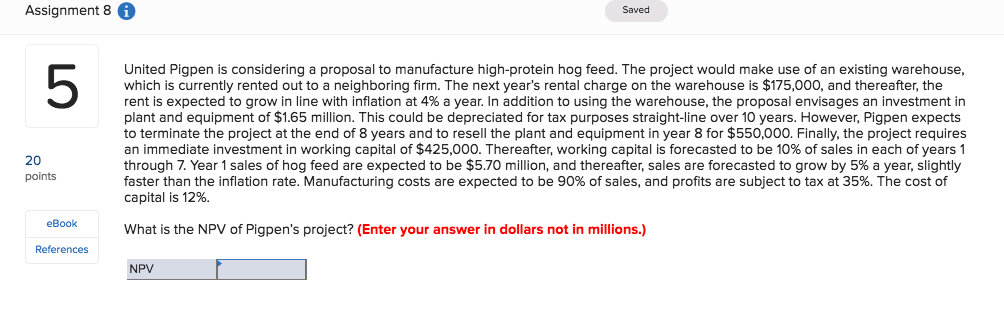

Question: Assignment 8 6 Saved 5 United Pigpen is considering a proposal to manufacture high-protein hog feed. The project would make use of an existing warehouse,

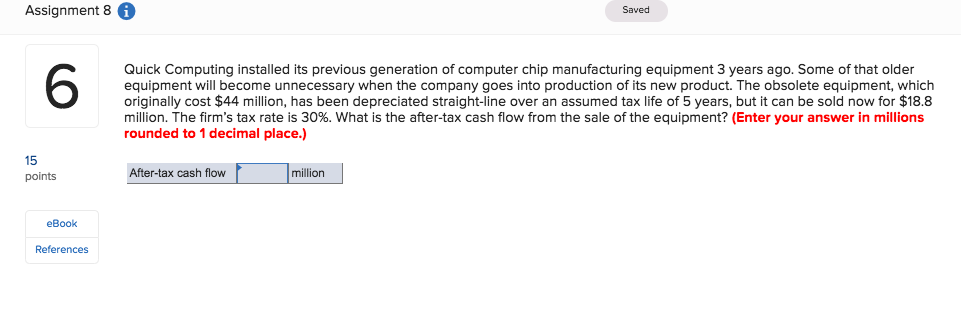

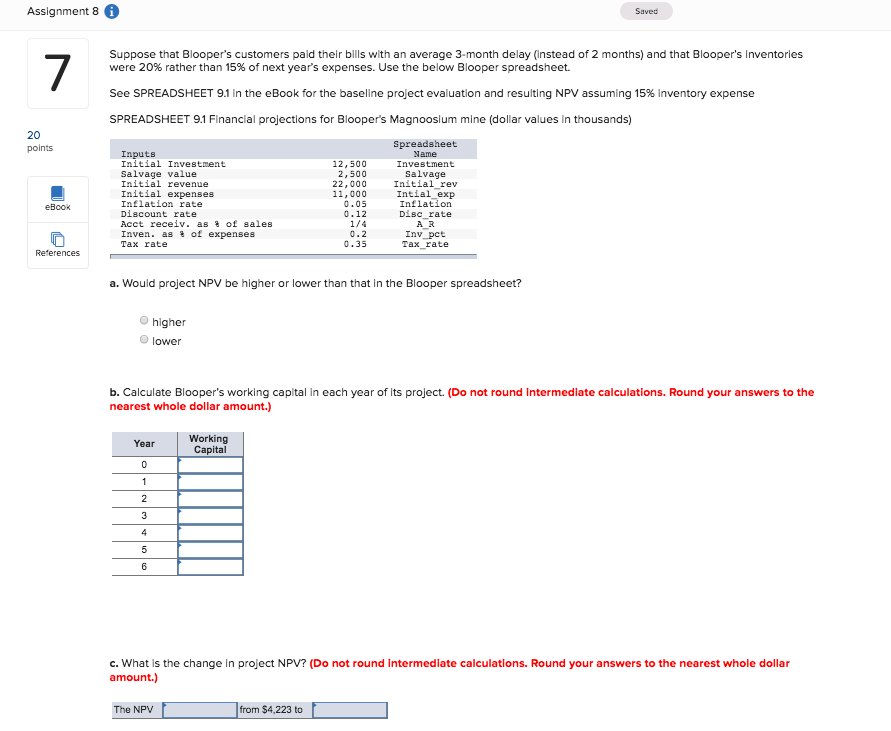

Assignment 8 6 Saved 5 United Pigpen is considering a proposal to manufacture high-protein hog feed. The project would make use of an existing warehouse, which is currently rented out to a neighboring firm. The next year's rental charge on the warehouse is $175,000, and thereafter, the rent is expected to grow in line with inflation at 4% a year. In addition to using the warehouse, the proposal envisages an investment in plant and equipment of $1.65 million. This could be depreciated for tax purposes straight-line over 10 years. However, Pigpen expects to terminate the project at the end of 8 years and to resell the plant and equipment in year 8 for $550,000. Finally, the project requires an immediate investment in working capital of $425,000. Thereafter, working capital is forecasted to be 10% of sales in each of years 1 through 7, Year 1 sales of hog feed are expected to be $570 million, and thereafter, sales are forecasted to grow by 5% a year, slightly faster than the inflation rate. Manufacturing costs are expected to be 90% of sales, and profits are subject to tax at 35%. The cost of capital is 12%. 20 points eBook What is the NPV of Pigpen's project? (Enter your answer in dollars not in millions.) References NPV Assignment 8 6 Saved 6 Quick Computing installed its previous generation of computer chip manufacturing equipment 3 years ago. Some of that older equipment will become unnecessary when the company goes into production of its new product. The obsolete equipment, which originally cost $44 million, has been depreciated straight-line over an assumed tax life of 5 years, but it can be sold now for $18.8 million. The firm's tax rate is 30%, what is the after-tax cash flow from the sale of the equipment? (Enter your answer in millions rounded to 1 decimal place.) 15 points r 1 million | After-tax cash flow eBook References Assignment 8 Saved Suppose that Blooper's customers paid their bills with an average 3-month delay (instead of 2 months) and that Blooper's inventories were 20% rather than 15% of next year's expenses. Use the below Blooper spreadsheet. See SPREADSHEET 9.1 in the eBook for the baseline project evaluation and resulting NPV assuming 15% inventory expense SPREADSHEET 9.1 Financial projections for Blooper's Magnooslum mine (dollar values in thousands) 20 points Inputs Initial Investment Salvage value Initial revenue Initial expenses Inflation rate D8count rate Acct receiv. as % of 8ales inven. as % of expense8 Tax rate 12,500 2,500 22,000 11,000 0.05 0.12 1/4 0.2 . 35 Spreadsheet Name Investment Salvage Initial rev Intial_exp Inflation Disc rate A R eBook Inv pct Tax rate References a. Would project NPV be higher or lower than that in the Blooper spreadsheet? higher lower b. Calculate Blooper's working capital in each year of its project. (Do not round Intermediate calculations. Round your answers to the nearest whole dollar amount.) Working Capital Year c. What is the change in project NPV? (Do not round Intermediate calculations. Round your answers to the nearest whole dollar amount.) The NPV from $4,223 to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts