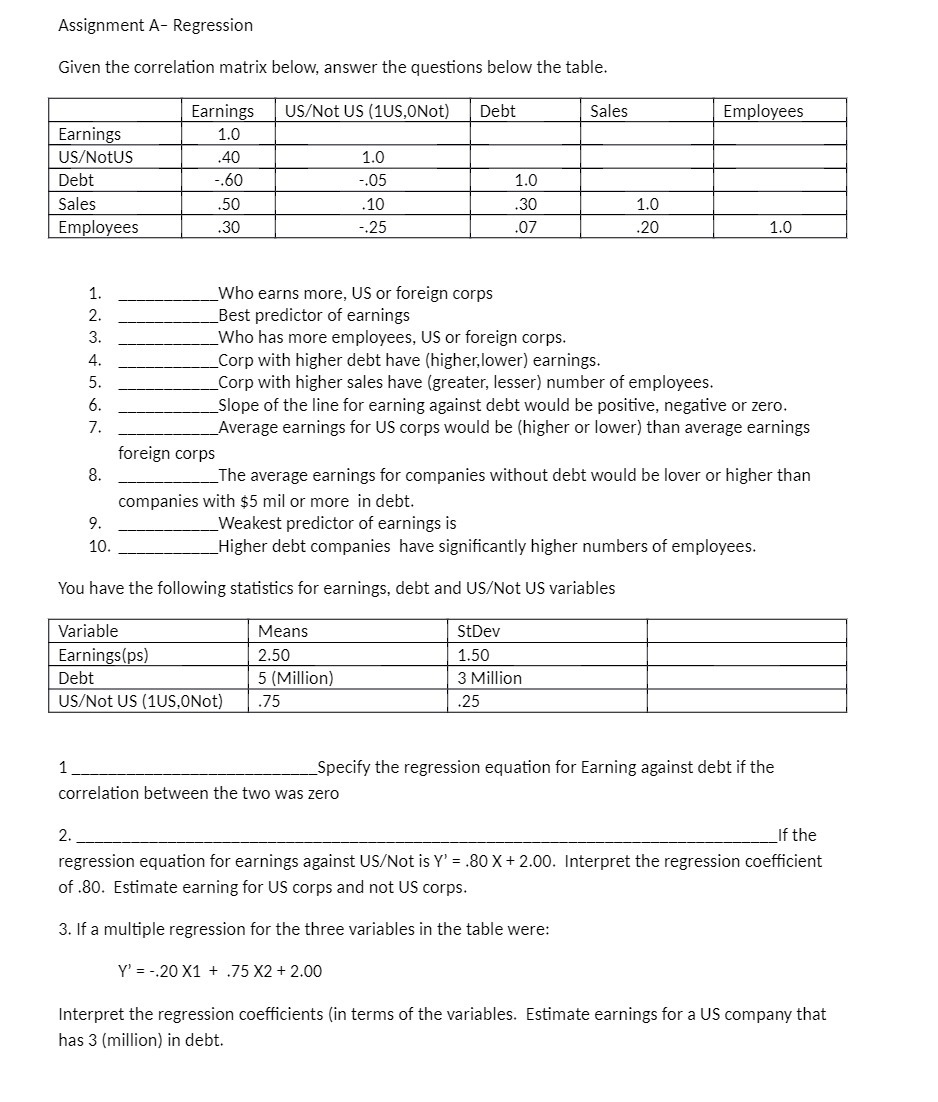

Question: Assignment A- Regression Given the correlation matrix below, answer the questions below the table. Earnings US/Not US (1US,0Not) Debt Sales Employees Earnings 1.0 US/NotUS 40

Assignment A- Regression Given the correlation matrix below, answer the questions below the table. Earnings US/Not US (1US,0Not) Debt Sales Employees Earnings 1.0 US/NotUS 40 1.0 Debt .60 .05 1.0 Sales 50 .10 30 1.0 Employees 30 .25 07 20 1.0 WNP Who earns more, US or foreign corps Best predictor of earnings Who has more employees, US or foreign corps. 4. Corp with higher debt have (higher, lower) earnings. 5. Corp with higher sales have (greater, lesser) number of employees. 7 Slope of the line for earning against debt would be positive, negative or zero. Average earnings for US corps would be (higher or lower) than average earnings foreign corps 8. The average earnings for companies without debt would be lover or higher than companies with $5 mil or more in debt. 9. Weakest predictor of earnings is 10. Higher debt companies have significantly higher numbers of employees. You have the following statistics for earnings, debt and US/Not US variables Variable Means StDev Earnings(ps) 2.50 1.50 Debt 5 (Million) 3 Million US/Not US (1US,0Not) .75 .25 Specify the regression equation for Earning against debt if the correlation between the two was zero 2. If the regression equation for earnings against US/Not is Y' = .80 X + 2.00. Interpret the regression coefficient of .80. Estimate earning for US corps and not US corps. 3. If a multiple regression for the three variables in the table were: Y' = -.20 X1 + .75 X2 + 2.00 Interpret the regression coefficients (in terms of the variables. Estimate earnings for a US company that has 3 (million) in debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts