Question: Assignment 6.4 Exercises Problem 3: Rate of Return Calculations 5 Points a) An investment of only $2,000 today returns $150,000 in 40 years. What is

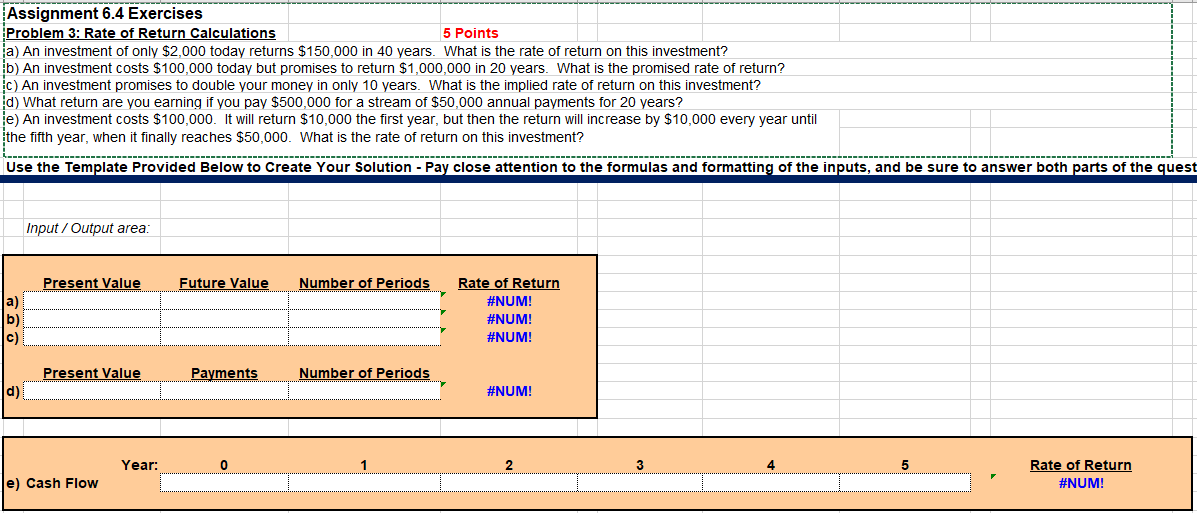

Assignment 6.4 Exercises Problem 3: Rate of Return Calculations 5 Points a) An investment of only $2,000 today returns $150,000 in 40 years. What is the rate of return on this investment? b) An investment costs $100,000 today but promises to return $1,000,000 in 20 years. What is the promised rate of return? c) An investment promises to double your money in only 10 years. What is the implied rate of return on this investment? d) What return are you earning if you pay $500,000 for a stream of $50,000 annual payments for 20 years? e) An investment costs $100,000. It will return $10,000 the first year, but then the return will increase by $10,000 every year until the fifth year, when it finally reaches $50,000. What is the rate of return on this investment?

Assignment 6.4 Exercises Problem 3: Rate of Return Calculations 5 Points a) An investment of only \\( \\$ 2,000 \\) today returns \\( \\$ 150,000 \\) in 40 years. What is the rate of return on this investment? b) An investment costs \\( \\$ 100,000 \\) today but promises to return \\( \\$ 1,000,000 \\) in 20 years. What is the promised rate of return? c) An investment promises to double your money in only 10 years. What is the implied rate of return on this investment? d) What return are you earning if you pay \\( \\$ 500,000 \\) for a stream of \\( \\$ 50,000 \\) annual payments for 20 years? e) An investment costs \\( \\$ 100,000 \\). It will return \\( \\$ 10,000 \\) the first year, but then the return will increase by \\( \\$ 10,000 \\) every year until the fifth year, when it finally reaches \\( \\$ 50,000 \\). What is the rate of return on this investment? Use the Template Provided Below to Create Your Solution - Pay close attention to the formulas and formatting of the inputs, and be sure to answer both parts of the quest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts