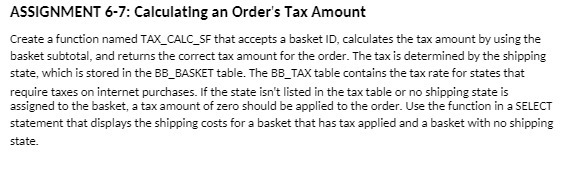

Question: ASSIGNMENT 6-7: Calculating an Order's Tax Amount Create a function named TAX_CALC_SF that accepts a basket ID, calculates the tax amount by using the basket

ASSIGNMENT 6-7: Calculating an Order's Tax Amount Create a function named TAX_CALC_SF that accepts a basket ID, calculates the tax amount by using the basket subtotal, and returns the correct tax amount for the order. The tax is determined by the shipping state, which is stored in the BB_BASKET table. The BB_TAX table contains the tax rate for states that require taxes on internet purchases. If the state isn't listed in the tax table or no shipping state is assigned to the basket, a tax amount of zero should be applied to the order. Use the function in a SELECT statement that displays the shipping costs for a basket that has tax applied and a basket with no shipping state

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts