs 5 Points A growing company wants to raise $275 million in a new stock issue. Its investment banker indicates the sale of stock will require 9 percent underpricing to attract new investors. They will also charge an 8 percent spread. Underpricing is expressed as a percentage of the current public stock price, while the spread represents a cut of the issue price. The company's current stock price is $38 per share. a) At what price will the shares be sold to the public? b) What price per share will the company actually receive? c) How many shares must the company sell to raise the desired funds? d) How much money will the investment banking syndicate earn on the sale? e) What is the total cost of raising the funding, due to both investment bank costs and underpricing?

Assignment 5.4 Exercises Problem 5: Determining lssue Costs 5 Points A growing company wants to raise \\( \\$ 275 \\) million in a new stock issue. Its investment banker indicates the sale of stock will require 9 percent underpricing to attract new investors. They will also charge an 8 percent spread. Underpricing is expressed as a percentage of the current public stock price, while the spread represents a cut of the issue price. The company's current stock a) At what price will the shares be sold to the public? b) What price per share will the company actually receive? c) How many shares must the company sell to raise the desired funds? d) How much money will the investment banking syndicate earn on the sale? e) What is the total cost of raising the funding, due to both investment bank costs and underpricing? Use the Template Provided Below to Create Your Solution - Pay close attention to the formulas and formatting \\( \\operatorname{lng} / \\sin a \\) Desired Funds [\\$] Current Stock Price [ \\( \\$ \\) per share) Underpricing [\\%] Investment Banker's Spread [\\%] a) Price shares will be sold at: b] Net price company will receive: c) Shares that must be issued: d) Investment bank earnings: Cost of underpricing: e) Total cost of raising funds: 34.58 31.81 \\( 8,644,102 \\) \\( \\$ \\quad 23,913,044 \\) \\( \\begin{array}{r}53,475,872.61 \\\\ \\hline \\$ \\quad 77,388,916\\end{array} \\) \\#DIYIO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts