Question: Assignment 6: A new program in genetics engineering at Gentex will require RM10 million in capital. The cheif financial officer (CFO) has estimated the following

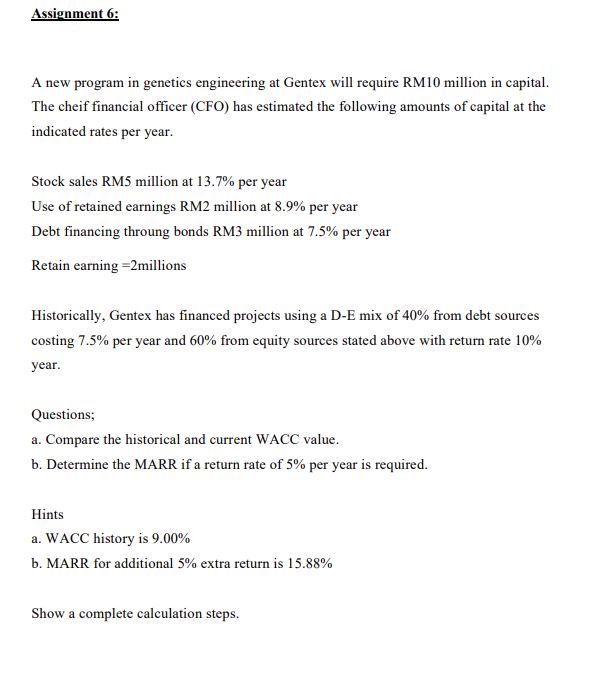

Assignment 6: A new program in genetics engineering at Gentex will require RM10 million in capital. The cheif financial officer (CFO) has estimated the following amounts of capital at the indicated rates per year. Stock sales RM5 million at 13.7% per year Use of retained earnings RM2 million at 8.9% per year Debt financing throung bonds RM3 million at 7.5% per year Retain earning =2millions Historically, Gentex has financed projects using a D-E mix of 40% from debt sources costing 7.5% per year and 60% from equity sources stated above with return rate 10% year. Questions; a. Compare the historical and current WACC value. b. Determine the MARR if a return rate of 5% per year is required. Hints a. WACC history is 9.00% b. MARR for additional 5% extra return is 15.88% Show a complete calculation steps

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts